Director Ann Bates Sells 16,061 Shares of United Natural Foods Inc (UNFI)

On October 11, 2023, Director Ann Bates sold 16,061 shares of United Natural Foods Inc (NYSE:UNFI). This move comes amidst a year where the insider has sold a total of 16,061 shares and purchased none.

Ann Bates is a key figure in the United Natural Foods Inc company. She serves as a Director, providing strategic guidance and oversight to the company's operations. United Natural Foods Inc is a leading distributor of natural, organic, and specialty foods and non-food products in the United States and Canada. The company operates through three main segments: Wholesale, Retail, and Manufacturing and Branded Products.

The insider's recent sell has raised eyebrows in the financial community, prompting a closer look at the company's insider trading trends and their relationship with the stock price.

The insider transaction history for United Natural Foods Inc shows a total of 3 insider buys and 5 insider sells over the past year. This trend suggests a cautious sentiment among insiders, with sells outnumbering buys. However, it's important to note that insider trading is only one of many indicators investors should consider when evaluating a stock.

On the day of the insider's recent sell, shares of United Natural Foods Inc were trading for $14.94 apiece, giving the stock a market cap of $899.144 million. The price-earnings ratio stood at 43.91, significantly higher than the industry median of 16.66 and the companys historical median price-earnings ratio. This suggests that the stock is currently trading at a premium compared to its earnings.

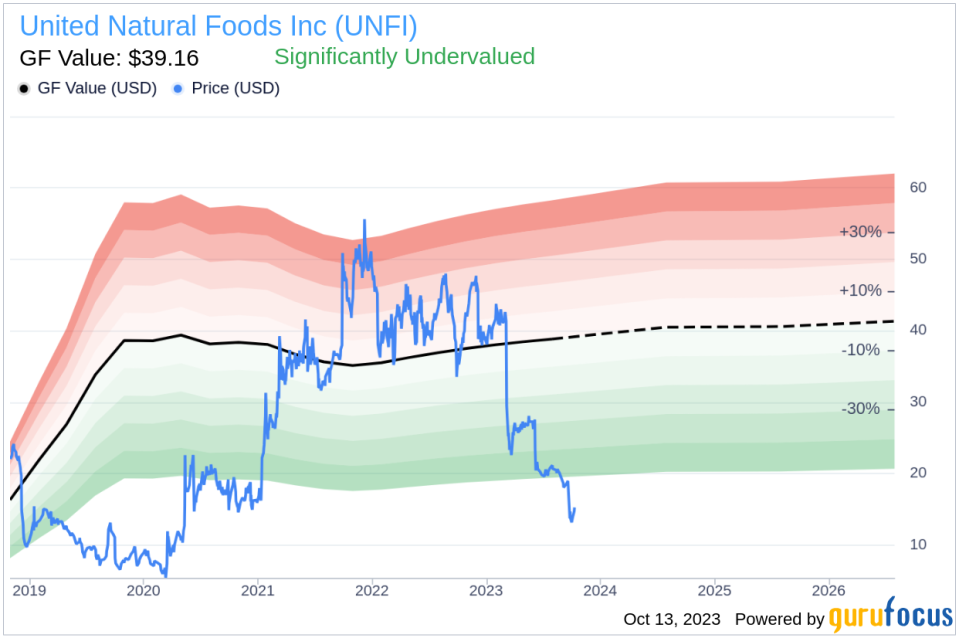

However, when we consider the GuruFocus Value of $39.16, the stock appears to be significantly undervalued with a price-to-GF-Value ratio of 0.38. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell might raise some concerns, the stock's current valuation suggests that it might still be a good buy for value investors. As always, investors should conduct their own due diligence and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.