Director James Kilts' Significant Insider Purchase in Advantage Solutions Inc

In the realm of stock market movements, insider trading activity is often a closely monitored event. It can provide insights into a company's internal perspective on its own financial health and future prospects. A recent transaction that has caught the attention of investors is the purchase of 96,944 shares of Advantage Solutions Inc (NASDAQ:ADV) by Director James Kilts on November 10, 2023. This article aims to delve into the details of this transaction and provide an objective analysis based on available data.

Who is James Kilts of Advantage Solutions Inc?

James Kilts is a notable figure in the business world, known for his leadership roles in various consumer goods companies. His experience includes serving as the CEO of The Gillette Company and as Vice Chairman of the Board at Procter & Gamble. Kilts' expertise in corporate strategy and brand management has been recognized through his positions on several boards, including his role as a director at Advantage Solutions Inc. His decision to increase his stake in the company is therefore seen as a significant vote of confidence from a seasoned industry veteran.

Advantage Solutions Inc's Business Description

Advantage Solutions Inc is a provider of outsourced sales and marketing solutions to consumer goods manufacturers and retailers. The company operates through multiple segments, including sales, marketing, and international. Its services range from headquarter sales representation and retail merchandising to digital commerce and technology solutions. Advantage Solutions works with a diverse set of clients, aiming to improve their performance in the marketplace through innovative strategies and a comprehensive approach to brand management.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares in a company by its officers, directors, or other insiders. Such transactions are closely monitored as they can indicate the insiders' confidence in the company's future performance. Conversely, insider selling is when these individuals sell their shares, which could suggest a variety of reasons, including portfolio diversification or concerns about the company's prospects. However, it is important to note that insider trading activity should be considered as part of a broader investment analysis and not as the sole indicator of a stock's potential.

Insider Trends

The insider transaction history for Advantage Solutions Inc shows a pattern of insider confidence, with 18 insider buys and no insider sells over the past year. This trend suggests that insiders are optimistic about the company's future and are willing to invest their own money into the stock.

Valuation

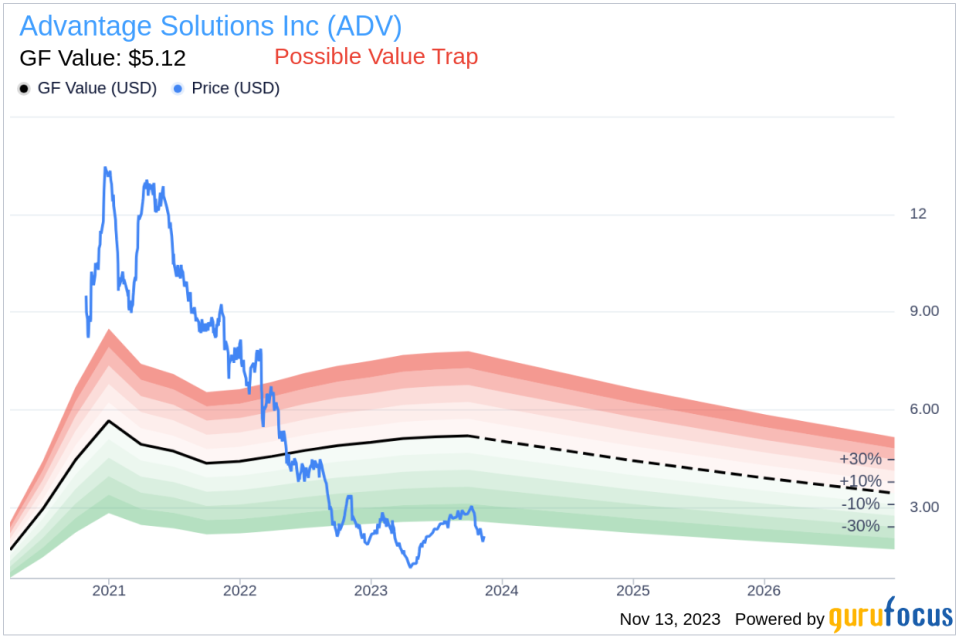

On the day of the insider's recent buy, shares of Advantage Solutions Inc were trading at $1.96, giving the stock a market cap of $691.954 million. This valuation is particularly interesting when considering the company's price relative to the GuruFocus Value (GF Value).

With a price of $1.96 and a GF Value of $5.12, Advantage Solutions Inc has a price-to-GF-Value ratio of 0.38. This ratio positions the stock as a Possible Value Trap, suggesting that investors should think twice before making an investment based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

James Kilts Trades and the Implications

Over the past year, James Kilts has been an active buyer of Advantage Solutions Inc's stock, purchasing a total of 370,181 shares. The absence of any sales transactions by Kilts during this period further underscores his bullish stance on the company. The recent acquisition of 96,944 shares is a continuation of this trend and represents a substantial investment in the company.

When a director of Kilts' caliber makes such a significant purchase, it often prompts investors to take a closer look at the company. The insider's actions may reflect a belief that the stock is undervalued or that there are positive developments on the horizon that could lead to an increase in the stock's value.

Conclusion

Director James Kilts' recent insider purchase of Advantage Solutions Inc shares is a noteworthy event that signals potential confidence in the company's future. While the stock's current price-to-GF-Value ratio suggests caution, the consistent pattern of insider buying over the past year could indicate an underlying value not yet recognized by the broader market. As with any investment decision, it is crucial for investors to conduct their own due diligence, considering insider trading activity as one of many factors in their analysis.

Advantage Solutions Inc's position as a provider of comprehensive sales and marketing solutions, combined with the insider's demonstrated confidence, presents a compelling narrative for further investigation by investors. The coming months will reveal whether the insider's significant investment will align with the company's performance and market valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.