Director Alex Schultz's Strategic Stake Increase in Lindblad Expeditions Holdings Inc

In the realm of investment, insider trading activities often serve as a beacon, guiding market participants to potential opportunities or risks within a company. A recent transaction that has caught the attention of the market is the purchase of 39,293 shares of Lindblad Expeditions Holdings Inc (NASDAQ:LIND) by Director Alex Schultz on December 13, 2023. This article delves into the details of this insider buying event, providing an objective analysis based on the available data.

Who is Alex Schultz of Lindblad Expeditions Holdings Inc?

Alex Schultz, a member of the board of directors at Lindblad Expeditions Holdings Inc, has a history of aligning his interests with those of the company and its shareholders. Directors with skin in the game are often seen as more committed to the company's success, and Schultz's recent purchase is a testament to this belief. His role in the company provides him with a unique perspective on its operations and potential, making his investment decisions particularly noteworthy.

Lindblad Expeditions Holdings Inc's Business Description

Lindblad Expeditions Holdings Inc is a global leader in expedition cruising and adventure travel experiences. The company offers voyages to various remote and culturally rich destinations around the world. These include the Galapagos Islands, Antarctica, the Arctic, and more, aboard a fleet of small ships designed for such expeditions. Lindblad Expeditions is known for its commitment to sustainable tourism, educational programs, and providing guests with immersive and interactive experiences with nature and wildlife.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares in a company by individuals who have access to non-public, material information about the company, such as its directors, officers, or employees. Conversely, insider selling involves these insiders disposing of their shares. These transactions are closely monitored by investors and analysts as they can provide signals about the insider's confidence in the company's future prospects. A director's purchase of shares, as seen with Alex Schultz, can be interpreted as a positive sign, suggesting that the insider believes the stock is undervalued or that the company is poised for growth.

On the other hand, insider selling does not necessarily indicate a lack of confidence in the company; it could also be due to personal financial management or diversification reasons. However, a pattern of insider selling could be cause for a more cautious approach from investors.

Insider Trends

The insider transaction history for Lindblad Expeditions Holdings Inc shows a mix of insider buying and selling activities over the past year. With 2 insider buys and 7 insider sells, the market can glean insights into the internal perspectives of those with intimate knowledge of the company's workings.

Valuation and Market Cap

On the day of the insider's recent buy, shares of Lindblad Expeditions Holdings Inc were trading at $8.71, resulting in a market cap of $548.831 million. This valuation is a critical piece of the puzzle when analyzing Schultz's purchase.

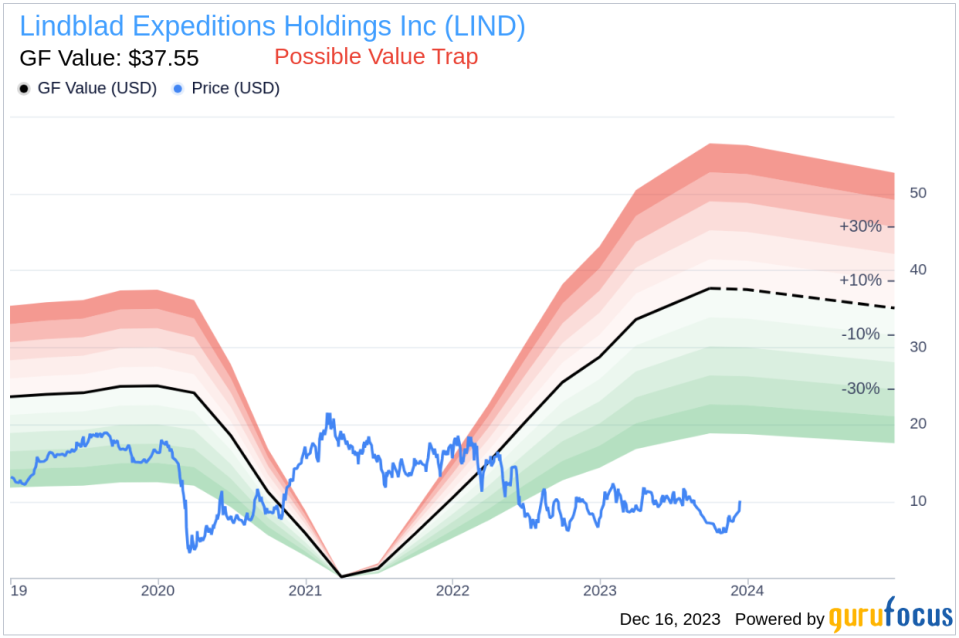

When juxtaposed with the GuruFocus Value of $37.55, Lindblad Expeditions Holdings Inc's price-to-GF-Value ratio stands at 0.23. This ratio suggests that the stock might be a Possible Value Trap, and investors should Think Twice before making an investment decision based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated considering historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, it incorporates a GuruFocus adjustment factor based on the company's past returns and growth, as well as future business performance estimates from Morningstar analysts.

Objective Analysis of Alex Schultz's Purchase

Director Alex Schultz's acquisition of 39,293 shares is a significant investment and signals a strong vote of confidence in the future of Lindblad Expeditions Holdings Inc. Given the current price-to-GF-Value ratio, Schultz's move could be seen as a contrarian bet, anticipating a potential correction in the stock's valuation.

It is important to note that while insider buying can be a positive indicator, it should not be the sole factor in an investment decision. Investors should consider the broader context, including market conditions, the company's financial health, competitive landscape, and growth prospects. Additionally, the insider's historical trading behavior and the overall pattern of insider transactions within the company can provide further insights.

In conclusion, Alex Schultz's recent insider purchase of Lindblad Expeditions Holdings Inc shares is a noteworthy event that warrants attention. While the current valuation metrics suggest caution, Schultz's decision to increase his stake could be indicative of an optimistic outlook for the company's future. As always, investors are encouraged to conduct their due diligence and consider a multitude of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.