Digital Realty Trust Inc (DLR) Reports Mixed Q4 Results Amid Strategic Transformations

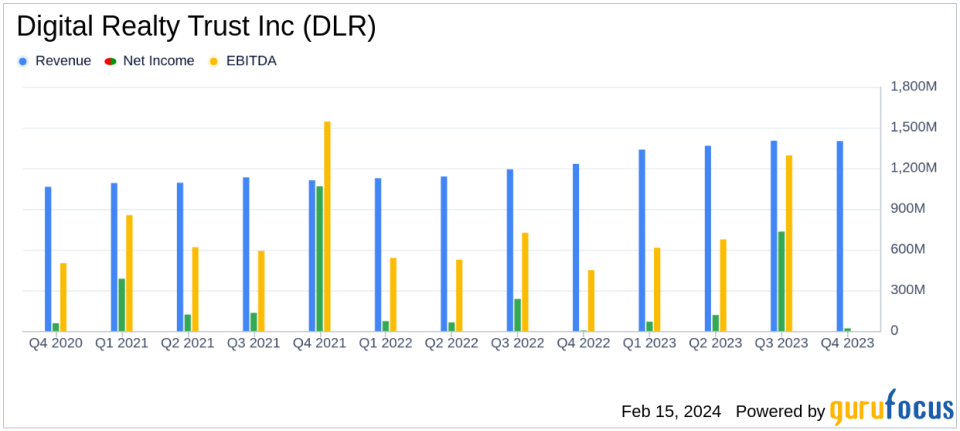

Revenue: $1.4 billion in Q4, an 11% increase year-over-year.

Net Income: $20 million in Q4, a decrease from $2.33 per diluted share in the previous quarter.

Adjusted EBITDA: $700 million in Q4, up 9% from the same quarter last year.

Funds From Operations (FFO): $484 million, or $1.53 per share in Q4.

Core FFO: $1.63 per share in Q4, slightly below $1.65 per share year-over-year.

Leasing Activity: Signed bookings expected to generate $110 million of annualized GAAP rental revenue.

Strategic Joint Ventures: Formed two new ventures, including a $7 billion initiative with Blackstone Inc.

On February 15, 2024, Digital Realty Trust Inc (NYSE:DLR) released its 8-K filing, detailing the financial outcomes for the fourth quarter of 2023. The company, a global provider of data center, colocation, and interconnection solutions, reported a slight decrease in revenue from the previous quarter but an 11% increase from the same quarter last year, reaching $1.4 billion. Net income available to common stockholders was reported at $18 million, or $0.08 per diluted share, which is a decrease from the previous quarter's $2.33 per diluted share and a turnaround from the ($0.02) per diluted share in the same quarter last year.

Digital Realty owns and operates over 300 data centers worldwide, with a portfolio comprising approximately 39.7 million square feet. The company's offerings cater to a diverse range of industry verticals, and it operates as a real estate investment trust (REIT).

Performance and Challenges

The company's Adjusted EBITDA for the quarter was $700 million, a 9% increase from the same period in the previous year. Funds From Operations (FFO) stood at $484 million, or $1.53 per share, while Core FFO per share was $1.63, slightly below the $1.65 per share from the same quarter last year. The performance reflects Digital Realty's strategic focus on evolving its portfolio to capture opportunities created by AI and other technological advancements.

However, the company faces challenges, including a competitive landscape and the need to continuously invest in technology to maintain its market position. The performance is significant as it demonstrates the company's ability to generate steady revenue streams and manage operational efficiency amidst industry challenges.

Financial Achievements and Importance

During the quarter, Digital Realty signed total bookings expected to generate $110 million of annualized GAAP rental revenue. The company also formed two new development joint ventures, including a significant $7 billion initiative with Blackstone Inc. These achievements are crucial as they represent the company's commitment to growth and its ability to attract substantial capital investment, which is vital for maintaining competitiveness in the REIT industry.

Key Financial Metrics

Important metrics from the earnings report include a net debt-to-Adjusted EBITDA ratio of 6.2x and a fixed charge coverage of 3.8x. These metrics are important as they provide insights into the company's debt management and its ability to cover fixed financial obligations.

"Our fourth quarter results marked the culmination of a transformative year for Digital Realty. We delivered on our strategic priorities and positioned the company for the growing opportunity that lies ahead," said Digital Realty President & Chief Executive Officer Andy Power.

Analysis of Company's Performance

Digital Realty's performance in the fourth quarter shows resilience in a dynamic market. The company's strategic joint ventures and development projects are set to bolster future growth. However, the slight dip in net income and Core FFO per share indicates the need for careful cost management and strategic planning to sustain profitability.

The company's outlook for 2024 includes a Core FFO per share and Constant-Currency Core FFO per share outlook of $6.60 - $6.75, reflecting cautious optimism in its continued growth trajectory.

For a detailed analysis of Digital Realty Trust Inc (NYSE:DLR)'s financials and strategic initiatives, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Digital Realty Trust Inc for further details.

This article first appeared on GuruFocus.