Diodes (DIOD) Q3 Earnings Lag Estimates, Revenues Down Y/Y

Diodes DIOD reported third-quarter 2023 non-GAAP earnings of $1.13 per share, which lagged the Zacks Consensus Estimate by 5.83% and fell 43.5% year over year.

The company reported revenues of $404.6 million, which declined 22.4% year over year and lagged the consensus mark by 4.68%.

Diodes’ top-line growth suffered from weaker-than-expected end-customer demand in the computing, consumer and communication markets, as well as the overall Asian market.

Quarter Details

Automotive product revenues in the third quarter remained at a record 19% of revenues. Industrial revenues were 45% of revenues and above Diodes’ target model of 40%.

The company’s gross profit decreased 28.4% year over year to $155.9 million. Gross margin contracted 330 basis points (bps) to 38.5%.

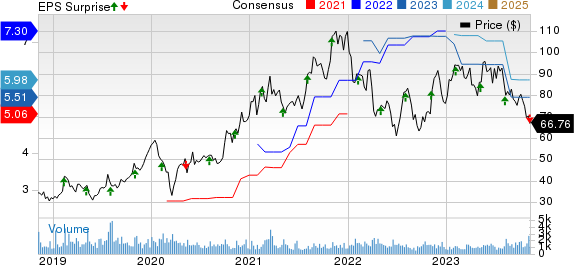

Diodes Incorporated Price, Consensus and EPS Surprise

Diodes Incorporated price-consensus-eps-surprise-chart | Diodes Incorporated Quote

Adjusted EBITDA was $90.6 million, down 36.2% year over year.

In third-quarter 2023, selling, general and administrative expenses declined 8.1% year over year to $63 million. However, research & development expenses increased 3.9% year over year to $34.1 million.

Operating expenses declined 3.2% year over year to $102 million.

Balance Sheet

As of Sep 30, 2023, cash, cash equivalents, restricted cash and short-term investments were $307.5 million.

As of Sep 30, 2023, Diodes had a total debt of $23.8 million.

At the end of the third quarter, total inventory days were approximately 124 compared with 112 in the previous quarter. Finished goods inventory days were 34 compared with 30 in the prior quarter.

Outlook

For fourth-quarter 2023, Diodes expects revenues of $325 million (+/- 3%).

It expects GAAP gross margin to be 35% (+/-1%), primarily due to higher underutilization costs on lower expected revenues combined with a less favorable product mix.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Anterix ATEX, ASANA ASAN and Snowflake SNOW are some better-ranked stocks that investors can consider in the broader sector, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Anterix’s shares have declined 6.4% year to date. ATEX is set to report its second-quarter fiscal 2024 results on Nov 13.

ASANA shares have gained 44.6% year to date. ASAN is set to report its third-quarter fiscal 2024 results on Dec 5.

Snowflake shares have returned 10.8% year to date. SNOW is set to report its third-quarter fiscal 2024 results on Nov 29.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Anterix Inc. (ATEX) : Free Stock Analysis Report

Asana, Inc. (ASAN) : Free Stock Analysis Report