Dip in Consumer Confidence Sparks Recession Fears: 3 Gainers

Americans felt much better about their financial situations in July as price pressures cooled down. Strength in the labor market also improved consumer sentiment about future economic conditions.

However, predominantly, higher gasoline prices dented consumer confidence in August, and it was apparent across all age groups. What’s more, consumers’ assessment of future business scenarios dropped, a clear-cut sign that Americans at present are feeling helpless about a looming economic slump.

This calls for investing in recession-proof stocks like J & J Snack Foods JJSF, Atmos Energy ATO, and Activision Blizzard ATVI for steady returns.

Americans Aren’t Feeling Much Better About the Economy

The Conference Board stated that its consumer confidence index slipped to 106.1 in August from July’s revised reading of 114, which was the highest since December 2021. Analysts estimated a modest pullback to 116 in August from the initial two-year high reading of 117 in July.

Consumers’ assessment of present economic conditions tanked to 114.8 in August from last month’s reading of 153. To top it off, their assessment of economic conditions in the next six-month period declined to 80.2 this month from 88 in July. Notably, any reading below the 80 mark in reality indicates a recession within the next one-year period.

The dip in consumer confidence, by the way, can be attributed to a jump in gasoline prices. So far this year, the price of a gallon of unleaded gasoline climbed 19.6% and increased more than 2% from last month.

Consumers are now anticipating an economic downturn next year. This is because many are limiting their spending, and are relying on credit cards to make ends meet. A few of them said that jobs at present were “plentiful,” while most of them said that jobs were “hard to get.”

Don’t Shun Equities, Instead Buy Recession-Proof Stocks

With consumer confidence dipping, and concerns about a recession resurfacing, things don’t bode well for the stock market. But, contrary to popular belief, defensive stocks do well during economic downturns. This is because they are cyclical, or whose products and services are in constant demand irrespective of market upheavals.

These stocks generally belong to the consumer staples and utility sectors. After all, demand for food, electricity, gas, and water remains unaltered amid market gyrations. Vice stocks, including gaming companies, also provide a stable stream of income during market volatility. The very nature of their products is comparatively inelastic, and business is recession-proof.

3 Recession-Proof Stocks to Buy Now

We have, therefore, highlighted three recession-proof stocks that should make meaningful additions to your portfolio as of now. These stocks carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

J & J Snack Foods is an American manufacturer, marketer and distributor of branded niche snack foods. Currently, JJSF sports a Zacks Rank #1.

The Zacks Consensus Estimate for its current-year earnings has increased 16.4% over the past 60 days. The company’s expected earnings growth for the current year is 62.3%.

Atmos Energy is engaged in regulated natural gas distribution and storage business. ATO currently has a Zacks Rank #2.

The Zacks Consensus Estimate for its current-year earnings has increased 0.3% over the past 60 days. The company’s expected earnings growth for the current year is 8%.

Activision Blizzard is a leading developer and publisher of console, online, and mobile games. ATVI, presently, has a Zacks Rank #2.

The Zacks Consensus Estimate for its current-year earnings has increased 4.5% over the past 60 days. The company’s expected earnings growth for the current year is 23.2%.

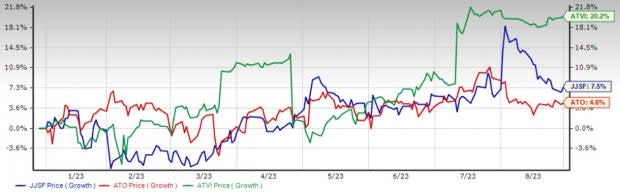

Shares of J & J Snack Foods, Atmos Energy and Activision Blizzard have gained 7.5%, 4.6% and 20.2%, respectively, in the year-to-date period.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report