Dime Community Bancshares Inc (DCOM) Reports Mixed Financial Outcomes Amidst Strategic Growth ...

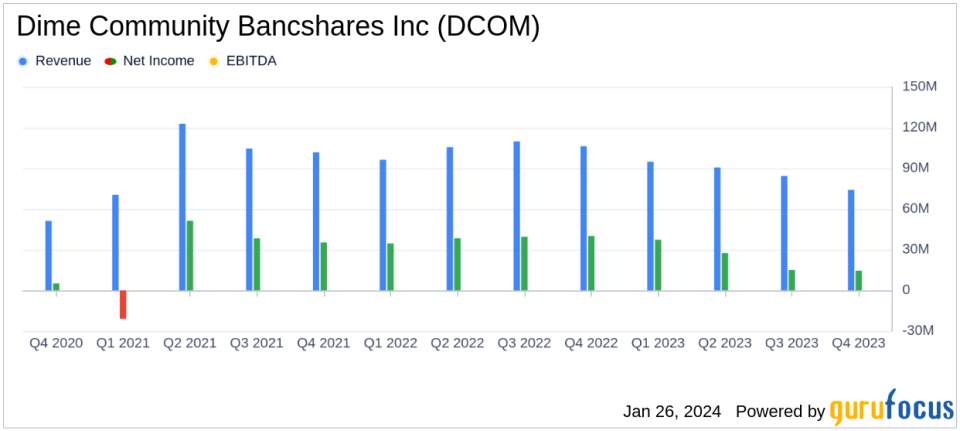

Net Income: DCOM reported a decrease in net income to $88.8 million for 2023, down from $145.3 million in 2022.

Deposits: Total deposits grew by over $276 million year-over-year, bolstered by strategic hiring in deposit gathering.

Net Interest Margin: A reduction in net interest margin compression was observed, with a focus on stabilizing the non-interest-bearing deposit base.

Loan Portfolio: The weighted average rate on the total loan portfolio increased to 5.29% at the end of 2023.

Non-Interest Income and Expense: Non-interest income stood at $8.9 million for Q4 2023, while non-interest expense was $53.9 million.

Asset Quality: Asset quality remained stable with non-performing loans at $29.1 million as of December 31, 2023.

Capital Management: Regulatory capital ratios exceeded requirements, with book value per common share rising to $28.58.

Dime Community Bancshares Inc (NASDAQ:DCOM), the holding company for Dime Community Bank, released its 8-K filing on January 26, 2024, detailing its financial results for the fourth quarter and full year of 2023. DCOM operates as a holding company, primarily engaged in gathering deposits and investing in a diverse loan portfolio, including multifamily residential, commercial real estate, and commercial and industrial loans.

Financial Performance and Challenges

For the year ended December 31, 2023, DCOM reported a net income available to common stockholders of $88.8 million, or $2.29 per diluted common share, a decrease from the previous year's $145.3 million, or $3.73 per diluted common share. The fourth quarter of 2023 saw a net income of $14.5 million, or $0.37 per diluted common share, which included a $1.0 million pre-tax expense related to the FDIC special assessment. This performance is significant as it reflects the company's ability to navigate economic challenges, including the impact of Federal Reserve rate changes and banking system liquidity issues.

Financial Achievements

Despite the decrease in net income, DCOM achieved notable growth in total deposits, driven by strategic hires in its deposit gathering group. The company's capital ratios continued to increase, and asset quality remained stable, showcasing the strength of its balance sheet and risk management practices. These achievements are particularly important for banks, as they indicate a solid foundation for future growth and the ability to withstand economic fluctuations.

Key Financial Metrics

DCOM's net interest income for the fourth quarter of 2023 was $74.1 million, a decrease from $96.8 million in the same quarter of the previous year. The net interest margin (NIM) was 2.29%, down from 3.15% in Q4 2022. The loan portfolio saw an increase in the weighted average rate, indicating a potential for higher interest income going forward. The company's deposit growth and capital management reflect its strategic focus on maintaining a strong liquidity position and capital base.

"Our fourth quarter results were marked by a continued stabilization in our non-interest-bearing deposit base, a continued reduction in the pace of net interest margin compression, a steady build-up in our capital ratios and stable asset quality," said Stuart H. Lubow, President and CEO of DCOM.

Analysis of Company Performance

DCOM's performance in 2023 demonstrates a mixed outcome, with significant deposit growth and capital ratio improvements offset by a decline in net income. The company's strategic initiatives, including the expansion of its Private and Commercial Bank and the addition of a new Healthcare lending vertical, indicate a forward-looking approach to diversifying its asset base and enhancing its technological capabilities. However, the challenges posed by the economic environment and the banking sector's dynamics have impacted its net interest margin and overall profitability.

For a detailed analysis of Dime Community Bancshares Inc's financial results and strategic initiatives, investors and interested parties can access the full earnings call information and further financial details provided in the company's 8-K filing.

Contact: Avinash Reddy, Senior Executive Vice President Chief Financial Officer, 718-782-6200 extension 5909

Explore the complete 8-K earnings release (here) from Dime Community Bancshares Inc for further details.

This article first appeared on GuruFocus.