Dillard's (NYSE:DDS) Misses Q3 Sales Targets

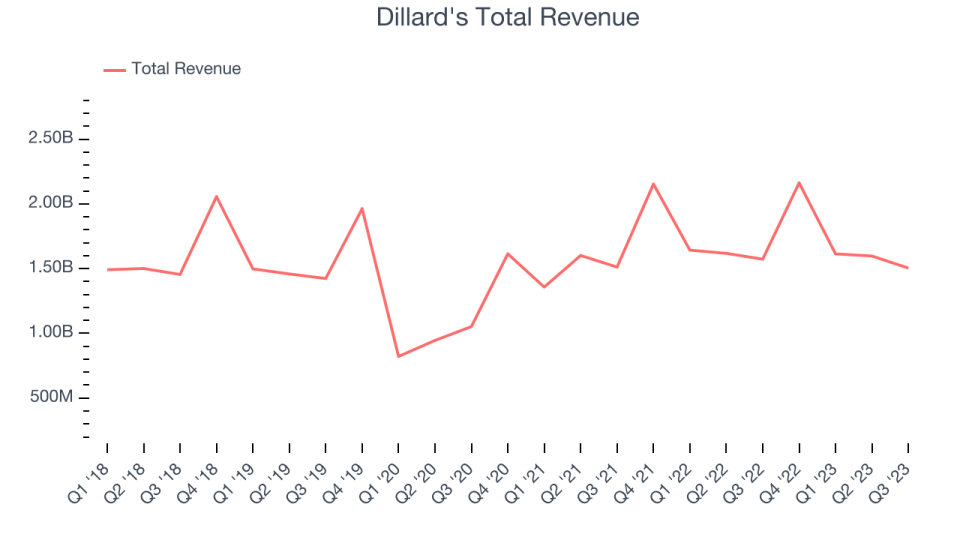

Department store chain Dillard’s (NYSE:DDS) missed analysts' expectations in Q3 FY2023, with revenue down 4.4% year on year to $1.50 billion. Turning to EPS, Dillard's made a GAAP profit of $9.49 per share, down from its profit of $10.96 per share in the same quarter last year.

Is now the time to buy Dillard's? Find out by accessing our full research report, it's free.

Dillard's (DDS) Q3 FY2023 Highlights:

Revenue: $1.50 billion vs analyst estimates of $1.52 billion (1.1% miss)

EPS: $9.49 vs analyst estimates of $7.19 (31.9% beat)

Free Cash Flow of $8.3 million, down 96.6% from the same quarter last year (large miss)

Gross Margin (GAAP): 44.5%, down from 45.6% in the same quarter last year

Same-Store Sales were down 6% year on year (big miss vs. expectations of down 1.8% year on year)

Store Locations: 273 at quarter end, increasing by 24 over the last 12 months

Dillard’s Chief Executive Officer William T. Dillard, II stated, “The sales environment remained challenging in the third quarter with particular weakness beginning in September. Our focus on producing profitable sales with inventory control paid off - with retail gross margin of 45.3% and inventory down 1% year over year. We repurchased $48 million of stock and had $893 million of cash and short-term investments remaining.”

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

Dillard's is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's annualized revenue growth rate of 1.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Dillard's reported a rather uninspiring 4.4% year-on-year revenue decline, missing analysts' expectations. Looking ahead, Wall Street expects revenue to decline 6% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

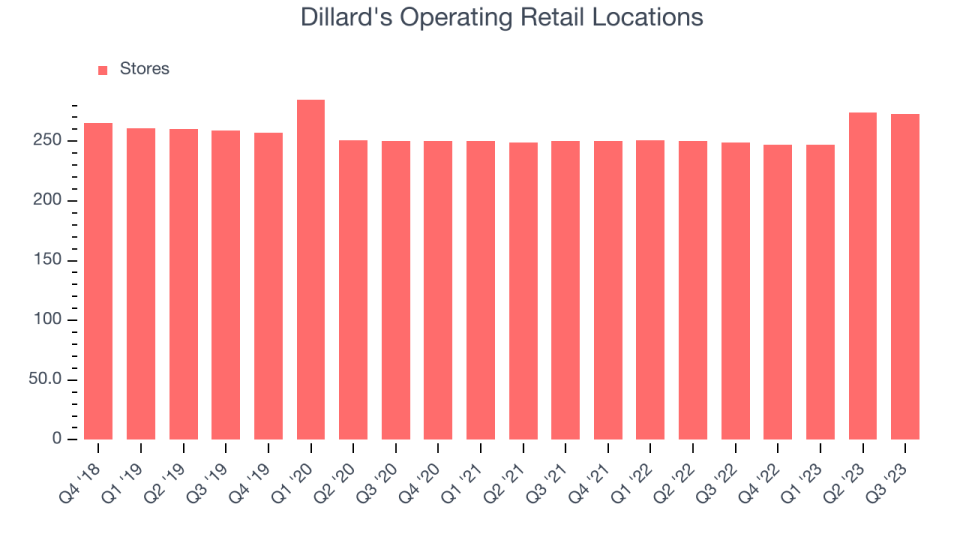

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like Dillard's keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Since last year, Dillard's store count increased by 24 locations, or 9.6%, to 273 total retail locations in the most recently reported quarter.

Taking a step back, the company has only opened a few new stores over the last eight quarters, averaging 2.1% annual growth in new locations. Although it's expanded its presence, this sluggish store growth lags other retailers. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

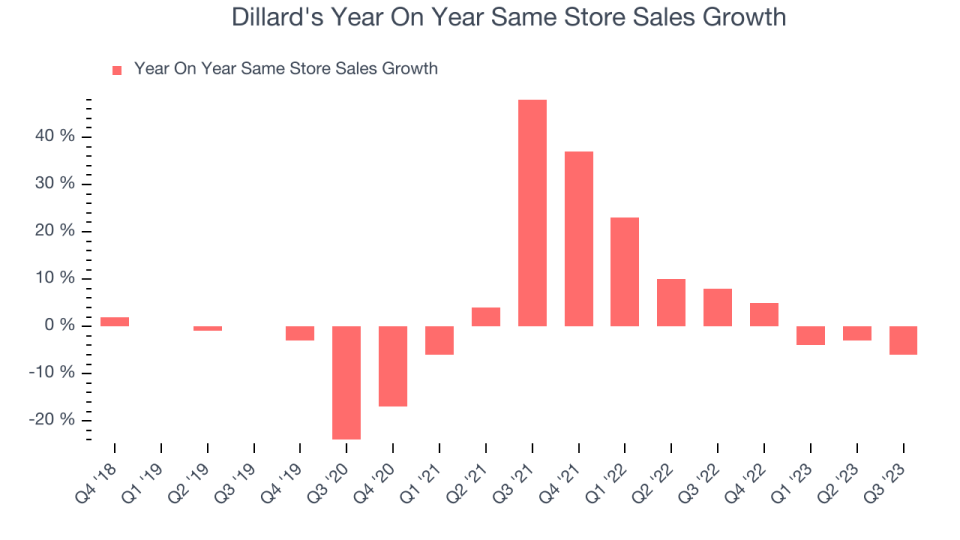

Dillard's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 8.8% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Dillard's is reaching more customers and growing sales.

In the latest quarter, Dillard's same-store sales fell 6% year on year. This decline was a reversal from the 8% year-on-year increase it posted 12 months ago. A one quarter hiccup isn't material for the long-term prospects of a business, but we'll keep a close eye on the company.

Key Takeaways from Dillard's Q3 Results

With a market capitalization of $5.07 billion, Dillard's is among smaller companies, but its $893.3 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

We like to track ROIC because it tells us about a company’s prospects for profitable growth and its management team's ability to achieve it through capital allocation decisions such as organic investments, acquisitions, and share buybacks. ROIC is also a helpful tool to benchmark performance versus peers, and just like how we focus on long-term investment returns, we care more about a company's long-term ROIC because short-term market volatility can distort results.

So should you invest in Dillard's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.