Director Jerry Leamon Sells 10,000 Shares of Korn Ferry (KFY)

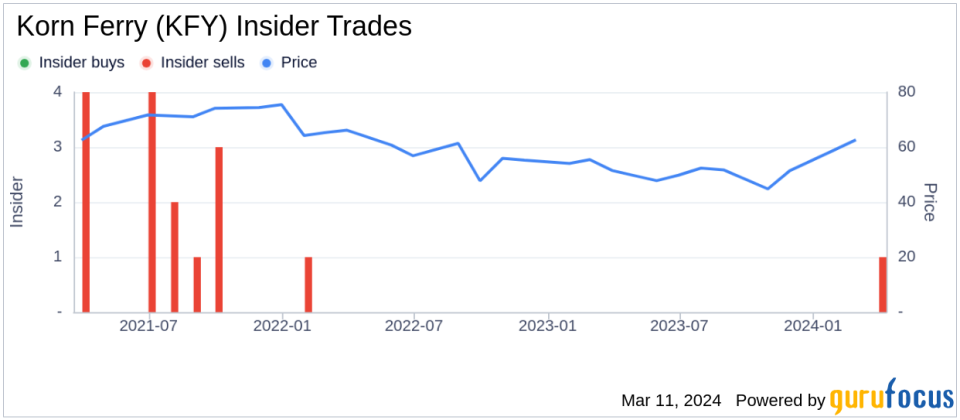

Director Jerry Leamon has sold 10,000 shares of Korn Ferry (NYSE:KFY), a global organizational consulting firm, according to a recent SEC filing. The transaction took place on March 8, 2024, and was reported through an official SEC filing.Korn Ferry operates as a global consulting firm, offering a range of solutions that help organizations manage their talent and drive performance. The company's services include organizational strategy, talent acquisition, rewards and benefits, assessment and succession, and leadership development.Jerry Leamon, who holds the position of Director at Korn Ferry, executed the sale of shares at a price of $65.8 each, resulting in a transaction value of $658,000. Over the past year, the insider has sold a total of 10,000 shares and has not made any purchases of the company's stock.The insider transaction history for Korn Ferry reveals a pattern of insider activity. Over the past year, there have been no insider purchases and only one insider sale, indicating a possible preference for selling over buying among the company's insiders.

On the valuation front, Korn Ferry's shares were trading at $65.8 on the day of the insider's recent sale, giving the company a market capitalization of $3.433 billion. The price-earnings ratio stands at 33.30, which is above both the industry median of 17.83 and the company's historical median price-earnings ratio.With the current share price and a GuruFocus Value of $70.88, Korn Ferry has a price-to-GF-Value ratio of 0.93, suggesting that the stock is Fairly Valued based on its GF Value.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates provided by Morningstar analysts.The sale by Director Jerry Leamon may attract the attention of investors monitoring insider activities as an indicator of confidence in the company's future prospects. However, it is important to consider the broader context of the company's performance and market valuation when interpreting insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.