Director Alan Feller Sells 10,000 Shares of G-III Apparel Group Ltd

On September 11, 2023, Director Alan Feller sold 10,000 shares of G-III Apparel Group Ltd (NASDAQ:GIII). This move comes amidst a year where the insider has sold a total of 10,000 shares and purchased none.

Alan Feller is a key figure in the G-III Apparel Group Ltd, a leading manufacturer and distributor of apparel and accessories under licensed brands, owned brands, and private label brands. G-IIIs owned brands include Donna Karan, DKNY, Vilebrequin, G. H. Bass, Andrew Marc, Marc New York, Eliza J, and Jessica Howard. G-III has fashion licenses under the Calvin Klein, Tommy Hilfiger, Karl Lagerfeld Paris, Kenneth Cole, Cole Haan, Guess?, Vince Camuto, Levi's, and Dockers brands.

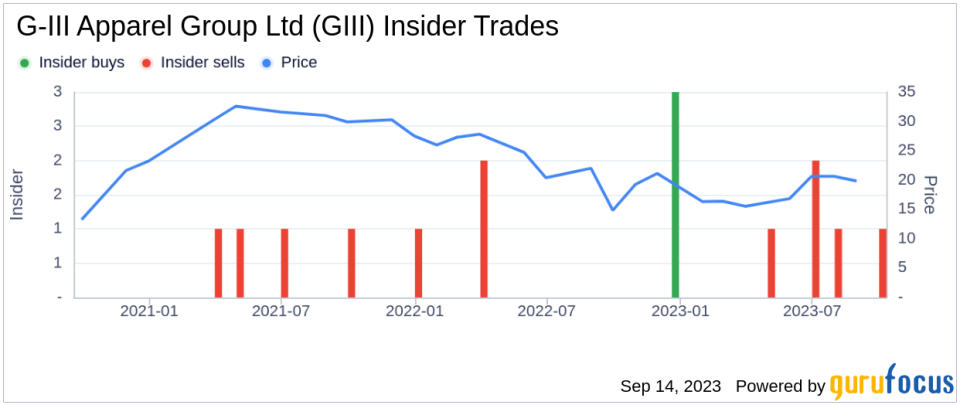

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To understand the implications of this move, it's essential to analyze the insider buy/sell trends and their relationship with the stock price.

Over the past year, there have been 3 insider buys and 5 insider sells for G-III Apparel Group Ltd. The insider's recent sell-off is part of a broader trend of insider selling, which could signal a bearish outlook on the company's future performance.

On the day of the insider's recent sell, G-III Apparel Group Ltd's shares were trading at $24.04, giving the company a market cap of $1.124 billion.

With a GuruFocus Value of $28.89, G-III Apparel Group Ltd has a price-to-GF-Value ratio of 0.83, indicating that the stock is modestly undervalued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

Despite the insider's recent sell-off, the stock's modest undervaluation could present an attractive entry point for investors. However, the ongoing trend of insider selling warrants caution and further analysis.

As always, investors should not solely rely on insider transactions when making investment decisions but should consider them as part of a broader analysis of a company's fundamentals, market conditions, and other relevant factors.

This article first appeared on GuruFocus.