Director Charles Frischer Buys 3,900 Shares of Kingsway Financial Services Inc

On September 12, 2023, Director Charles Frischer of Kingsway Financial Services Inc (NYSE:KFS) purchased 3,900 shares of the company, further solidifying his investment in the firm. This move is of particular interest to investors and market watchers, as insider buying can often be a positive signal about a company's future prospects.

Charles Frischer is a seasoned investor and a director at Kingsway Financial Services Inc. His extensive experience in the financial sector and his role within the company give him a unique insight into the workings and potential of Kingsway Financial Services Inc. Over the past year, Frischer has purchased a total of 38,600 shares and has not sold any, demonstrating his confidence in the company's potential.

Kingsway Financial Services Inc is a holding company functioning in the insurance industry. It operates through two segments: Extended Warranty and Leased Real Estate. The Extended Warranty segment provides after-market vehicle protection services distributed by credit unions. The Leased Real Estate segment leases real estate to a third party pursuant to a long-term triple net lease.

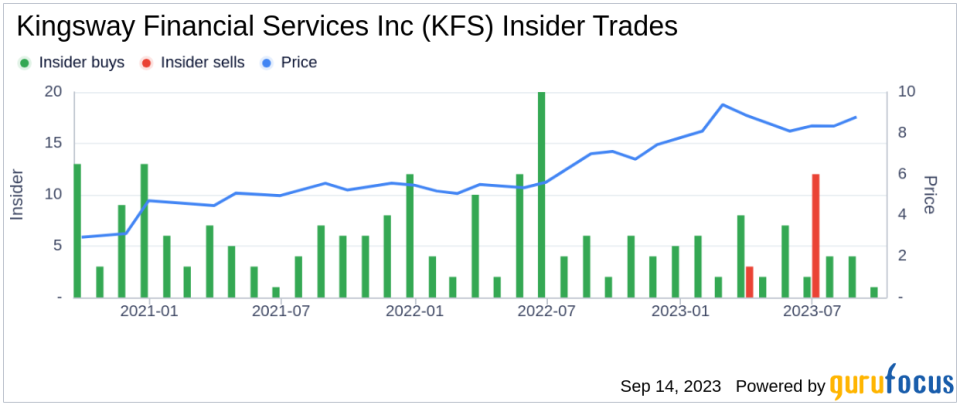

The insider transaction history for Kingsway Financial Services Inc shows a total of 53 insider buys over the past year, compared to 15 insider sells over the same timeframe. This trend suggests a positive sentiment among the insiders about the company's future.

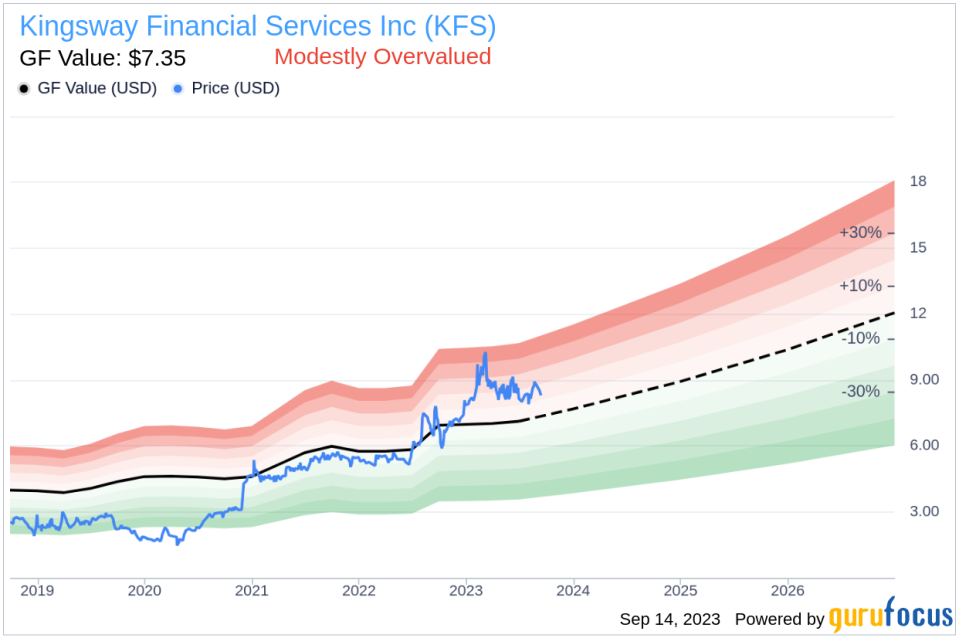

On the day of the insider's recent buy, shares of Kingsway Financial Services Inc were trading for $8.5 apiece, giving the stock a market cap of $224.083 million. The price-earnings ratio is 3.93, which is lower than the industry median of 16.8 and lower than the companys historical median price-earnings ratio. This could indicate that the stock is undervalued.

The GF Value of Kingsway Financial Services Inc is $7.35, resulting in a price-to-GF-Value ratio of 1.16. This suggests that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent purchase by Director Charles Frischer could be a positive signal for the future prospects of Kingsway Financial Services Inc. Despite the stock being modestly overvalued based on its GF Value, the insider's continued investment in the company, coupled with a lower price-earnings ratio compared to industry and historical medians, could indicate potential for future growth.

This article first appeared on GuruFocus.