Director Glenn Carter Sells Shares of Tyler Technologies Inc (TYL)

Tyler Technologies Inc (NYSE:TYL) experienced an insider sell on February 27, 2024, according to a recent SEC filing. Director Glenn Carter sold 1,650 shares of the company at an average price of $437.84. Following this transaction, the insider's stake in Tyler Technologies Inc has adjusted accordingly.Tyler Technologies Inc is a major player in the provision of integrated software and technology services. The company focuses on providing essential information management solutions to local governments across the United States, aiming to streamline the way cities, counties, and regional government entities manage their operations.Over the past year, Glenn Carter has sold a total of 3,650 shares of Tyler Technologies Inc and has not made any purchases of the stock. This latest transaction continues a pattern of insider selling activity at the company.

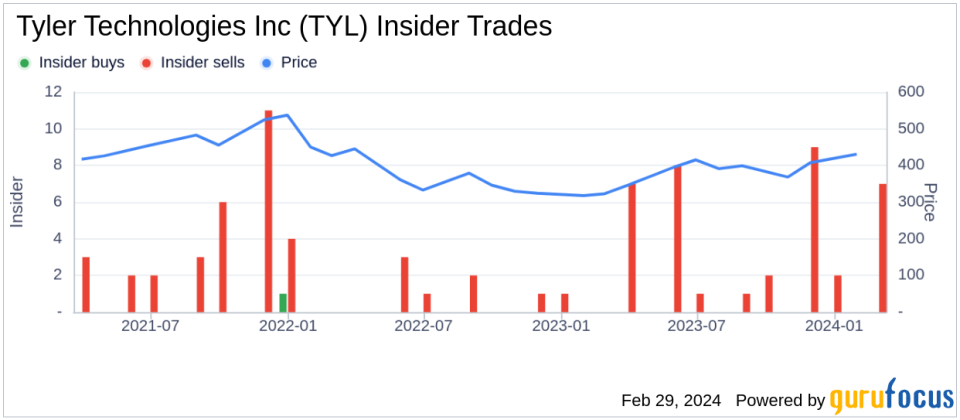

The insider transaction history for Tyler Technologies Inc shows a trend of insider sales, with 37 insider sells recorded over the past year and no insider buys during the same period.In terms of valuation, Tyler Technologies Inc's shares were trading at $437.84 on the day of the insider's recent sell, giving the company a market capitalization of $18.48 billion. The price-earnings ratio stands at 112.38, which is significantly higher than the industry median of 27.88 and also above the company's historical median price-earnings ratio.

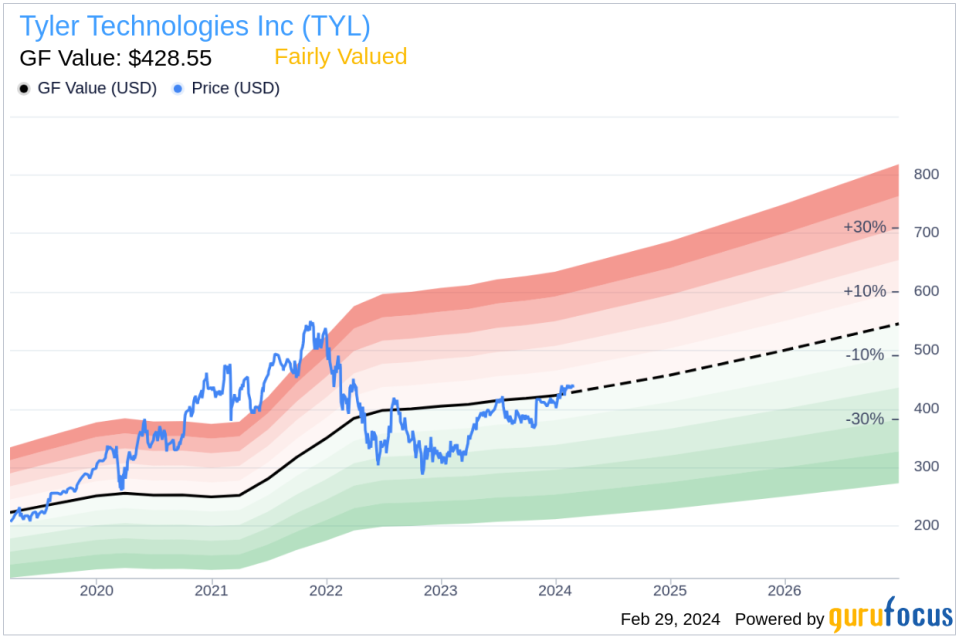

The stock's price-to-GF-Value ratio is 1.02, indicating that Tyler Technologies Inc is Fairly Valued based on its GF Value of $428.27. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.The recent insider sell by Director Glenn Carter provides investors with information on the insider's perspective of the stock's value, although it does not necessarily indicate a future direction for the share price. Investors often monitor insider transactions as part of their due diligence process when evaluating potential investments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.