Direct Digital Holdings Inc (DRCT) Aligns with EPS Projections, Reports Revenue Surge in ...

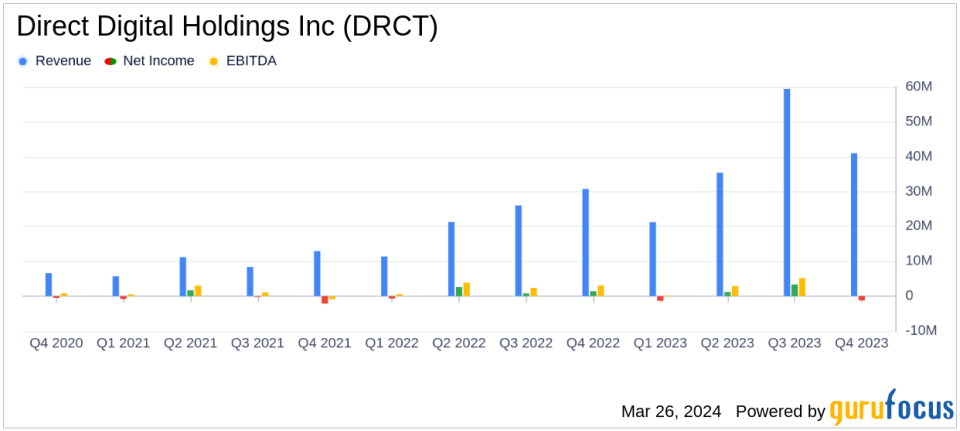

Revenue: Full-Year 2023 revenue increased by 76% to $157.1 million, consistent with analyst estimates.

Net Income: Reported at $2.0 million for Full-Year 2023, with a fourth-quarter net loss of $1.2 million.

EPS: Estimated earnings per share of 0.0233 align with analyst projections.

Adjusted EBITDA: Grew by 11% Year-Over-Year to $11.3 million.

Market Share: Significant growth in average monthly impressions and bid requests processed.

On March 26, 2024, Direct Digital Holdings Inc (NASDAQ:DRCT), a prominent player in the advertising and marketing technology sector, disclosed its financial outcomes for the fourth quarter and the entire fiscal year of 2023 in its 8-K filing. The company, which operates through its subsidiaries Colossus Media, LLC, Orange142, LLC, and Huddled Masses LLC, reported a significant 76% revenue increase year-over-year, reaching $157.1 million, marking the eighth consecutive quarter of double-digit growth. Despite this impressive annual performance, DRCT faced a challenging fourth quarter, with net losses amounting to $1.2 million, contrasting with a net income of $1.4 million in the same period of the previous year.

Direct Digital Holdings Inc is an end-to-end, full-service programmatic advertising platform that specializes in delivering technology, data-driven campaign optimization, and solutions to underserved markets within the digital advertising ecosystem. The company's robust annual performance underscores its strategic position in the Media - Diversified industry, where it continues to capture market share and deliver value to shareholders.

Performance and Challenges

DRCT's full-year net income stood at $2.0 million, with an adjusted EBITDA increase of 11% to $11.3 million. The company's sell-side advertising segment was particularly strong, contributing a 104% growth over the previous fiscal year. However, the fourth quarter saw a dip in performance, attributed to proactive measures in response to changing macro industry trends. This decline in quarterly earnings highlights the volatility and challenges faced by the company in a rapidly evolving digital advertising landscape.

Financial Achievements

The company's financial achievements are critical, particularly its sell-side advertising segment, which saw revenue grow to $122.4 million, a 104% increase. This growth demonstrates DRCT's ability to scale and adapt in a competitive industry. Furthermore, the company's buy-side advertising segment also reported growth, serving approximately 234 customers in the fourth quarter, a 7% increase over the previous year.

Key Financial Metrics

Direct Digital Holdings Inc's financial stability and growth are evident in its balance sheet and cash flow statements. The company's operational expansion and strategic investments have positioned it for continued growth, as evidenced by the substantial increases in processed impressions and bid requests. These metrics are crucial for the company as they reflect its capacity to handle high volumes of advertising traffic and its effectiveness in monetizing these opportunities.

"2023 was another transformational year for Direct Digital Holdings, achieving remarkable year-over-year revenue growth of 76% as well as dramatic operational expansion, and impressive results for our shareholders," stated Mark D. Walker, Chairman and Chief Executive Officer.

"We are pleased to announce our fiscal year 2024 revenue guidance of $170 million to $190 million. This range demonstrates our belief that we can continue our growth and operational optimization strategies to deliver strong performance for our shareholders this year," commented Diana Diaz, Chief Financial Officer.

Looking Ahead

Looking forward to fiscal year 2024, Direct Digital Holdings Inc has set a revenue guidance of $170 million to $190 million, reflecting the company's confidence in its growth trajectory and strategic initiatives. The company's proactive shift towards a cookie-less advertising environment positions it to navigate anticipated industry changes effectively.

Direct Digital Holdings Inc's performance, particularly in the context of its alignment with EPS projections and substantial revenue growth, positions it as a company of interest for value investors and potential GuruFocus.com members seeking opportunities in the digital advertising space.

For more detailed financial information and to join the upcoming conference call discussing these results, please visit Direct Digital Holdings' investor relations website.

Explore the complete 8-K earnings release (here) from Direct Digital Holdings Inc for further details.

This article first appeared on GuruFocus.