Diodes' (DIOD) New Compact Rectifiers, LED Driver Aid Prospects

Diodes DIOD is benefiting from its expanding footprint in the industrial and automotive markets. These two markets represented 46% of the total product revenues in 2023.

DIOD is further strengthening its position in these markets with the launch of two groundbreaking products.

The first, a series of 2A trench Schottky rectifiers — SDT2U30CP3, SDT2U40CP3 and SDT2U60CP3 — has garnered attention for an unmatched performance and compact design. The second, an automotive-compliant linear LED driver — AL1783Q — promises unparalleled flexibility and safety features for automotive lighting applications.

The trio of 2A trench Schottky rectifiers represents a significant leap forward in power management solutions. With the industry’s highest current densities in their class, these rectifiers boast low forward voltage drop and thermal resistance, making them ideal for smaller, more efficient portable devices.

Housed in a chip-scale package that occupies just 0.84 square millimeters of board space, the rectifiers offer unparalleled versatility, serving as blocking or reverse-polarity protection diodes, boost diodes and switching diodes.

Additionally, their ultra-low forward voltage performance minimizes power losses, resulting in higher efficiency systems. With robust capability and full compliance with RoHS 3.0 standards, these rectifiers ensure reliability and environmental responsibility.

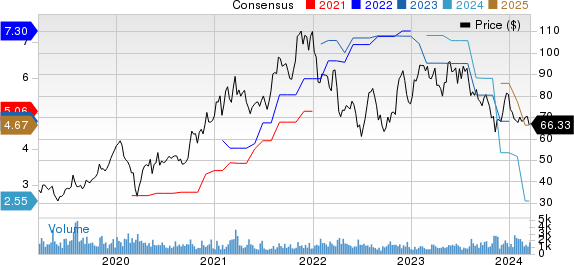

Diodes Incorporated Price and Consensus

Diodes Incorporated price-consensus-chart | Diodes Incorporated Quote

Meanwhile, the AL1783Q linear LED driver is set to redefine automotive lighting systems. With independent controls for brightness and color across three channels, this driver enables dynamic lighting effects tailored to individual preferences.

AL1783Q linear LED driver’s compatibility with both electric and internal combustion vehicles underscores its versatility and adaptability to evolving automotive trends. Moreover, designed to operate from a 55V rail, AL1783Q surpasses competitors by supporting higher LED chain voltages, catering to the demands of modern vehicle subsystems. Enhanced current capabilities per channel and multiple fault detection features further solidify its position as the go-to solution for automotive lighting applications.

Automotive Expansion to Boost Prospect

Automotive contributed 18% of product revenues in fourth-quarter 2023. DIOD introduced more than 350 automotive compliance products in 2023, which are driving the design pipeline and expanding the total available market.

Diodes is benefiting from strong demand for managing sensor data, control information, infotainment, and power line and battery management in the automotive market. Automotive-compliant diode controllers have been experiencing strong demand from ADAS telematic and infotainment systems manufacturers.

However, an overall challenging microenvironment and increasing sluggishness in the industrial end-market do not bode well for Diodes’ top-line growth.

For first-quarter 2024, Diodes expects revenues of $305 million, plus or minus 3%. The Zacks Consensus Estimate for revenues is pegged at $304.7 million, indicating a 34.79% year-over-year decline.

The consensus mark for earnings is pegged at 27 cents per share, unchanged in the past 30 days.

Zacks Rank & Stocks to Consider

Diodes currently has a Zacks Rank #5 (Strong Sell).

Diodes shares have underperformed the Zacks Computer & Technology sector in the year-to-date period. While DIOD shares have lost 17.6%, the broader sector has returned 8.7%.

NVIDIA NVDA, Meta Platforms META and Synopsys SNPS are some better-ranked stocks in the broader sector, each flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Year to date, shares of NVDA, META and SNPS have gained 77.4%, 36.8% and 6.8%, respectively.

Long-term earnings growth rates for NVIDIA, Meta Platforms and Synopsys are currently pegged at 29.73%, 19.5% and 17.51%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report