Director David Kong Sells 26,000 Shares of Uranium Energy Corp (UEC)

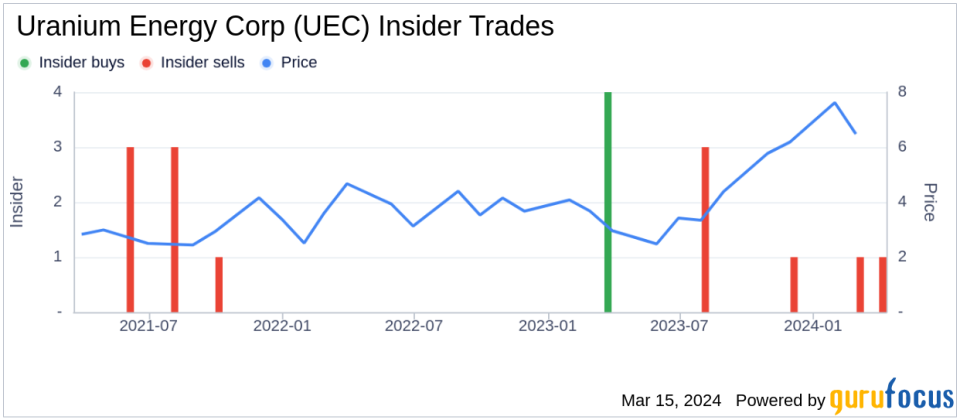

Director David Kong has executed a sale of 26,000 shares of Uranium Energy Corp (AMEX:UEC) on March 12, 2024, according to a recent SEC filing. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link.Uranium Energy Corp is a uranium mining and exploration company that engages in the extraction, processing, and production of uranium. The company focuses on low-cost, environmentally friendly in-situ recovery (ISR) mining technology.Over the past year, the insider has sold a total of 33,000 shares of Uranium Energy Corp and has not made any purchases of the stock. The recent sale by David Kong represents a continuation of this selling trend.The insider transaction history for Uranium Energy Corp shows a pattern of insider activity. In the past year, there have been 4 insider buys and 6 insider sells. It is important for investors to consider this context when evaluating insider transactions.

On the day of the insider's recent sale, shares of Uranium Energy Corp were trading at $6.81 each, giving the company a market capitalization of approximately $2.574 billion.Investors and analysts often monitor insider buying and selling trends as an indicator of corporate sentiment. While individual transactions can vary in their implications, consistent patterns of insider behavior can provide insights into the outlook for the company's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.