Diodes (DIOD) Expands Portfolio With Latest Hall-Effect Latches

Diodes DIOD is expanding its portfolio with the latest launch of the AH371xQ series of high-voltage Hall-effect latches, which are automotive-compliant. These devices feature a Hall plate design that boosts performance.

These latches are used for brushless DC motor control, valve operation, linear and incremental rotary encoders and position-sensing functions. Hence, it can support numerous in-vehicle comfort and engine management applications.

Hall-effect latches have an operating voltage range from 3V to 27V, with 40V load dump protection. The latches in the AH371xQ series have an 8kV human body model electrostatic discharge rating.

The AH371xQ series is available at 32 cents in 1,000-piece quantities.

Automotive Expansion to Boost Prospect

Diodes is benefiting from expanding its footprint in the automotive and industrial markets. These two markets represented 45% of total product revenues in the third quarter of 2023.

Automotive contributed 19% of revenues. In the third quarter, the company witnessed stable demand in the automotive end-market. DIOD introduced 139 new automotive compliance products, which included low voltage modified products for Automotive Battery Management Systems, Wi-Fi telecommunications and infotainment applications in the reported quarter.

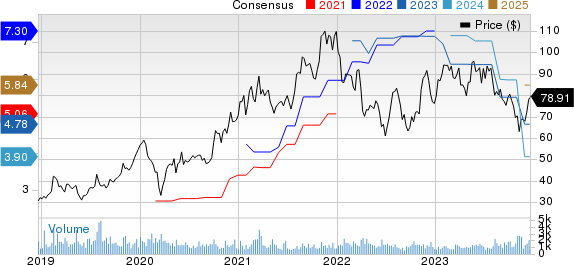

Diodes Incorporated Price and Consensus

Diodes Incorporated price-consensus-chart | Diodes Incorporated Quote

Diodes is benefiting from strong demand for managing sensor data, control information, infotainment and power line and battery management in the automotive market. Automotive-compliant diode controllers have been experiencing strong demand from ADAS telematic and infotainment systems manufacturers.

Moreover, recovery in the computing market bodes well for Diodes. The company expects further recovery in the first half of 2024.

However, an overall challenging microenvironment and increasing sluggishness in the industrial end-market don’t bode well for Diodes’ top-line growth.

For fourth-quarter 2023, Diodes expects revenues to be approximately $325 million, plus or minus 3%. The Zacks Consensus Estimate for revenues is currently pegged at $324.5 million, indicating a 34.6% year-over-year decline.

The consensus mark for earnings is pegged at 47 cents per share, unchanged in the past 30 days.

Zacks Rank & Stocks to Consider

Diodes currently has a Zacks Rank #5 (Strong Sell).

Diodes shares have underperformed the Zacks Computer & Technology sector in the past year. While DIOD shares have gained 0.5%, the Computer & Technology sector has returned 49.7%.

Ceridian HCM CDAY, Dropbox DBX and 8x8 EGHT are some better-ranked stocks that investors can consider in the broader sector, each carrying a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past year, shares of Ceridian HCM and Dropbox have gained 7.5% and 34.5%, respectively. 8x8 shares have declined 20% over the same timeframe.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

8x8 Inc (EGHT) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Ceridian HCM (CDAY) : Free Stock Analysis Report