DigitalOcean Holdings Inc (DOCN) Reports Solid Revenue Growth and Robust Free Cash Flow in FY 2023

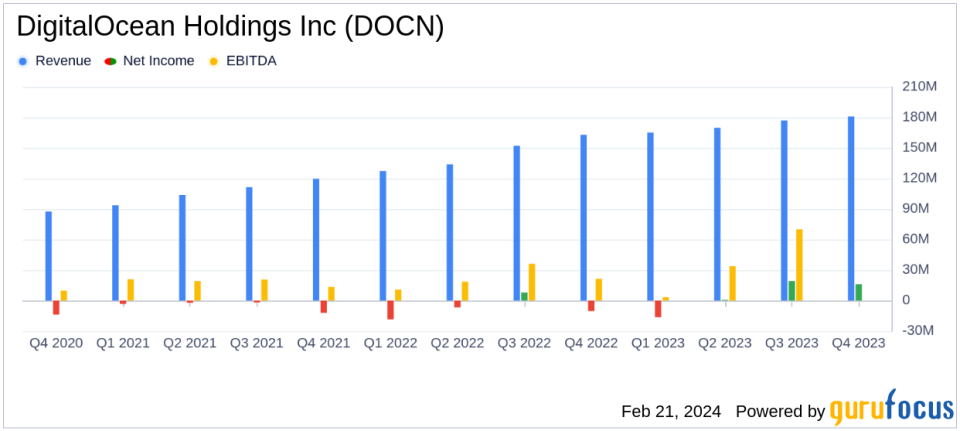

Revenue Growth: DigitalOcean Holdings Inc (NYSE:DOCN) reported a 20% increase in annual revenue, reaching $693 million for the fiscal year 2023.

Operating Cash Flow: The company generated a robust operating cash flow of $235 million, indicating healthy cash-generating capabilities.

Net Income: DOCN achieved a net income of $19 million, with a net income margin of 3% for the fiscal year.

Adjusted EBITDA: Adjusted EBITDA grew by 39% year-over-year to $277 million, showcasing operational efficiency and profitability.

Stock Repurchase Plan: A new stock repurchase program was approved, authorizing the repurchase of up to $140 million of stock through fiscal year 2025.

Strategic Acquisitions: The acquisition of Paperspace, a leading provider of cloud infrastructure, expanded DOCN's addressable market and capabilities in AI/ML.

On February 21, 2024, DigitalOcean Holdings Inc (NYSE:DOCN), a leading cloud computing platform, released its 8-K filing, announcing financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, known for its developer-friendly cloud solutions, caters to startups and growing digital businesses, offering a range of services from web and mobile application development to e-commerce and managed services. With a global presence, DOCN continues to focus on product-led growth and developer experience enhancement.

Fiscal Year 2023 Performance Highlights

DOCN's revenue for the fiscal year 2023 was $693 million, marking a 20% increase from the previous year. The company's focus on margin improvement and market expansion through strategic acquisitions, such as Paperspace, has laid a solid foundation for double-digit growth. The full-year operating cash flow stood at $235 million, reflecting the company's strong cash generation capabilities.

The net income attributable to common stockholders was $19 million, translating to a net income margin of 3%. Adjusted EBITDA saw a significant increase of 39% year-over-year, reaching $277 million, with an adjusted EBITDA margin of 40%. This margin expansion is indicative of DOCN's operational efficiency and its ability to scale profitably.

Financial Metrics and Shareholder Returns

Key financial metrics such as the Annual Run-Rate Revenue (ARR) ended the quarter at $730 million, up by 11% year-over-year. The Adjusted Free Cash Flow for the fiscal year was $156 million, compared to $78 million in the prior year, demonstrating the company's enhanced liquidity and financial health.

DOCN also returned $488 million to shareholders through the repurchase of 14,487,509 shares, underscoring the company's commitment to enhancing shareholder value. The newly approved stock repurchase program further reflects this commitment and the confidence in the company's future cash flow generation.

Operational Successes and Future Outlook

Operational highlights include the introduction of premium CPU-optimized droplets and a new managed Kafka offering, which are expected to drive customer growth and retention. The Average Revenue Per Customer (ARPU) increased by 6% over the fourth quarter of 2022, and the Net Dollar Retention Rate (NDR) was 96%, compared to 112% in the prior year.

For the first quarter of 2024, DOCN expects total revenue of $182 to $183 million, with an adjusted EBITDA margin of 37% to 38%. The full year 2024 outlook anticipates total revenue of $755 to $775 million and an adjusted free cash flow margin in the range of 19% to 21% of revenue.

DOCN's CEO, Paddy Srinivasan, expressed enthusiasm for the company's trajectory and its focus on product-led growth, while CFO Matt Steinfort highlighted the strong balance sheet and free cash flow as enablers for future expansion initiatives.

Value investors may find DOCN's consistent revenue growth, solid cash flow generation, and strategic investments in AI solutions compelling reasons to consider the stock. The company's financial health and operational achievements position it well for sustained growth in the competitive cloud computing market.

Explore the complete 8-K earnings release (here) from DigitalOcean Holdings Inc for further details.

This article first appeared on GuruFocus.