Digital Turbine Inc (APPS) Faces Revenue Decline and Net Loss in Fiscal Q3 2024

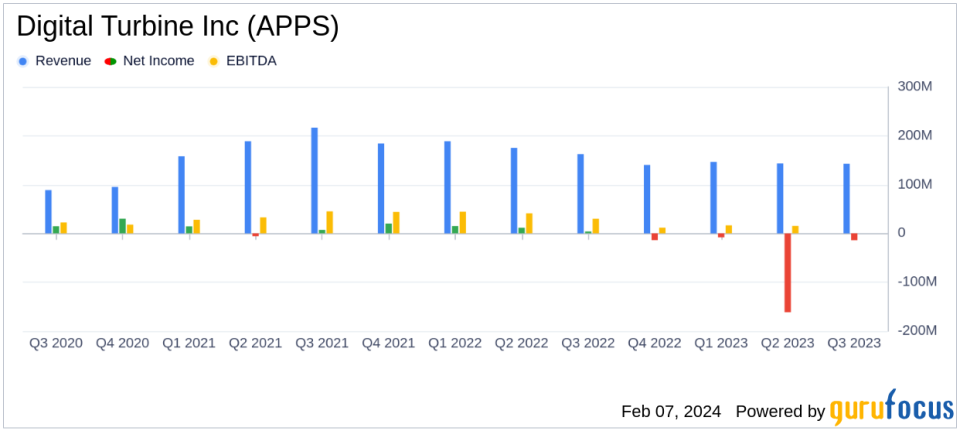

Revenue: Fiscal Q3 2024 revenue declined by 12% year-over-year to $142.6 million.

Net Loss: GAAP net loss reported at $14.1 million, compared to a net income of $4.1 million in the same quarter last year.

Adjusted EBITDA: Non-GAAP adjusted EBITDA decreased to $25.4 million from $40.0 million in fiscal Q3 2023.

Adjusted Net Income: Non-GAAP adjusted net income was $15.6 million, down from $30.2 million year-over-year.

Debt Reduction: Long-term debt balance reduced by $9.8 million to $374.0 million.

Free Cash Flow: Non-GAAP free cash flow for the quarter stood at $14.3 million.

On February 7, 2024, Digital Turbine Inc (NASDAQ:APPS) released its 8-K filing, detailing the financial results for the fiscal third quarter ended December 31, 2023. The company, an independent mobile growth platform, reported a year-over-year revenue decline of 12% to $142.6 million, reflecting weaker U.S. device upgrade rates and temporary platform consolidation factors.

Digital Turbine Inc (NASDAQ:APPS) operates in the mobile application ecosystem, offering solutions for brand discovery and advertising, user acquisition and engagement, and operational efficiency for advertisers. Its key revenue is derived from the On Device Media (ODM) segment, which connects mobile carriers, device OEMs, app publishers and developers, and brands with end users.

The company's GAAP net loss for the quarter was $14.1 million, or ($0.14) per share, a significant downturn from the GAAP net income of $4.1 million, or $0.04 per share, in the fiscal third quarter of 2023. Non-GAAP adjusted net income was $15.6 million, or $0.15 per share, compared to $30.2 million, or $0.29 per share, in the prior year's quarter. Non-GAAP adjusted EBITDA also saw a decrease to $25.4 million from $40.0 million year-over-year.

Despite the challenges, CEO Bill Stone remains optimistic about the company's market opportunities, particularly with the upcoming Digital Markets Act in the European Union. Stone believes that recent regulatory and legislative changes will draw global operators, OEMs, and app publishers to Digital Turbine's direct distribution platform offerings.

Weaker U.S. device upgrade rates and temporary platform consolidation factors represent near-term headwinds, but in no way impact our broader outlook on the tremendous market opportunity in front of us," said Bill Stone, CEO.

For the full-year fiscal 2024, the company expects revenue between $547 million and $553 million, Non-GAAP adjusted EBITDA between $90 million and $94 million, and Non-GAAP adjusted EPS between $0.50 and $0.54.

The balance sheet shows a reduction in long-term debt and a healthy cash position, with net cash provided by operating activities at $11.7 million for the quarter. The company's efforts to reduce its debt balance and generate free cash flow are crucial for maintaining financial flexibility and investing in growth opportunities.

Overall, Digital Turbine Inc (NASDAQ:APPS) faces a challenging fiscal Q3 2024, with revenue and profit metrics showing declines from the previous year. However, strategic investments and a focus on future growth opportunities may position the company for recovery and success in the evolving mobile application market.

Explore the complete 8-K earnings release (here) from Digital Turbine Inc for further details.

This article first appeared on GuruFocus.