Director Frank Watkins Sells 3,000 Shares of ShockWave Medical Inc

On September 20, 2023, Director Frank Watkins sold 3,000 shares of ShockWave Medical Inc (NASDAQ:SWAV). This move comes amidst a year where the insider has sold a total of 40,000 shares and purchased none.

Frank Watkins is a key figure at ShockWave Medical Inc, a company that is a pioneer in the development and commercialization of Intravascular Lithotripsy (IVL) to treat complex calcified cardiovascular disease. IVL is an innovative therapy designed to selectively target hardened calcified lesions within the cardiovascular system with significantly less risk of injury to soft tissue.

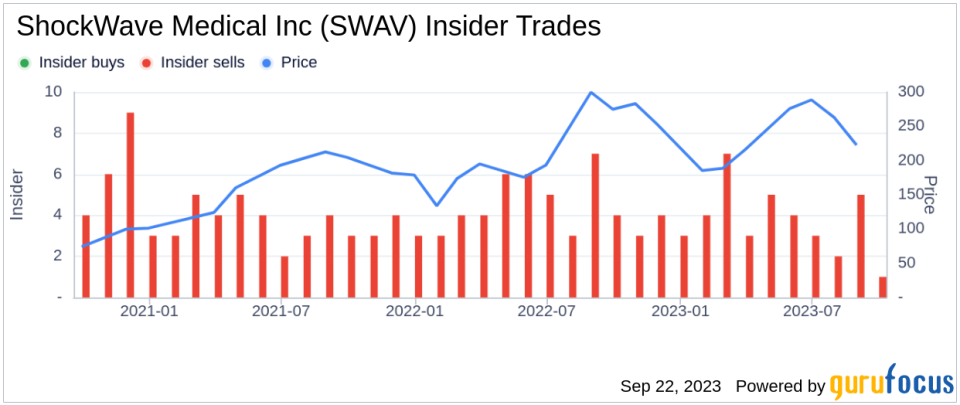

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To understand the implications of this move, it's essential to analyze the insider buy/sell trends and their relationship with the stock price.

The insider transaction history for ShockWave Medical Inc shows a clear trend of more sells than buys over the past year. With 46 insider sells and no insider buys, this could indicate a bearish sentiment among the company's insiders.

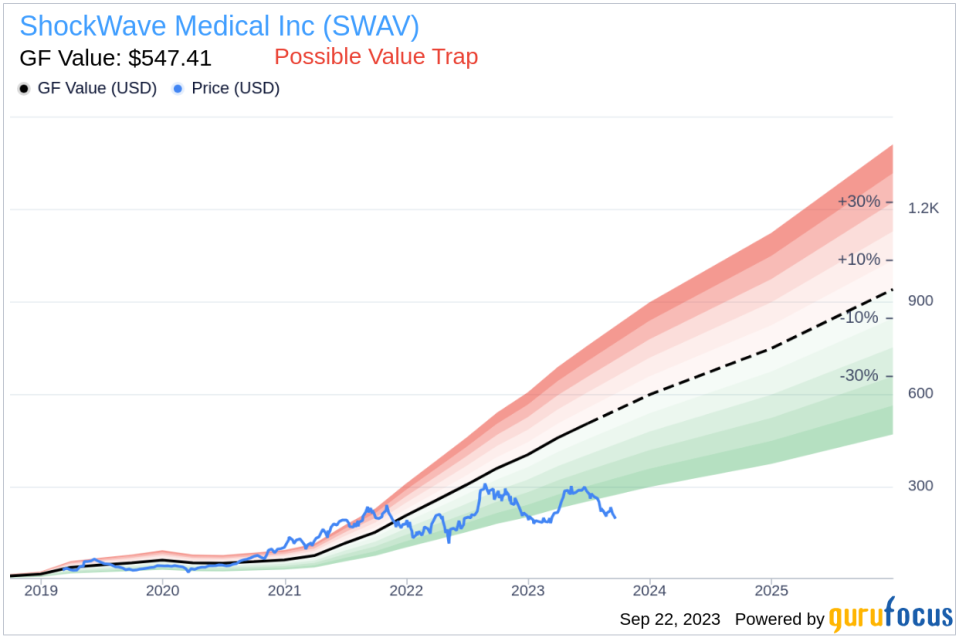

On the day of the insider's recent sell, shares of ShockWave Medical Inc were trading for $209.23, giving the stock a market cap of $7.24 billion. The price-earnings ratio stands at 30.67, higher than the industry median of 27.88 but lower than the companys historical median price-earnings ratio.

The GuruFocus Value of ShockWave Medical Inc is $547.41, resulting in a price-to-GF-Value ratio of 0.38. This suggests that the stock could be a possible value trap, and investors should think twice before making a move.

The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell-off, coupled with the company's valuation and insider sell trend, suggests a cautious approach towards ShockWave Medical Inc. Investors should closely monitor the company's performance and insider transactions to make informed decisions.

This article first appeared on GuruFocus.