Director James Kilts' Significant Insider Purchase in Advantage Solutions Inc

Insider buying can be an informative indicator for investors, as it may suggest that those with the most intimate knowledge of a company's operations believe in the stock's future performance. In a notable move, James Kilts, a director of Advantage Solutions Inc (ADV), has recently increased his stake in the company by purchasing 55,474 shares on November 14, 2023. This article will delve into the details of this transaction, provide background on James Kilts and Advantage Solutions Inc, and analyze the insider buying trends and the company's valuation.

Who is James Kilts?

James Kilts is a seasoned executive with a wealth of experience in the consumer goods industry. He has held leadership positions at several prominent companies, including serving as the CEO of Gillette until its acquisition by Procter & Gamble. Kilts' expertise in brand management and corporate strategy has been recognized through his roles on various corporate boards. His involvement with Advantage Solutions Inc as a director provides the company with valuable insights into consumer markets and strategic growth.

About Advantage Solutions Inc

Advantage Solutions Inc is a provider of outsourced solutions to consumer goods companies and retailers. The company operates in a diverse range of services, including sales, marketing, merchandising, and digital technology. With a focus on improving efficiency and driving growth, Advantage Solutions caters to a broad client base, offering data-driven insights and expertise in brand development and retail execution. The company's ability to adapt to the evolving retail landscape has been crucial in maintaining its competitive edge.

Description of Insider Buy/Sell

Insider transactions involve the buying and selling of a company's stock by its executives, directors, or other insiders. These transactions are closely monitored by investors and regulators, as they can provide hints about a company's future prospects. An insider buy, such as the one executed by James Kilts, is often perceived positively, as it may indicate the insider's confidence in the company's growth potential or undervaluation. Conversely, insider sells can sometimes raise concerns about a company's outlook, although they can also occur for personal reasons unrelated to the company's performance.

Insider Trends

The insider transaction history for Advantage Solutions Inc shows a pattern of insider confidence. Over the past year, there have been 20 insider buys and no insider sells, suggesting a unanimous belief among insiders in the company's potential. James Kilts himself has been a significant participant in this trend, having purchased a total of 425,655 shares over the past year without selling any.

Valuation and Market Cap

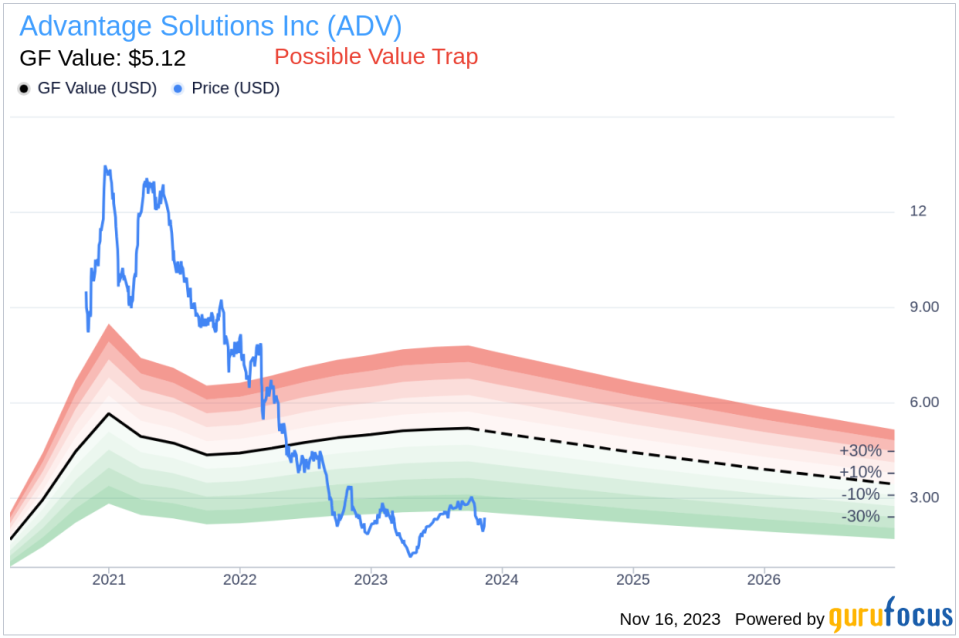

On the day of the insider's recent purchase, shares of Advantage Solutions Inc were trading at $2.25, giving the company a market cap of $780.081 million. This valuation is particularly interesting when considering the company's price relative to the GuruFocus Value (GF Value).

With a GF Value of $5.12, the price-to-GF-Value ratio stands at 0.44, indicating that the stock may be undervalued. The GF Value suggests that the stock is a "Possible Value Trap, Think Twice," which implies that while the stock appears cheap, investors should be cautious and conduct further analysis before making an investment decision.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business estimates provided by analysts. This comprehensive approach to valuation aims to provide a more nuanced view of a stock's intrinsic value.

Objective Analysis Based on Data

When analyzing insider buying activity, it is essential to consider the context of the transactions. In the case of James Kilts' recent purchase, the sizeable addition to his holdings in Advantage Solutions Inc is a strong vote of confidence. The insider's history of buying without selling over the past year further reinforces this positive sentiment.

The insider buying trend at Advantage Solutions Inc is also noteworthy. With 20 insider buys and no sells over the past year, there appears to be a consensus among insiders about the company's prospects. This could be interpreted as a bullish signal for investors considering an investment in ADV.

However, the valuation presents a more complex picture. The low price-to-GF-Value ratio suggests that the stock is undervalued, which could mean that it is an attractive buy. Yet, the classification as a "Possible Value Trap" warrants caution. Investors should examine the reasons behind the low valuation, such as potential challenges the company may face or broader market conditions that could be affecting the stock price.

It is also important to consider the company's fundamentals and growth prospects. Advantage Solutions Inc's business model, which focuses on providing essential services to consumer goods companies and retailers, positions it well in a market where efficiency and data-driven decision-making are increasingly important. The company's ability to leverage technology and analytics could be a key driver of future growth.

In conclusion, the insider buying activity at Advantage Solutions Inc, particularly the recent purchase by James Kilts, suggests a positive outlook among those closest to the company. However, the valuation indicates that investors should proceed with caution and conduct thorough due diligence. By examining the company's financials, market position, and growth strategies, investors can make a more informed decision about the potential risks and rewards associated with investing in ADV.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.