Director David Johnson's Strategic Purchase of Zentalis Pharmaceuticals Inc Shares

In the realm of stock market movements, insider trading activity is often a significant indicator that investors monitor to gauge the confidence of management and key stakeholders in the company's future. A recent transaction by David Johnson, a director at Zentalis Pharmaceuticals Inc (ZNTL), has caught the attention of the market. On November 10, 2023, the insider made a notable purchase of 17,000 shares of the company, signaling a potential bullish stance on the company's prospects.

Who is David Johnson of Zentalis Pharmaceuticals Inc?

David Johnson is a seasoned member of the board of directors at Zentalis Pharmaceuticals Inc. His background and experience in the pharmaceutical industry provide him with a unique perspective on the company's operations and strategic direction. Directors like Johnson are privy to in-depth knowledge about the company's research, development pipeline, and market opportunities, which can inform their investment decisions.

Zentalis Pharmaceuticals Inc's Business Description

Zentalis Pharmaceuticals Inc is a biopharmaceutical company focused on the discovery and development of small molecule therapeutics for the treatment of cancer. The company's approach is centered on creating treatments that target fundamental biological pathways of cancer. Zentalis Pharmaceuticals Inc is committed to advancing a diverse pipeline of drug candidates that have the potential to address unmet medical needs and improve the lives of patients battling this disease.

Understanding Insider Buy/Sell

Insider buying occurs when a company's executives, directors, or other key employees purchase shares of their own company's stock. Such transactions are often interpreted as a sign of confidence in the company's future performance. Conversely, insider selling refers to the sale of company stock by insiders, which could be for various reasons, including portfolio diversification or personal financial needs, and does not necessarily indicate a negative outlook.

Insider Transaction History and Trends

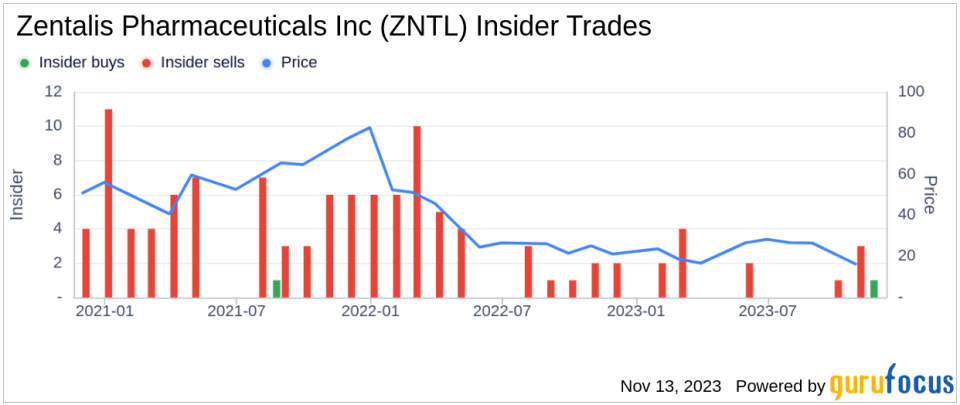

The insider transaction history for Zentalis Pharmaceuticals Inc reveals a pattern of insider activity that can offer insights into the sentiment within the company's leadership. Over the past year, there have been 2 insider buys, including the recent purchase by David Johnson. In contrast, there have been 13 insider sells in the same timeframe. This pattern of insider transactions can be a valuable piece of information for investors trying to understand the internal perspectives on the company's valuation and future prospects.

Valuation and Market Response

On the day of the insider's recent buy, shares of Zentalis Pharmaceuticals Inc were trading at $9.88 each, resulting in a market capitalization of $726.057 million. This valuation places the company in the mid-cap category, which is often associated with higher growth potential compared to large-cap companies, albeit with increased volatility and risk.

Objective Analysis of David Johnson's Purchase

To objectively analyze David Johnson's purchase of 17,000 shares, we must consider several factors, including the size of the transaction, the timing, and the stock's performance leading up to the purchase. The acquisition of a significant number of shares suggests a strong belief in the company's value and growth potential. The timing of the buy, especially if it follows a period of stock price decline or ahead of potential positive company developments, can also be telling.

The insider's decision to increase their stake in Zentalis Pharmaceuticals Inc without any corresponding sales over the past year indicates a long-term commitment to the company. This is particularly noteworthy given the broader context of insider selling activity. While the reasons behind each individual sell transaction are not always clear, the contrast between the selling and buying patterns may reflect a diversity of perspectives and circumstances among the company's insiders.

Investors often look at insider buying as a positive sign that those with the most intimate knowledge of the company anticipate that the stock will perform well in the future. However, it is essential to consider that insider buying is just one piece of the puzzle. A comprehensive investment decision should also take into account the company's financial health, competitive position, industry trends, and broader market conditions.

Conclusion

David Johnson's recent insider purchase of Zentalis Pharmaceuticals Inc shares is a significant event that warrants attention from current and potential investors. While insider buying can be a bullish signal, it is crucial to analyze such transactions within the broader context of the company's performance and market dynamics. As with any investment decision, due diligence and a balanced consideration of all available information are key to understanding the implications of insider trading activity.

Investors and analysts will continue to monitor insider transactions, along with other financial metrics and industry developments, to gauge the investment potential of Zentalis Pharmaceuticals Inc. The insider's recent buy may be a piece of the puzzle that suggests a positive outlook for the company, but it should not be the sole basis for an investment decision.

For those interested in following the insider's future transactions or exploring the insider trends of other companies, resources like GuruFocus provide valuable data and insights to inform investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.