Director Biotech Wg's Strategic Investment in Y-mAbs Therapeutics Inc

Y-mAbs Therapeutics Inc (NASDAQ:YMAB), a commercial-stage biopharmaceutical company, has recently witnessed a significant insider purchase that has caught the attention of investors and market analysts alike. On December 11, 2023, Director Biotech Wg acquired a substantial number of shares, indicating a strong belief in the company's future prospects. This article delves into the details of the transaction and provides an objective analysis based on the available data.

Who is Biotech Wg of Y-mAbs Therapeutics Inc?

Before analyzing the transaction, it is essential to understand who Biotech Wg is within the context of Y-mAbs Therapeutics Inc. Biotech Wg is listed as a director of the company, playing a crucial role in its strategic direction and corporate governance. Directors are typically well-informed about the company's operations and future plans, and their investment decisions are often seen as a signal of their confidence in the company's potential.

Y-mAbs Therapeutics Inc's Business Description

Y-mAbs Therapeutics Inc is a biopharmaceutical company focused on the development and commercialization of novel antibody-based therapies for the treatment of cancer. The company's product pipeline includes innovative treatments that target a variety of oncology indications, with a commitment to advancing care for pediatric and adult patients. Y-mAbs leverages its expertise in antibody development to create therapies that aim to improve outcomes for patients with high unmet medical needs.

Description of Insider Buy/Sell

Insider buying and selling refer to the purchase or sale of a company's shares by its executives, directors, or other insiders. These transactions are closely monitored by investors as they can provide insights into insiders' perspectives on the company's valuation and future performance. An insider buy, such as the one executed by Biotech Wg, is often interpreted as a positive sign, suggesting that the insider believes the stock is undervalued or that there is potential for growth. Conversely, insider selling might raise concerns about the company's outlook, although it can also occur for personal reasons unrelated to the company's performance.

Insider Buying Analysis

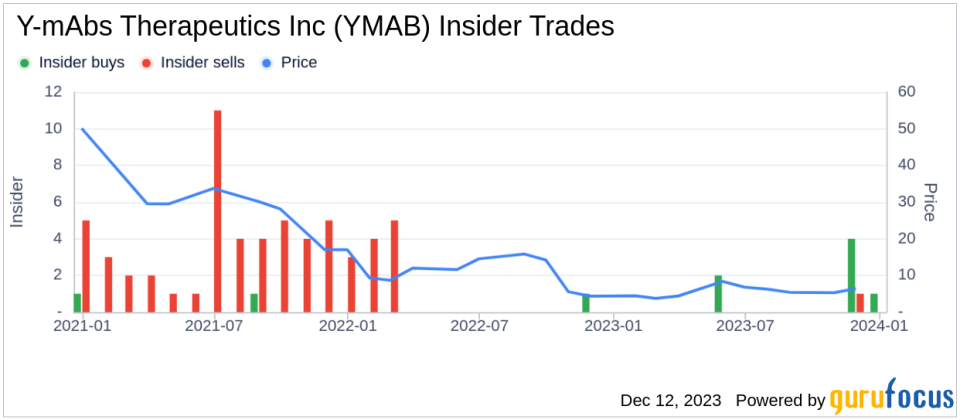

On December 11, 2023, Biotech Wg made a notable investment in Y-mAbs Therapeutics Inc by purchasing 127,549 shares. This transaction is part of a pattern of insider buying activity over the past year, with Biotech Wg having acquired a total of 374,313 shares. The absence of any insider sales during this period further underscores the confidence that insiders have in the company's trajectory.

The insider transaction history for Y-mAbs Therapeutics Inc reveals a predominance of insider buying, with 7 insider buys and only 1 insider sell over the past year. This trend suggests a general optimism among insiders about the company's future.

Valuation and Market Cap

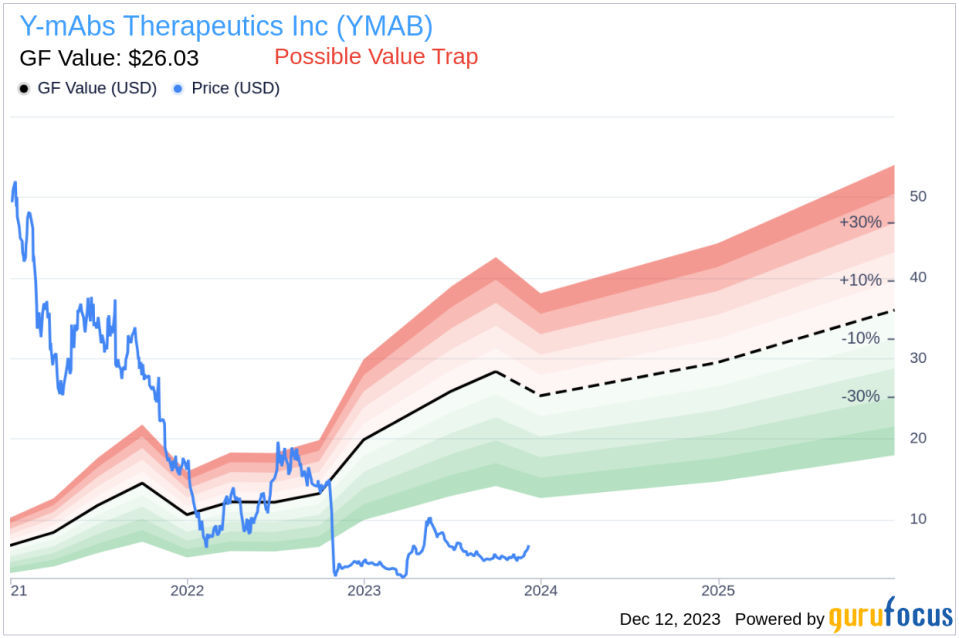

At the time of the insider's recent purchase, shares of Y-mAbs Therapeutics Inc were trading at $6.98 each, resulting in a market cap of $290.956 million. This valuation is particularly interesting when compared to the GuruFocus Value (GF Value) of $26.03 per share. The price-to-GF-Value ratio stands at 0.27, indicating that the stock could be a Possible Value Trap, and investors should Think Twice before making an investment decision based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated by considering historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, it incorporates a GuruFocus adjustment factor based on the company's past returns and growth, as well as future business performance estimates from Morningstar analysts.

Objective Analysis Based on Data

While the price-to-GF-Value ratio suggests caution, the insider's substantial purchase could be seen as a counterpoint to this valuation metric. It is possible that the insider has access to information or a perspective that provides a more optimistic outlook on the company's value and growth potential. The insider's decision to increase their stake in Y-mAbs Therapeutics Inc by 127,549 shares is a significant financial commitment and may signal a belief in the company's strategic initiatives, upcoming product pipeline, or potential for acquisition by larger pharmaceutical entities.

Investors should consider the insider's buying activity in the context of the company's recent developments, financial health, and industry trends. While insider transactions can provide valuable clues, they are just one piece of the puzzle when it comes to making informed investment decisions. It is also crucial to conduct thorough due diligence, including an analysis of the company's financial statements, competitive position, and market dynamics.

In conclusion, the insider's recent purchase of Y-mAbs Therapeutics Inc shares is a noteworthy event that warrants attention. While the GF Value suggests the stock may be undervalued, investors should carefully evaluate all available information before drawing conclusions. The insider's buying trend could be a positive indicator, but it is essential to consider the broader financial and industry context to make a well-rounded investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.