Director Jody Feragen Sells 5,036 Shares of Graco Inc (GGG)

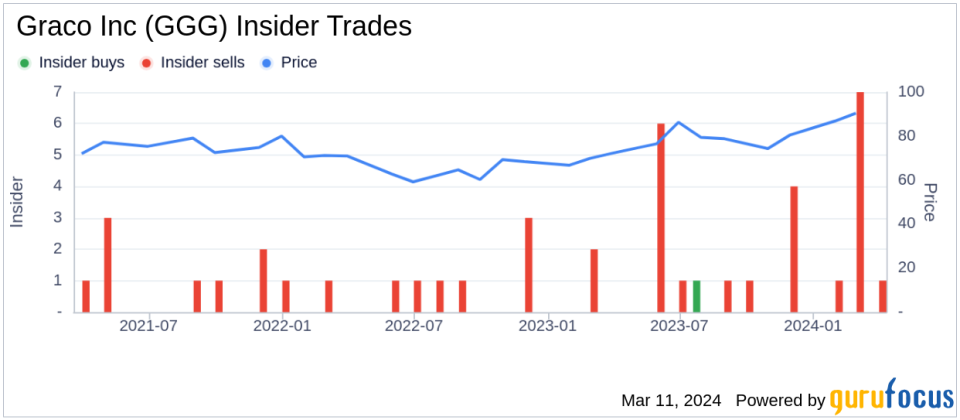

Graco Inc (NYSE:GGG), a leading manufacturer of fluid handling systems and components, recently saw a transaction from one of its directors. According to a SEC Filing on March 11, 2024, Director Jody Feragen sold 5,036 shares of the company. This transaction has caught the attention of investors and market analysts, as insider activity can provide insights into a company's financial health and future prospects.Over the past year, Jody Feragen has sold a total of 5,036 shares and has not made any purchases of the company's stock. This recent sale continues the trend of insider selling at Graco Inc, with 22 insider sells recorded over the past year compared to just 1 insider buy.

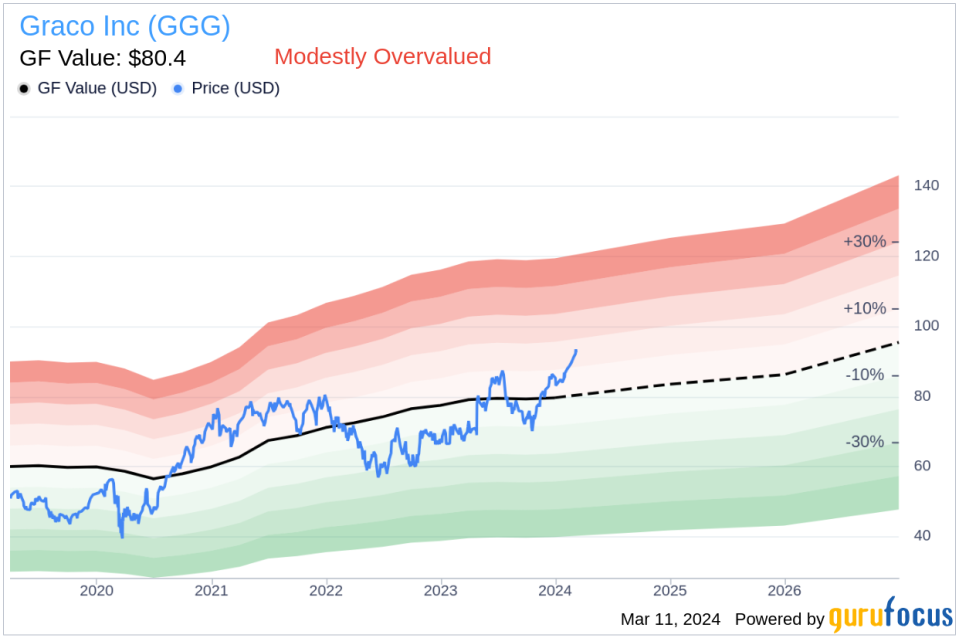

The insider transaction history suggests a pattern where insiders are more inclined to sell shares than to acquire them. This could be interpreted in various ways, but without additional context, it remains a single data point for investors to consider.On the valuation front, Graco Inc's shares were trading at $92.29 on the day of the insider's sale, giving the company a market capitalization of $15.57 billion. The price-earnings ratio stands at 31.49, which is above both the industry median of 22.47 and the company's historical median price-earnings ratio. This indicates that the stock is trading at a premium compared to its peers and its own historical valuation.

Furthermore, with a share price of $92.29 and a GuruFocus Value of $80.40, Graco Inc has a price-to-GF-Value ratio of 1.15. According to GuruFocus, this suggests that the stock is modestly overvalued in relation to its intrinsic value, which is estimated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.Investors and analysts often monitor insider transactions as part of their due diligence process. While the sale of shares by Director Jody Feragen may not necessarily indicate a bearish outlook for the company, it is one of many factors that can influence investment decisions. It is important for investors to consider the full picture, including the company's financial performance, market conditions, and broader economic indicators, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.