Dillard's (DDS) Stock Rallies 11% in a Year: What's Ahead?

Dillard’s, Inc. DDS has been in investor good books, driven by its sound fundamentals and impressive growth efforts. Continued consumer demand and focus on inventory and expense management bode well. The company’s strategy to offer more fashion-forward and trendy products in order to attract customers has been a key driver.

DDS boasts a robust surprise trend, which continued in second-quarter fiscal 2023. The company’s sales and earnings beat the Zacks Consensus Estimate for the 10th straight quarter in the fiscal second quarter. Results gained from better inventory management and consumer demand. The company witnessed robust sales in cosmetics, and home and furniture categories. However, sales were affected by the continued cautiousness of consumers in the first few weeks of the fiscal second quarter.

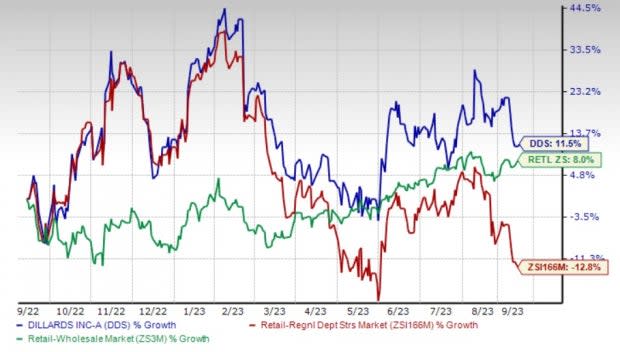

Backed by the robust surprise trend, the Zacks Rank #1 (Strong Buy) stock has outperformed the industry and the Retail - Wholesale sector in the past year. DDS has rallied 11.5% against the industry’s decline of 12.8%. The stock also compares favorably with the sector’s growth of 8% in the same period.

Image Source: Zacks Investment Research

Dillard's is likely to retain its sales momentum on efforts to capture growth opportunities in brick-and-mortar stores and e-commerce business. On the store front, the company is gaining from initiatives to enhance brand relations, focus on in-trend categories, store remodels and increased rewards to store personnel. Its activewear brands have been gaining market share.

Moreover, DDS’ e-commerce business is catching pace with strategies like the enhancement of merchandise assortments and effective inventory management. We expect the company to gain from its focus on increasing productivity at existing stores, developing a leading omni-channel platform and enhancing domestic operations in the years ahead.

Additionally, Dillard’s has been delivering improved inventory levels in recent quarters, driven by its ongoing inventory management initiatives. The company exited second-quarter fiscal 2023 with flat year-over-year inventory levels. This resulted in a strong retail gross margin of 40.4%, even though it declined year over year. Merchandise inventory as of Jul 29, 2023, was $1,192.7 million compared with $1,193.4 million in the year-ago quarter.

Dillard's is focused on maintaining a strong balance sheet and liquidity. Some highlights of its financial status include smaller rent obligations compared with the industry. This is because the company owns 90% of its retail stores, and 100% of its corporate headquarters, distribution and fulfillment facilities.

As of Jul 29, 2023, the company's long-term debt and finance lease liabilities (including subordinate debentures) remained flat at $521.4 million sequentially. The company’s debt-to-capitalization ratio is stable at 0.24 on a sequential basis. Also, the times interest earned ratio stands at 96.3, reflecting an improvement from 53.3 in the prior quarter.

3 Stocks Looking Red Hot

Here we have highlighted three better-ranked stocks, namely Abercrombie & Fitch ANF, American Eagle Outfitters AEO and Urban Outfitters URBN.

Abercrombie, a specialty retailer of premium, high-quality casual apparel for men, women, and kids, currently sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 724.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie’s current financial-year sales suggests growth of 10.4%, from the year-ago reported number. The consensus mark for EPS is pegged at $4.36, suggesting significant growth of 1,644% from the year-ago quarter’s EPS of 25 cents.

American Eagle, which operates as a specialty retailer of casual apparel, accessories and footwear for men and women, currently flaunts a Zacks Rank #1. The expected EPS growth rate for three to five years is 15.3%.

The Zacks Consensus Estimate for American Eagle’s current financial-year sales and earnings indicates growth of 1.3% and 24.7%, respectively, from the year-ago reported numbers. AEO has a trailing four-quarter earnings surprise of 4.7%, on average.

Urban Outfitters, a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home décor and gifts products, currently sports a Zacks Rank #1. The expected EPS growth rate for three to five years is 23.8%.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and earnings implies growth of 9% and 84.6%, respectively, from the year-ago reported numbers. URBN has a trailing four-quarter earnings surprise of 19.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report