Director Larry Fitzgerald Bolsters Position in Dick's Sporting Goods Inc with Recent Purchase

In a notable insider transaction, Director Larry Fitzgerald of Dick's Sporting Goods Inc (NYSE:DKS) has increased his stake in the company. On November 29, 2023, the insider executed a purchase of 783 shares, signaling a vote of confidence in the retailer's future prospects. This article delves into the details of the transaction, provides an overview of Larry Fitzgerald's role within the company, and offers an objective analysis of Dick's Sporting Goods Inc's business and the implications of insider trading activities.

Who is Larry Fitzgerald of Dick's Sporting Goods Inc?

Larry Fitzgerald is a member of the board of directors at Dick's Sporting Goods Inc, a leading omnichannel sporting goods retailer. Directors like Fitzgerald are responsible for providing strategic guidance and oversight to the company's management team. They play a crucial role in shaping the company's direction and ensuring that it operates in the best interest of its shareholders. Fitzgerald's recent purchase of shares is a strong indication that he believes in the company's strategic initiatives and long-term value proposition.

Dick's Sporting Goods Inc's Business Description

Dick's Sporting Goods Inc is a prominent player in the retail space, offering a wide range of sports equipment, apparel, footwear, and accessories. With a strong presence both online and through its extensive network of brick-and-mortar stores, the company caters to a diverse customer base, from casual enthusiasts to professional athletes. Dick's Sporting Goods is known for its commitment to providing high-quality products and fostering a culture of sports and fitness among communities.

Description of Insider Buy/Sell

Insider transactions, such as buys and sells, are closely monitored by investors as they can provide valuable insights into a company's internal perspective. An insider buy, such as the one executed by Larry Fitzgerald, often suggests that the insider is bullish on the company's future and expects the stock price to rise. Conversely, insider sells might indicate that insiders believe the stock is fully valued or potentially overvalued. However, it's important to consider the context of these transactions, as they may not always be indicative of the company's financial health or future performance.

Insider Trends

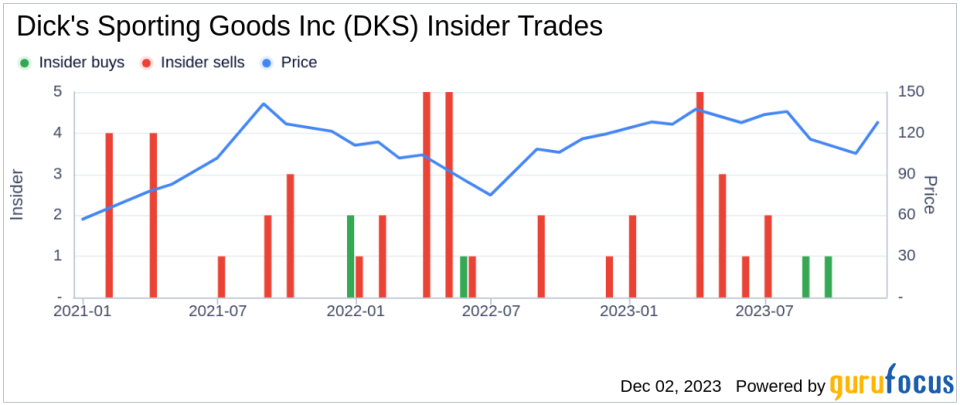

The insider transaction history for Dick's Sporting Goods Inc shows a mix of buying and selling activities over the past year. There have been 3 insider buys and 14 insider sells during this period. This pattern of insider behavior warrants attention, as it may suggest varied perspectives among different insiders about the company's valuation and growth prospects.

Valuation

On the day of the insider's recent buy, shares of Dick's Sporting Goods Inc were trading at $127.97, giving the company a market cap of $11,302.778 billion. This valuation places the stock at a price-earnings ratio of 12.33, which is lower than both the industry median of 16.91 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own trading history.

Furthermore, with a price of $127.97 and a GuruFocus Value of $140.13, Dick's Sporting Goods Inc has a price-to-GF-Value ratio of 0.91. According to this metric, the stock is considered Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Objective Analysis of Larry Fitzgerald's Insider Buying

Larry Fitzgerald's recent purchase of 783 shares adds to the insider buying trend observed over the past year. While the number of insider sells outnumbers the buys, it is essential to consider the size and timing of these transactions. Fitzgerald's decision to invest further in the company could be based on non-public information or a belief in the company's strategic initiatives and growth potential.

The current price-earnings ratio of Dick's Sporting Goods Inc suggests that the stock is trading at a discount relative to the industry and its historical averages. This could be an attractive entry point for investors seeking value. Additionally, the price-to-GF-Value ratio indicates that the stock is fairly valued, which may provide some reassurance to investors concerned about overpaying for the shares.

It is also worth noting that the GF Value takes into account the company's past performance and analyst estimates for future business growth. Given that the stock is trading close to its GF Value, investors might interpret this as a sign that the stock is priced appropriately, considering its earnings potential and market position.

In conclusion, the insider buying activity by Director Larry Fitzgerald at Dick's Sporting Goods Inc offers an interesting data point for investors. While insider transactions should not be the sole factor in making investment decisions, they can provide valuable context when combined with a comprehensive analysis of the company's financials, market position, and growth prospects. As always, investors are encouraged to conduct their due diligence and consider a range of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.