Director Brian Ratzan's Strategic Insider Purchase of Advantage Solutions Inc Shares

Insider buying can often provide valuable insights into a company's prospects and the confidence that insiders have in the company's future performance. A significant insider purchase can signal that those with the most intimate knowledge of the company's operations believe the stock is undervalued or that there are positive developments ahead. This is why the recent insider buying activity at Advantage Solutions Inc (NASDAQ:ADV) by Director Brian Ratzan has caught the attention of investors and market analysts alike.

Who is Brian Ratzan at Advantage Solutions Inc?

Brian Ratzan is a seasoned professional with a deep understanding of the financial and operational aspects of business. As a director of Advantage Solutions Inc, Ratzan holds a position of significant responsibility, overseeing the strategic direction of the company and making decisions that impact its long-term success. His recent purchase of shares in the company is not only a financial investment but also a strong vote of confidence in the company's future.

Advantage Solutions Inc's Business Description

Advantage Solutions Inc is a leading provider of outsourced sales and marketing solutions to consumer goods manufacturers and retailers. The company's innovative and customized solutions are designed to improve performance and drive growth for their clients. With a comprehensive suite of services, including headquarter sales, retail merchandising, business intelligence, and digital commerce, Advantage Solutions Inc is well-positioned to meet the evolving needs of a dynamic retail landscape.

Description of Insider Buy/Sell

An insider buy occurs when an officer, director, or any person with key access to company information purchases shares of the company's stock. This is often viewed as a bullish signal, as insiders are likely to buy stock based on their belief that the shares are undervalued or that positive corporate developments are on the horizon. Conversely, an insider sell is when these individuals sell their shares, which can be interpreted in various ways, but often it is seen as less positive than insider buying.

According to the data provided, Brian Ratzan has demonstrated a strong conviction in the potential of Advantage Solutions Inc by purchasing a total of 215,400 shares and not selling any over the past year. This level of insider buying is noteworthy and warrants a closer look by investors.

Insider Trends

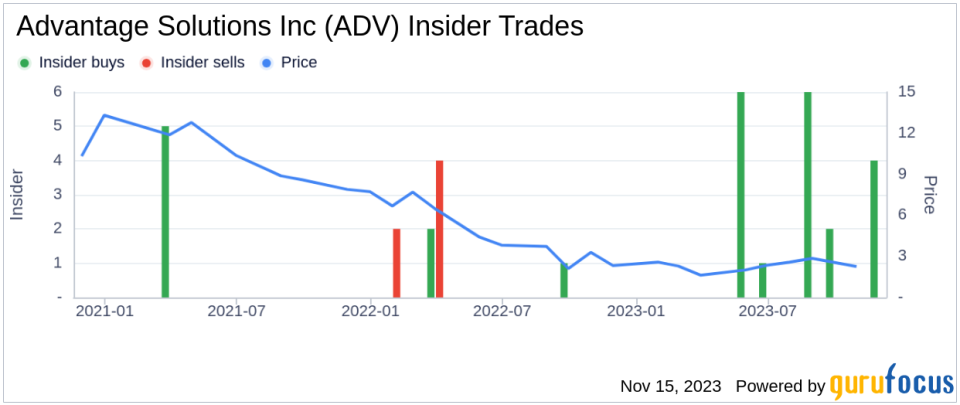

The insider transaction history for Advantage Solutions Inc shows a clear trend of insider confidence. With 19 insider buys and zero insider sells over the past year, the pattern suggests that those closest to the company's operations are optimistic about its future. This trend is a positive indicator for potential investors, as it reflects a collective belief in the company's value among those who know it best.

Valuation and Market Cap

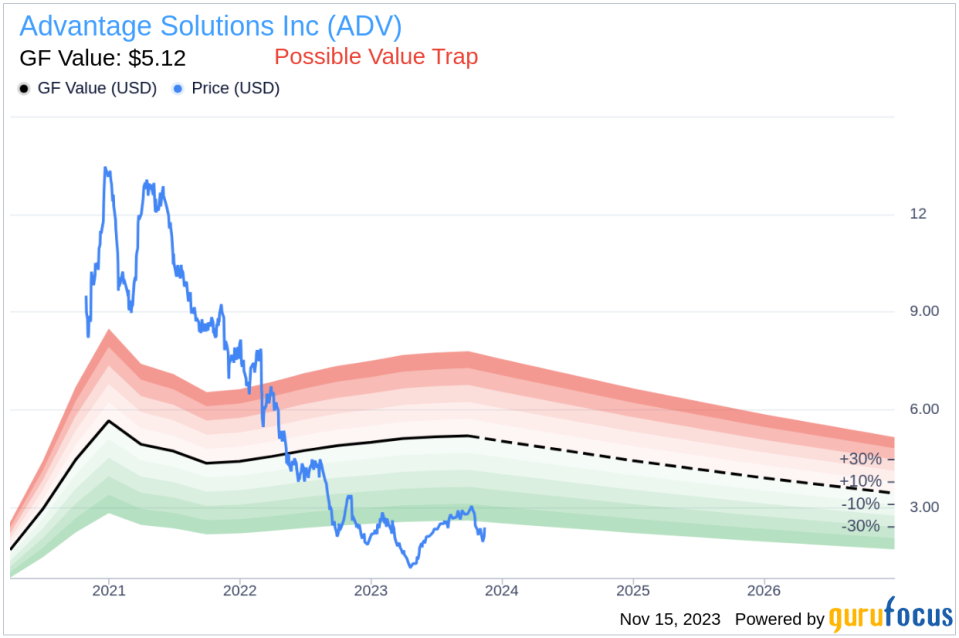

On the date of Brian Ratzan's recent purchase, shares of Advantage Solutions Inc were trading at $2.04, giving the company a market cap of $780.081 million. This valuation is particularly interesting when considering the company's GF Value.

With a price of $2.04 and a GuruFocus Value of $5.12, Advantage Solutions Inc has a price-to-GF-Value ratio of 0.4. This suggests that the stock is a Possible Value Trap, Think Twice, based on its GF Value. However, the significant insider buying activity could indicate that insiders believe the market has overly punished the stock, and it may be undervalued.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation provides a benchmark for investors to consider when evaluating the potential of a stock.

Conclusion

The recent insider buying activity at Advantage Solutions Inc, particularly by Director Brian Ratzan, is a significant event that warrants investor attention. Ratzan's purchase of 215,400 shares is a strong signal of his belief in the company's value and future prospects. While the current price-to-GF-Value ratio suggests caution, the insider buying trend may suggest that the stock's current valuation does not fully reflect its potential. As always, investors should conduct their own due diligence and consider the insights provided by insider transactions as one of many factors in their investment decision-making process.

Advantage Solutions Inc's position as a leader in outsourced sales and marketing solutions, combined with the confidence shown by insiders, presents a compelling narrative for investors looking for opportunities in the consumer goods sector. The coming months will reveal whether the insider's conviction translates into tangible performance improvements and market recognition, potentially leading to a revaluation of the stock closer to its intrinsic value as estimated by GuruFocus.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.