Director Justin Smith Acquires 30,000 Shares of Journey Medical Corp (DERM)

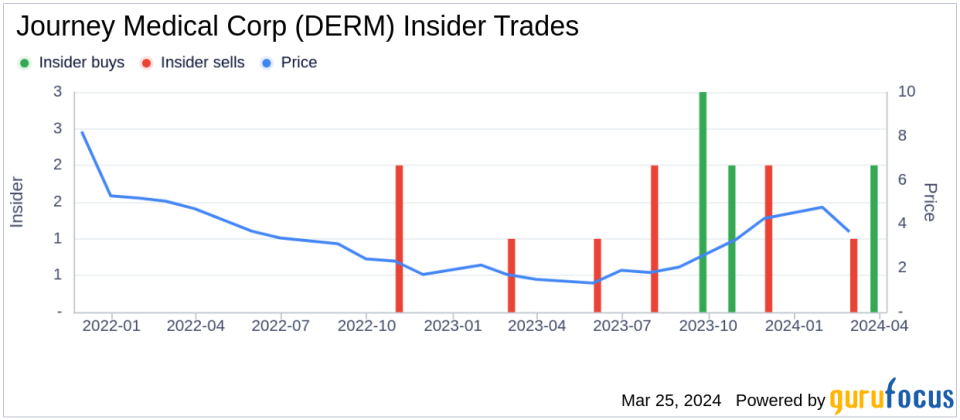

Journey Medical Corp (NASDAQ:DERM) has reported an insider purchase according to the latest SEC filings. Director Justin Smith has acquired 30,000 shares of the company on March 22, 2024. The transaction was disclosed in a legal filing with the Securities and Exchange Commission, which is available at this SEC Filing link.Over the past year, Justin Smith has been an active buyer of Journey Medical Corp stock, with a total of 63,000 shares purchased and no shares sold. This latest transaction continues the trend of insider buying activity at the company.Journey Medical Corp is a healthcare company that focuses on acquiring, licensing, and commercializing branded dermatology products. The company's portfolio includes treatments for conditions such as acne, fungal infections, and rosacea.Insider buying and selling activities are closely watched by investors as they can provide insights into a company's financial health or the insiders' view of the company's value. An insider purchase can suggest that the insider believes the stock is undervalued or that there may be positive developments within the company that could drive the stock price higher in the future.The insider transaction history for Journey Medical Corp shows a balance of insider activities over the past year, with 7 insider buys and 6 insider sells recorded.On the valuation front, shares of Journey Medical Corp were trading at $3.47 on the day of the insider's recent purchase, resulting in a market capitalization of approximately $56.429 million.

The insider's recent acquisition adds to the overall positive sentiment reflected in the insider buying trend at Journey Medical Corp. Investors and analysts often examine such insider trades to gain insights into the potential future direction of the stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.