Digital-Asset ETF Flows Dropped $500 Mln Last Week

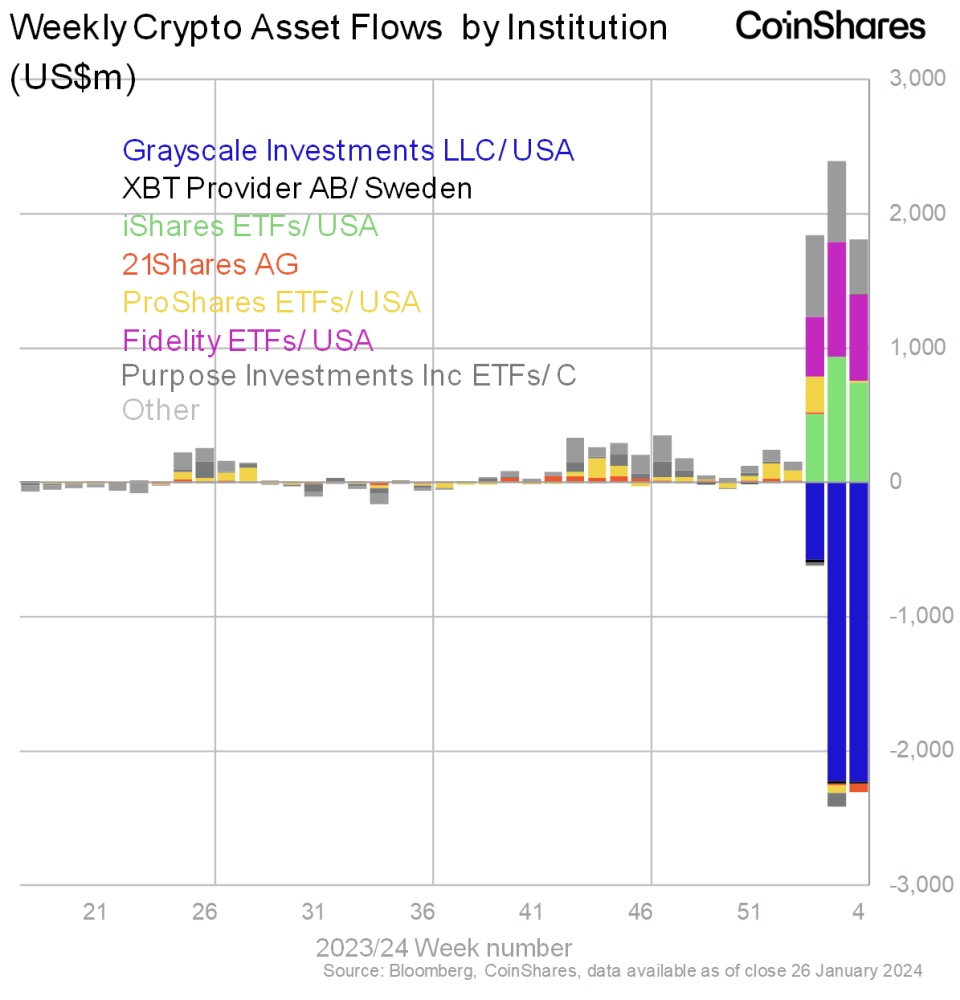

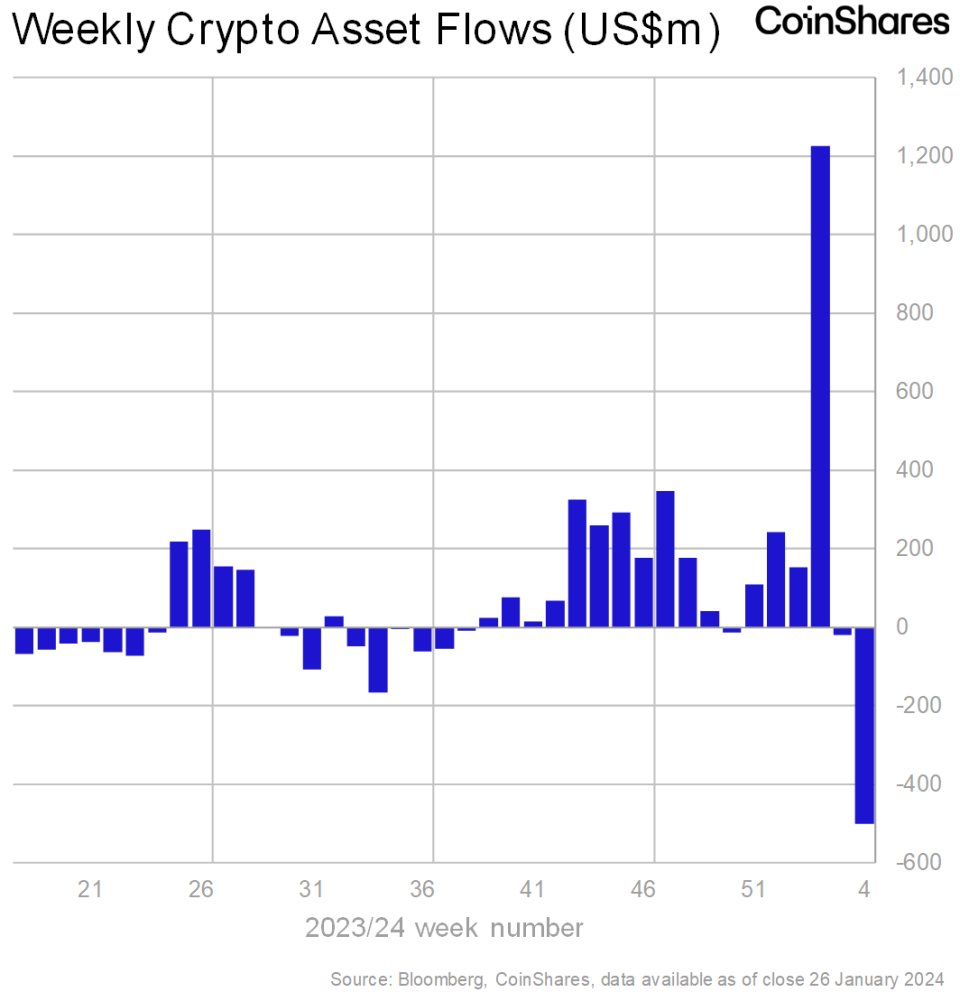

Global digital asset ETFs saw significant outflows last week totaling $500 million thanks to outflows in the Grayscale Bitcoin Trust ETF (GBTC).

Global digital asset ETFs saw significant outflows last week totaling $500 million thanks to outflows in the Grayscale Bitcoin Trust ETF (GBTC).

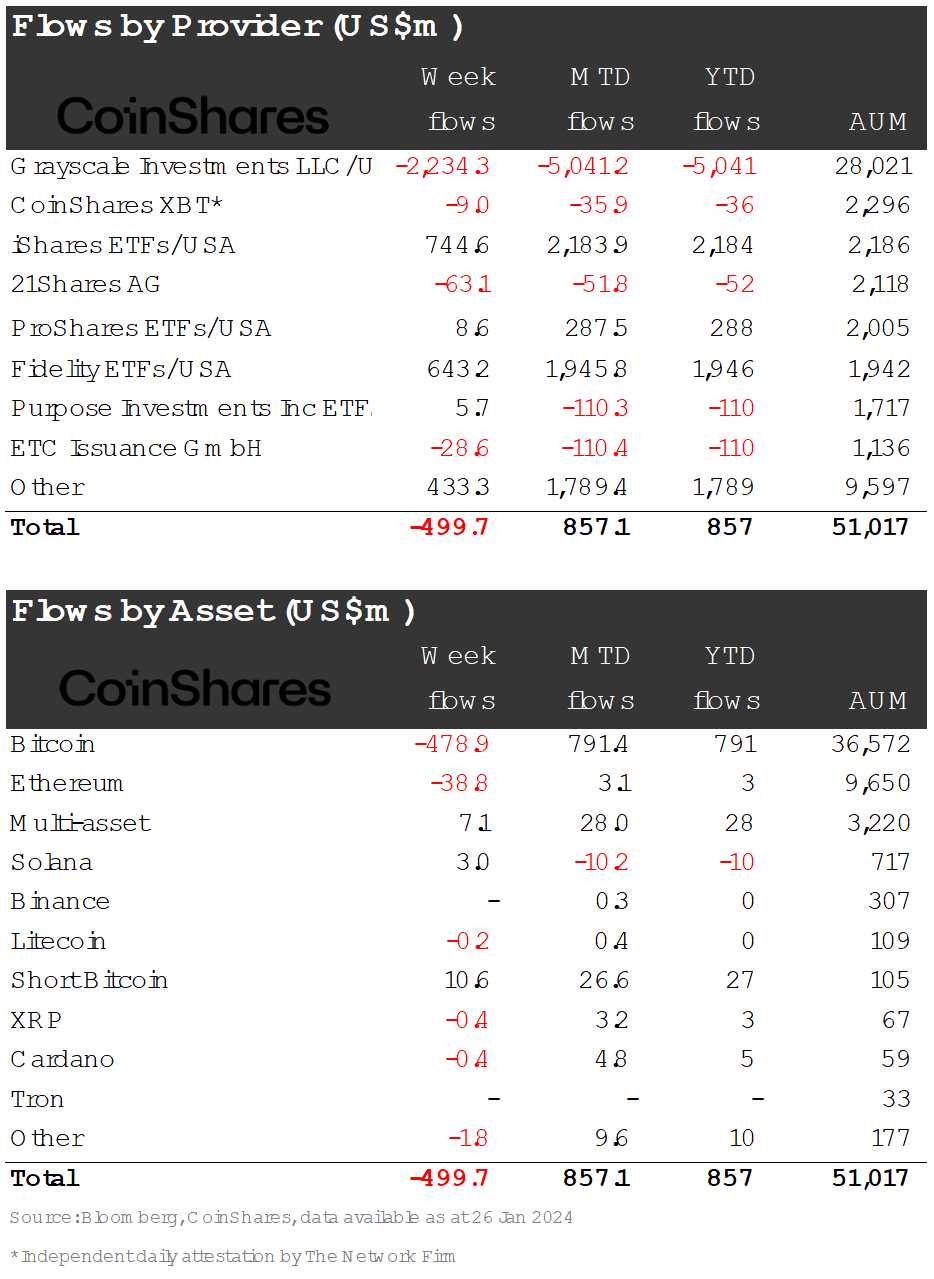

The outflows in Grayscale last week totaled $2.2 billion, although data suggests outflows are beginning to subside as the daily total continued to reduce towards over the week.

In stark contrast, newly issued U.S. exchange-traded fundas saw inflows totaling $1.8 billion last week, and since launch on Jan. 114 have seen $5.94 billion of inflows.

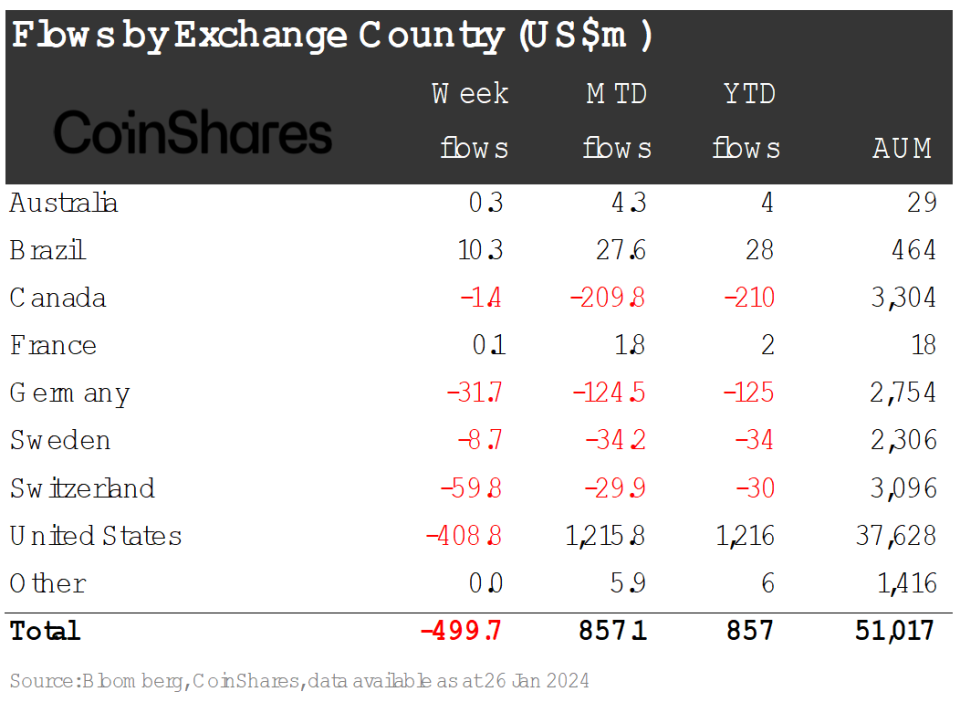

Digital asset investment products saw significant outflows from a global perspective, totaling $500 million. Regionally, outflows were focused on the US., Switzerland and Germany, with U.S. outflows totaling $409 million, Switzerland reaching $60 million and Germany with $32 million.

Grayscale

Recent price declines prompted by the substantial outflows from the incumbent ETF issuer Grayscale in the US totaling US $5 billion, have likely prompted further outflows other regions.

In stark contrast, newly issued US ETFs saw inflows totaling US $1.8 billion last week, and since the Jan. 11 launch of spot bitcoin ETFs, they've had $5.94 billion of inflows, meaning on a net basis, including Grayscale, inflows since launch now total $807 million. Much of the price falls, despite these positive flows, was likely due to Bitcoin seed capital being acquired prior to Jan. 11.

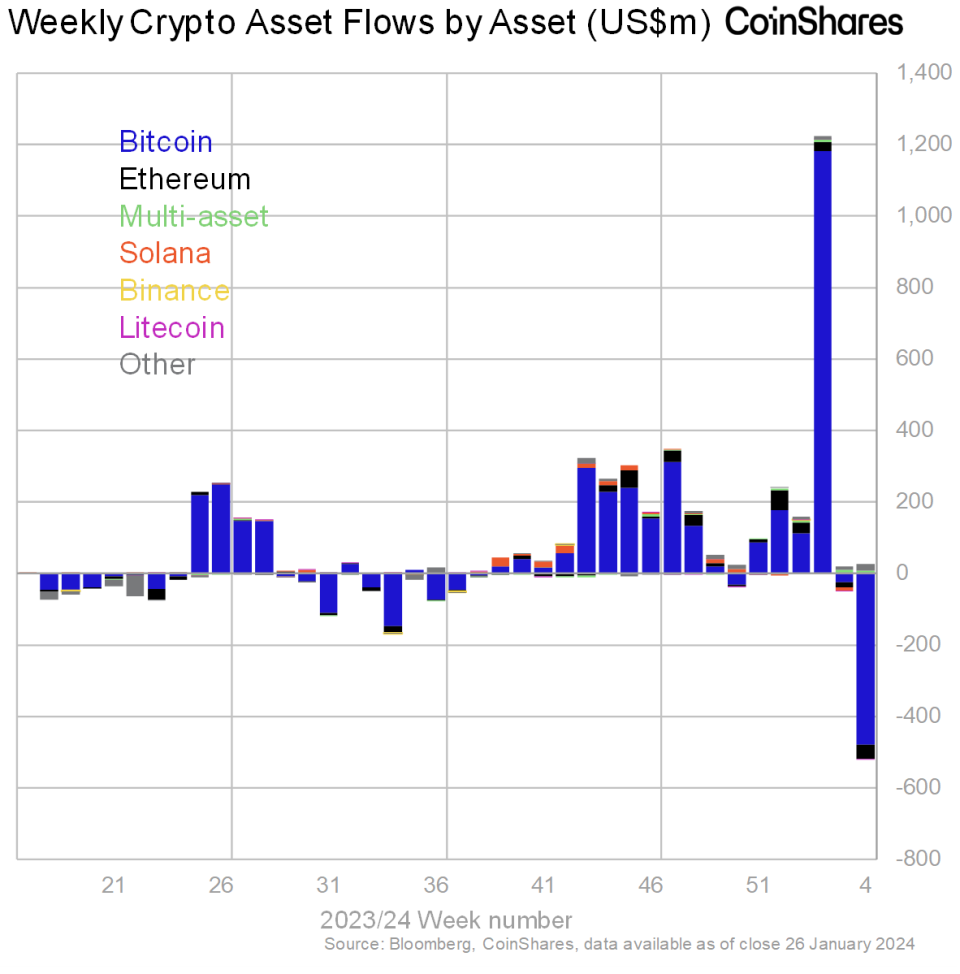

Bitcoin has understandably been the primary focus, seeing $479 million outflows, while short-bitcoin saw further inflows totaling $10.6 million. Altcoins predominantly saw outflows last week, with Ethereum seeing US$39m, and Polkadot and Chainlink seeing US$0.7m and US$0.6m respectively.

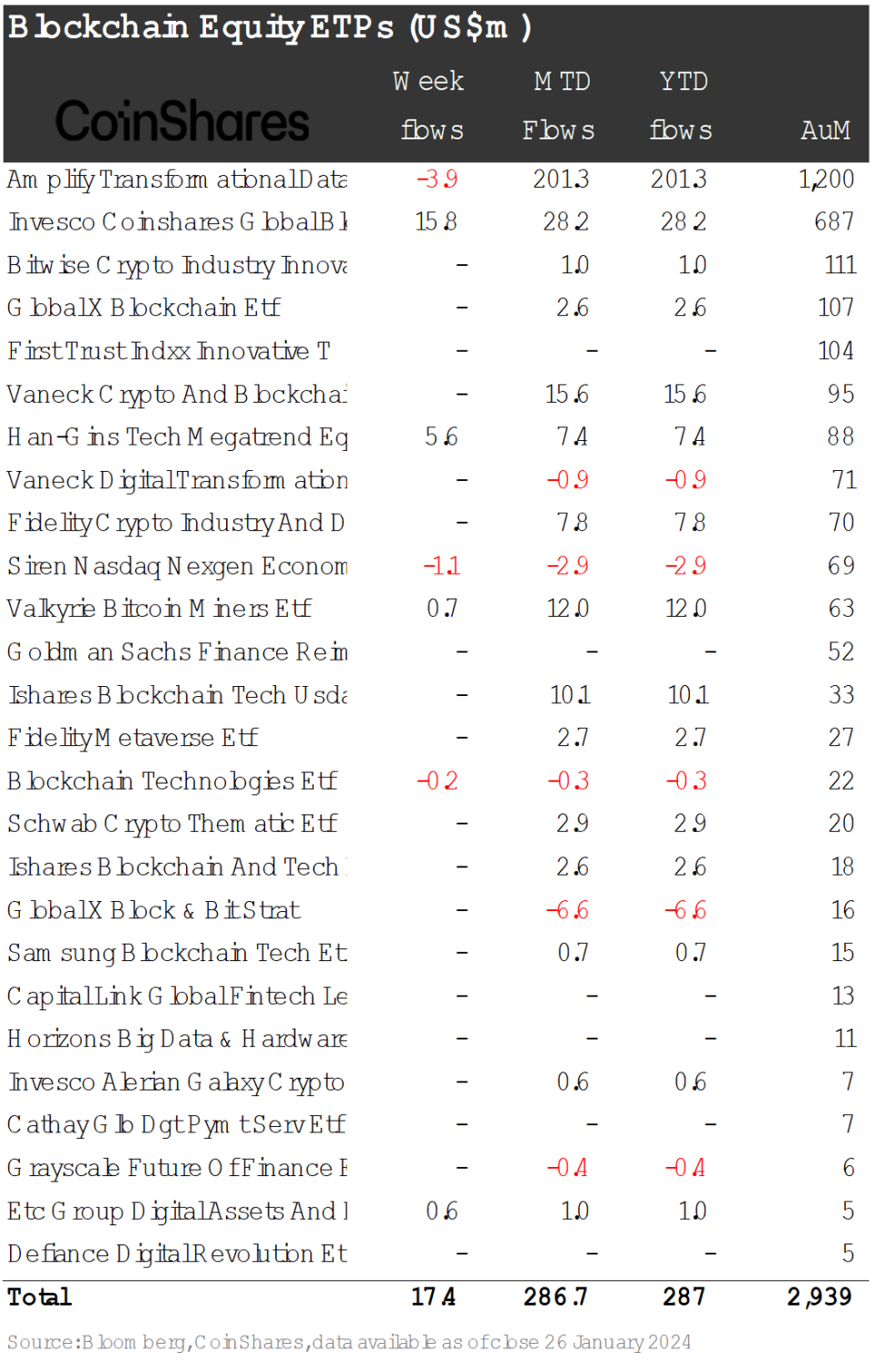

Blockchain equities saw further inflows totalling US$17m last week.