Director Christopher Molden Buys 778 Shares of William Penn Bancorporation (WMPN)

On September 13, 2023, Christopher Molden, a director at William Penn Bancorporation (NASDAQ:WMPN), purchased 778 shares of the company. This move is significant as insider buying can often be a positive indicator for the company's future performance.

Christopher Molden is a key figure at William Penn Bancorporation, a financial institution that provides banking products and services to individuals and businesses primarily in Bucks County and Philadelphia County, Pennsylvania, and Burlington and Camden Counties, New Jersey. The company offers various deposit products, including checking, savings, and money market accounts, as well as certificates of deposit.

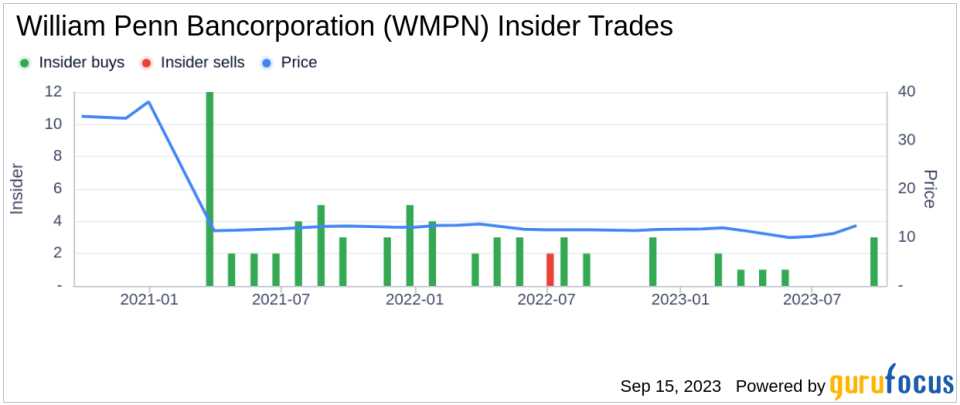

Over the past year, the insider has purchased a total of 4,204 shares and has not sold any shares. This recent purchase of 778 shares further strengthens the insider's position in the company.

The insider transaction history for William Penn Bancorporation shows a total of 11 insider buys over the past year, with no insider sells recorded over the same timeframe. This trend of insider buying could be a positive sign for the company's stock price, as it indicates confidence in the company's future performance from those with intimate knowledge of its operations.

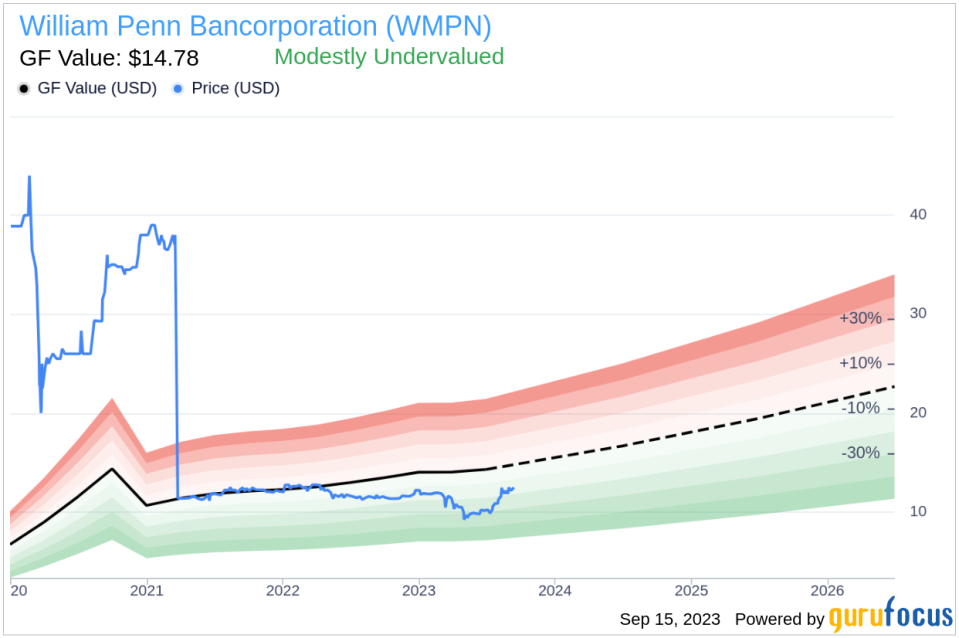

On the day of the insider's recent buy, shares of William Penn Bancorporation were trading for $12.45 apiece, giving the stock a market cap of $137.992 million. The price-earnings ratio stands at 56.32, which is higher than both the industry median of 8.29 and the companys historical median price-earnings ratio. This suggests that the stock is currently trading at a premium compared to its peers and its own historical average.

However, according to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance, the stock is modestly undervalued. With a price of $12.45 and a GuruFocus Value of $14.78, William Penn Bancorporation has a price-to-GF-Value ratio of 0.84. This suggests that the stock could be a good buy at its current price.

In conclusion, the recent insider buying activity at William Penn Bancorporation, coupled with the stock's modest undervaluation according to the GuruFocus Value, could make it an attractive investment opportunity. However, as always, potential investors should conduct their own due diligence before making any investment decisions.

This article first appeared on GuruFocus.