Digital Realty (DLR), Realty Income (O) Tie Up for Data Centers

In a significant move, Digital Realty DLR, the global provider of cloud and carrier-neutral data center solutions, has entered into a joint venture with Realty Income Corporation O to aid the development of two build-to-suit data centers in Northern Virginia, known for its prominence in the data center market. This partnership marks Realty Income's maiden foray into the data center sector and underlines its strategic approach to align with industry leaders.

Realty Income invested approximately $200 million, securing an 80% equity interest in the venture, while Digital Realty maintains a 20% interest. The collaboration combines Digital Realty's expertise in data center solutions with Realty Income's standing as a blue-chip net-lease REIT. Both partners will contribute their pro rata share toward the outstanding estimated development cost of $150 million for the first phase of the project, scheduled to conclude in mid-2024.

The two data centers, whose construction started in the fourth quarter of 2022, will deliver 16 megawatts of capacity, expandable up to 48 megawatts based on the client's discretion. The budget for the first phase is approximately $400 million, with the potential to escalate to $800 million if the client exercises the option to expand during the initial lease term.

The build-to-suit facilities, already 100% pre-leased to an S&P 100 investment-grade client, are expected to generate a 6.9% initial cash lease yield upon the commencement of the lease in mid-2024. These state-of-the-art facilities boast a 10-year initial lease term with extension options and annual rent escalators of 2%.

Digital Realty’s president and CEO, Andy Power, expressed enthusiasm about the partnership, emphasizing that the joint venture not only caters to the build-to-suit requirements of its customers but also diversifies and strengthens Digital Realty's capital sources. The move enhances the company's flexibility to support stakeholders' long-term capacity requirements prudently.

Realty Income's president and CEO, Sumit Roy, highlighted the strategic alignment with industry leaders as a core strategy. He emphasized the attractiveness of risk-adjusted returns for Realty Income stockholders through this venture with Digital Realty. The collaboration is particularly noteworthy as it supports the development of cutting-edge facilities in Northern Virginia, the largest data center market globally.

This strategic move not only augurs well for the growth prospects of both Digital Realty and Realty Income but also signifies increased investor confidence in the data center market. As the demand for data storage and processing continues to surge, especially in key markets like Northern Virginia, this joint venture positions the companies strategically to capitalize on the evolving needs of businesses.

In conclusion, the collaboration between Digital Realty and Realty Income is a testament to the dynamism and growth potential of the data center industry. As technology evolves, the demand for reliable and scalable data solutions is set to soar, and this joint venture positions both companies as key players in meeting these demands. Investors keen on exposure to the data center sector should keep a watchful eye on the developments stemming from this strategic partnership.

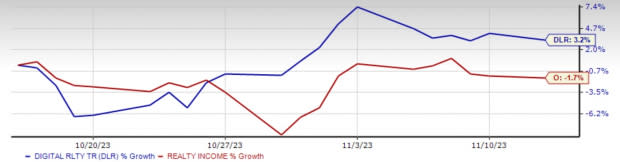

Digital Realty and Realty Income each carry a Zacks Rank #3 (Hold). Over the past month, shares of DLR have rallied 3.2%, while shares of O have declined 1.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are Welltower WELL and Iron Mountain Incorporated IRM, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Welltower’s current-year funds from operations (FFO) per share has moved marginally northward over the past week to $3.58.

The Zacks Consensus Estimate for Iron Mountain’s 2023 FFO per share has moved marginally upward in the past three months to $3.97.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report