Director Carlyn Taylor's Strategic Investment in The Hain Celestial Group Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that garners the attention of investors seeking clues about a company's future performance. A recent transaction by Carlyn Taylor, a director at The Hain Celestial Group Inc (NASDAQ:HAIN), has sparked interest as the insider purchased a substantial number of shares. This article delves into the details of the transaction and provides an objective analysis based on the available data.

Who is Carlyn Taylor?

Carlyn Taylor is a notable figure within The Hain Celestial Group Inc, serving as a member of the company's board of directors. Directors like Taylor are responsible for overseeing the company's strategic direction and ensuring that it operates in the best interest of its shareholders. With a keen understanding of the company's operations and market position, Taylor's investment decisions are closely watched as they may reflect an insider's confidence in the company's future prospects.

The Hain Celestial Group Inc's Business Description

The Hain Celestial Group Inc is a leading organic and natural products company with an extensive portfolio of well-known brands. The company operates in various segments, including grocery, snacks, personal care, and tea. Hain Celestial is committed to providing consumers with better-for-you food and personal care products, emphasizing health, wellness, and sustainability. With a global presence, the company caters to a growing consumer base that is increasingly conscious of the ingredients and the environmental impact of the products they purchase.

Insider Buy/Sell Description

Insider buying refers to the purchase of shares in a company by its officers, directors, or other insiders. Such transactions are closely monitored as they can provide insights into an insider's belief in the company's future performance. Conversely, insider selling involves these same individuals selling their shares, which can sometimes indicate a lack of confidence in the company's prospects or simply personal financial planning. However, it is essential to consider the context of each transaction, as not all insider selling is a negative signal.

Carlyn Taylor's Recent Insider Buying Activity

On November 13, 2023, Carlyn Taylor made a significant investment in The Hain Celestial Group Inc by purchasing 18,175 shares. Over the past year, Taylor has consistently shown confidence in the company, with a total of 18,175 shares bought and no shares sold. This pattern of investment suggests a strong belief in the company's value and potential for growth.

Insider Trends at The Hain Celestial Group Inc

The insider transaction history for The Hain Celestial Group Inc reveals a positive trend, with four insider buys and only one insider sell over the past year. This activity indicates a general consensus among insiders that the stock holds value that may not be fully recognized by the market.

Valuation and Market Cap

On the day of Taylor's recent purchase, shares of The Hain Celestial Group Inc were trading at $11, giving the company a market cap of $991.285 million. This valuation places the company in a substantial market position, reflecting its influence and stability in the industry.

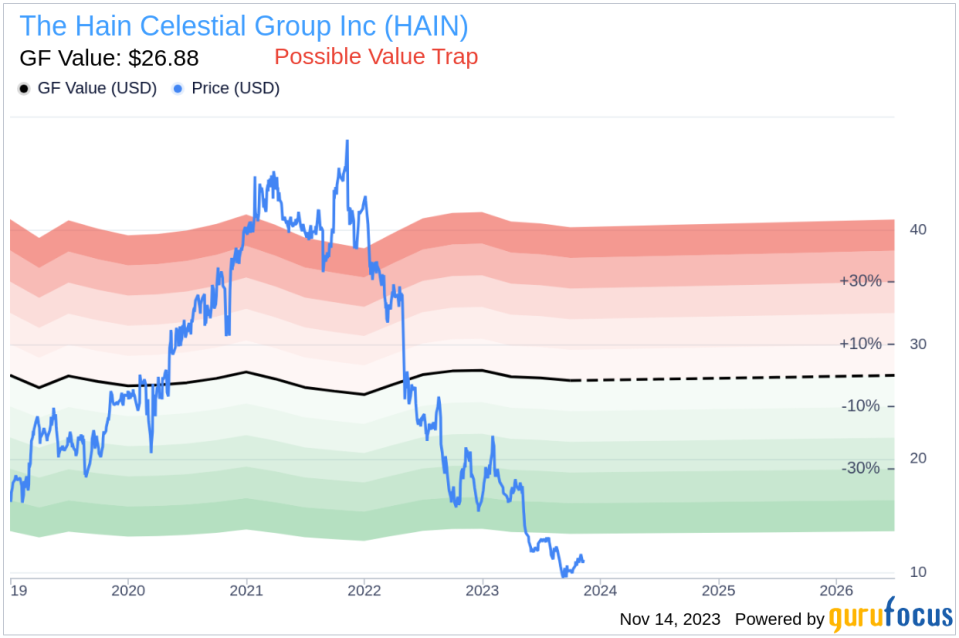

However, when considering the GuruFocus Value of $26.88, The Hain Celestial Group Inc has a price-to-GF-Value ratio of 0.41. This ratio suggests that the stock may be a Possible Value Trap, and investors should Think Twice before making an investment decision. The GF Value serves as an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts.

Objective Analysis Based on Data

While the price-to-GF-Value ratio indicates caution, the consistent insider buying activity, particularly by Carlyn Taylor, could signal that insiders believe the market has undervalued the company's stock. It is also worth noting that insider transactions are just one piece of the puzzle when evaluating a stock's potential. Investors should also consider the company's financial health, growth prospects, competitive position, and broader market conditions.

In conclusion, Carlyn Taylor's recent insider buying activity at The Hain Celestial Group Inc presents an interesting case for investors. While the GF Value suggests the stock may be undervalued, the positive insider trend could indicate a belief in the company's future success. As with any investment decision, it is crucial to conduct thorough research and consider a multitude of factors before reaching a conclusion.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.