Digital Capabilities & Acquisitions Aid Interpublic (IPG)

The Interpublic Group of Companies, Inc.IPG its digital capabilities and diverse workforce. The company has been benefiting from direct relations with customers while a robust acquisition strategy has helped grow its geographical presence.

The Interpublic Group of Companies’ first-quarter 2023 earnings beat the Zacks Consensus Estimate while revenues missed the same. Adjusted earnings (considering 5 cents from non-recurring items) were 38 cents per share, beating the consensus estimate but declining 19.2% on a year-over-year basis. Net revenues of $2.18 billion missed the consensus estimate by 0.9% and and decreased 15.2% on a year-over-year basis. Total revenues of $2.52 billion decreased 1.9% year over year.

Factors Favoring IPG

Interpublic's diverse workforce provides it a competitive advantage by attracting talent from various backgrounds, driving organic growth and expanding globally. The company invests in technology and digital expertise to adapt to the changing media landscape and ensure sustained growth.

IPG also rewards its shareholders through dividend payments, demonstrating its commitment to value creation and confidence in the business. In 2022, 2021 and 2020, Interpublic paid $457.3 million, $427.7 million and $398.1 million in dividends, respectively.

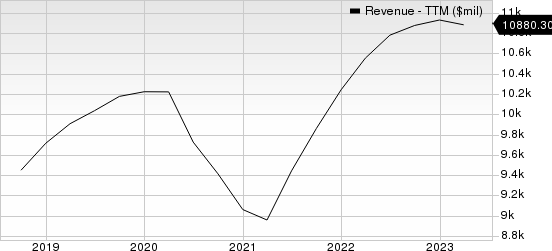

Interpublic Group of Companies, Inc. (The) Revenue (TTM)

Interpublic Group of Companies, Inc. (The) revenue-ttm | Interpublic Group of Companies, Inc. (The) Quote

Interpublic's growth strategy involves fostering direct consumer relationships by providing clients with tools and assistance to connect with individual customers. It combines data, technology and media expertise to develop software that enhances client marketing. The company expands its product portfolio globally, through disciplined acquisitions, to adapt to evolving marketing services and media opportunities.

A Major Concern

Interpublic's cash position is subject to seasonality due to clients' varying media spending budgets and patterns throughout the year, with the first quarter having the most significant impact.

Zacks Rank and Other Stocks to Consider

IPG currently carries a Zacks Rank #2 (Buy).

Investors interested in the broader Zacks Business Services can also consider the following stocks:

Avis Budget CAR: For second-quarter 2023, the Zacks Consensus Estimate of Avis Budget’s revenues suggests a decline of 1.6% year over year to $3.19 billion and the same for earnings indicates a 38.6% plunge to $9.78 per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 65.2%.

CAR currently has a Value Score of A and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS currently has a VGM Score of B along with a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report