Director Dennis Polk Sells 20,612 Shares of Concentrix Corp (CNXC)

On October 11, 2023, Dennis Polk, a director at Concentrix Corp (NASDAQ:CNXC), sold 20,612 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 60,612 shares and purchased none.

Dennis Polk is a key figure at Concentrix Corp, a leading global provider of customer experience (CX) solutions and technology. The company's innovative approach helps businesses manage and improve customer relationships across various channels and touchpoints. Concentrix Corp's services range from customer care and sales to technical support and customer retention, all designed to enhance customer engagement and boost business growth.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To gain a better understanding of this, we need to delve into the company's financials and the insider's trading history.

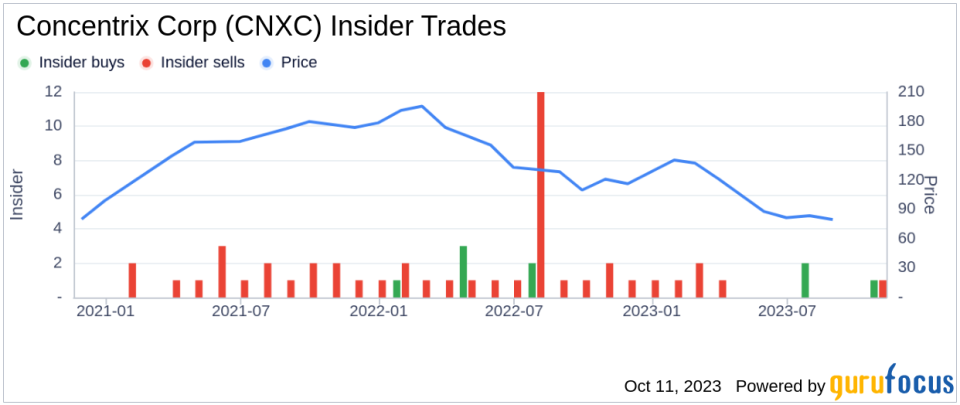

The insider transaction history for Concentrix Corp shows a trend of more sells than buys over the past year. There have been 3 insider buys and 7 insider sells in total. This could indicate that insiders believe the company's stock is currently overvalued, prompting them to sell their shares.

On the day of the insider's recent sell, shares of Concentrix Corp were trading at $81.2 each, giving the company a market cap of $5.514 billion. This is based on a price-earnings ratio of 12.32, which is lower than both the industry median of 26.77 and the company's historical median price-earnings ratio. This suggests that the company's stock is undervalued compared to its peers and its own historical standards.

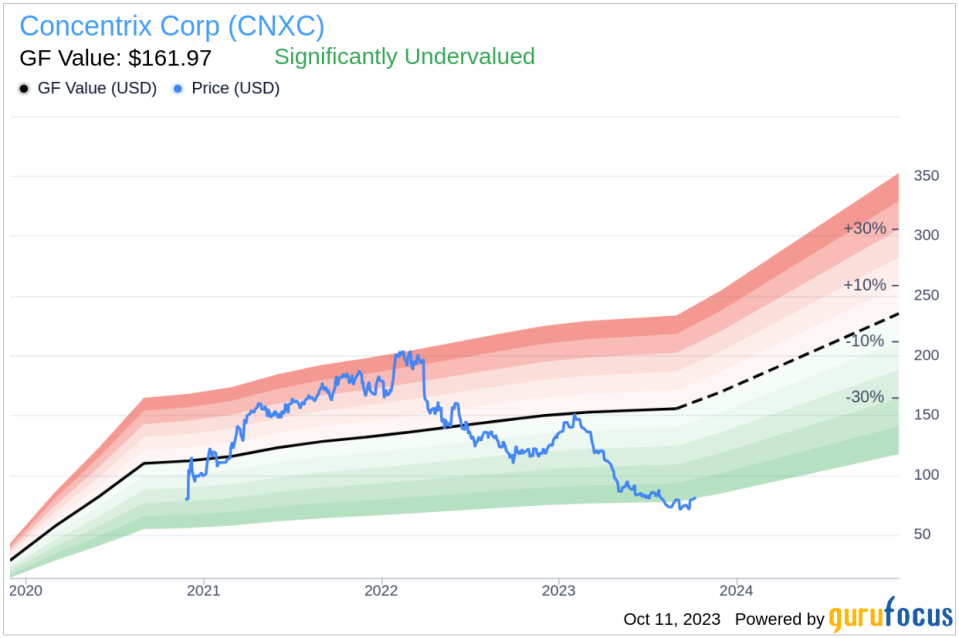

However, according to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Concentrix Corp is significantly undervalued. With a price of $81.2 and a GuruFocus Value of $161.97, the stock has a price-to-GF-Value ratio of 0.5.

In conclusion, while the insider's recent sell-off might raise some eyebrows, the company's financials and valuation metrics suggest that Concentrix Corp's stock is undervalued. This could present a good buying opportunity for investors who believe in the company's long-term prospects. However, as always, investors should conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.