Director Avi Zeevi Sells 150,000 Shares of Payoneer Global Inc (PAYO)

On September 15, 2023, Avi Zeevi, a director at Payoneer Global Inc (NASDAQ:PAYO), sold 150,000 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 300,000 shares over the past year and made no purchases.

Avi Zeevi is a seasoned entrepreneur and venture capitalist with a deep understanding of the fintech industry. His role as a director at Payoneer Global Inc allows him to leverage his expertise to guide the company's strategic direction and growth.

Payoneer Global Inc is a leading financial services company that provides businesses with a platform to manage and move money globally. The company's services are used by millions of businesses and professionals in more than 200 countries, enabling them to grow globally by improving the way they pay and get paid.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. On the day of the insider's recent sell, shares of Payoneer Global Inc were trading for $6.2 apiece, giving the company a market cap of $2.146 billion.

The company's price-earnings ratio stands at 199.17, which is significantly higher than the industry median of 27.27. This suggests that the stock may be overvalued compared to its peers. However, it's worth noting that the company's price-earnings ratio is lower than its historical median, indicating that the stock may be undervalued based on the company's own historical standards.

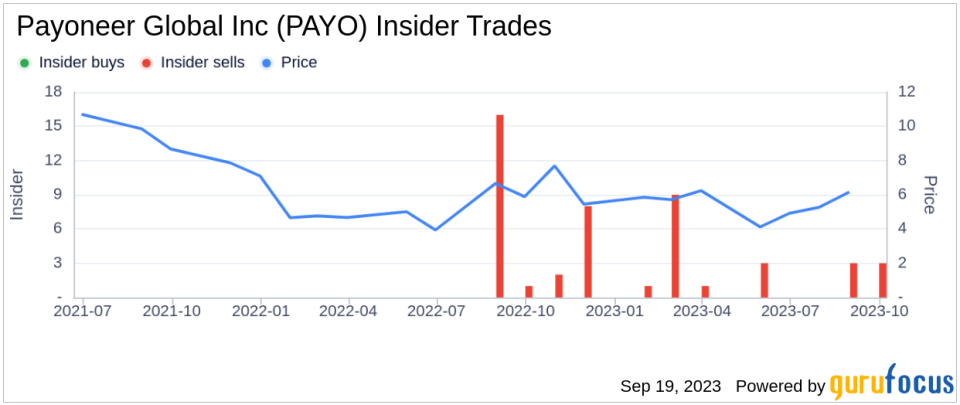

The insider's selling activity over the past year contrasts with the overall insider transaction history for Payoneer Global Inc. Over the past year, there have been no insider buys and 30 insider sells in total.

The above image shows the trend in insider transactions for Payoneer Global Inc. The lack of insider buying activity coupled with the insider's recent sell-off could be a cause for concern for investors. However, it's important to remember that insider transactions are just one of many factors to consider when evaluating a stock.

In conclusion, the insider's recent sell-off of Payoneer Global Inc shares warrants attention. While the company's valuation metrics suggest that the stock may be overvalued compared to its peers, the lack of insider buying activity over the past year could be a red flag. Investors should keep a close eye on the company's financial performance and insider transactions in the coming months.

This article first appeared on GuruFocus.