Director Isabelle Parize Buys 20,500 Shares of Coty Inc

On October 4, 2023, Director Isabelle Parize of Coty Inc (NYSE:COTY) made a significant insider purchase, acquiring 20,500 shares of the company. This move is noteworthy and deserves a closer look.

Who is Isabelle Parize?

Isabelle Parize is a seasoned executive with a wealth of experience in the beauty and cosmetics industry. She has been serving as a Director at Coty Inc, a leading multinational beauty company. Her insider position provides her with a unique perspective on the company's operations and future prospects.

About Coty Inc

Coty Inc is a renowned name in the beauty and cosmetics industry. The company boasts a diverse portfolio of brands across various categories like fragrances, cosmetics, skin care, and hair color. With its products sold in over 150 countries, Coty Inc has established a strong global presence.

Insider Buying Analysis

Over the past year, the insider has purchased a total of 20,500 shares and sold 0 shares. This indicates a positive sentiment towards the company's stock. The insider's recent purchase further strengthens this trend.

The insider transaction history for Coty Inc shows a total of 5 insider buys over the past year, with no insider sells recorded over the same timeframe. This suggests that insiders at Coty Inc have a bullish outlook on the company's stock.

Stock Price and Valuation

On the day of the insider's recent buy, shares of Coty Inc were trading at $10.29, giving the company a market cap of $9.4 billion. The price-earnings ratio stands at 18.07, which is lower than the industry median of 19.46 and also lower than the companys historical median price-earnings ratio.

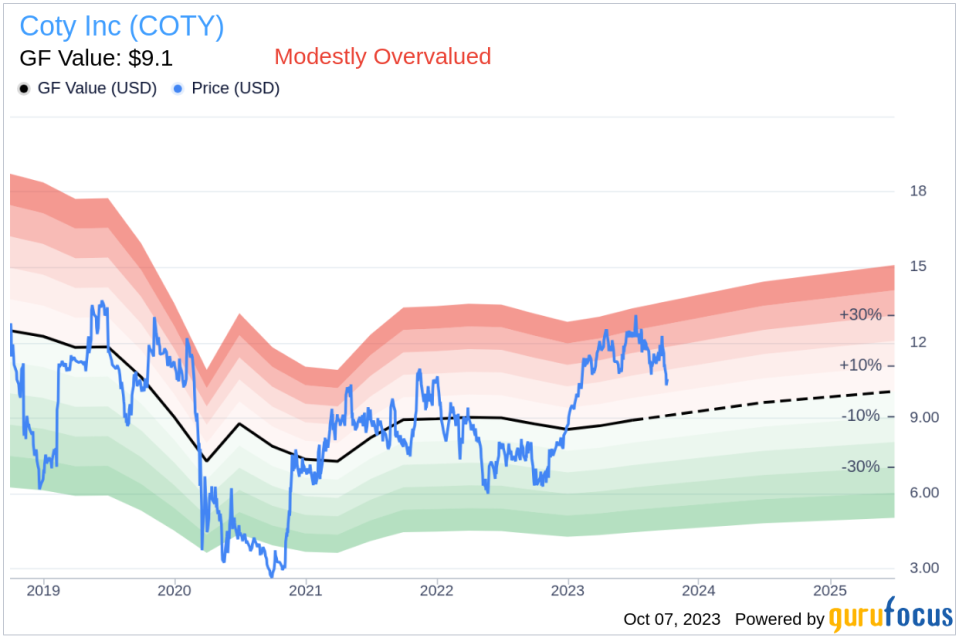

With a price of $10.29 and a GuruFocus Value of $9.10, Coty Inc has a price-to-GF-Value ratio of 1.13. This suggests that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance.

Conclusion

The insider's recent purchase of Coty Inc shares, coupled with the overall insider buying trend, suggests a positive outlook for the company. Despite the stock being modestly overvalued based on its GF Value, the insider's confidence in the company's prospects could indicate potential upside in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.