Director Lee Wortham's Strategic 4000 Share Purchase in Evans Bancorp Inc (EVBN)

Recent insider trading activity has caught the attention of market analysts and investors alike, as Director Lee Wortham of Evans Bancorp Inc (EVBN) made a notable purchase of company shares. On November 13, 2023, the insider acquired 4,000 shares of the financial institution, signaling a vote of confidence in the bank's future prospects. This article delves into the details of the transaction, the background of Lee Wortham, and the business operations of Evans Bancorp Inc, providing an objective analysis based on the available data.

Who is Lee Wortham of Evans Bancorp Inc?

Lee Wortham serves as a Director at Evans Bancorp Inc, a position that involves significant responsibilities such as overseeing the company's strategic direction and ensuring corporate governance. Directors like Wortham are privy to in-depth knowledge about the company's operations, financial health, and future plans. Their investment decisions are often scrutinized for insights into their belief in the company's value and growth potential.

Evans Bancorp Inc's Business Description

Evans Bancorp Inc is a financial institution that operates primarily in Western New York. As a community bank, it provides a wide range of banking services, including retail and commercial banking products, as well as insurance and wealth management services through its subsidiaries. The company prides itself on personalized service and local decision-making, which resonates with its customer base. With a focus on fostering community development and maintaining strong customer relationships, Evans Bancorp Inc has established itself as a key player in the regional banking landscape.

Description of Insider Buy/Sell

Insider buying and selling refer to the transactions made by company insiders such as executives, directors, and major shareholders in the company's own stock. These transactions are closely monitored by investors and analysts as they can provide valuable signals about the insider's confidence in the company's performance and outlook. An insider buy, such as the one executed by Lee Wortham, is often interpreted as a positive sign, suggesting that the insider believes the stock is undervalued or that there is potential for future appreciation. Conversely, insider selling might raise questions about the insider's view on the stock's future prospects, although it can also occur for personal reasons unrelated to the company's performance.

Insider Trends

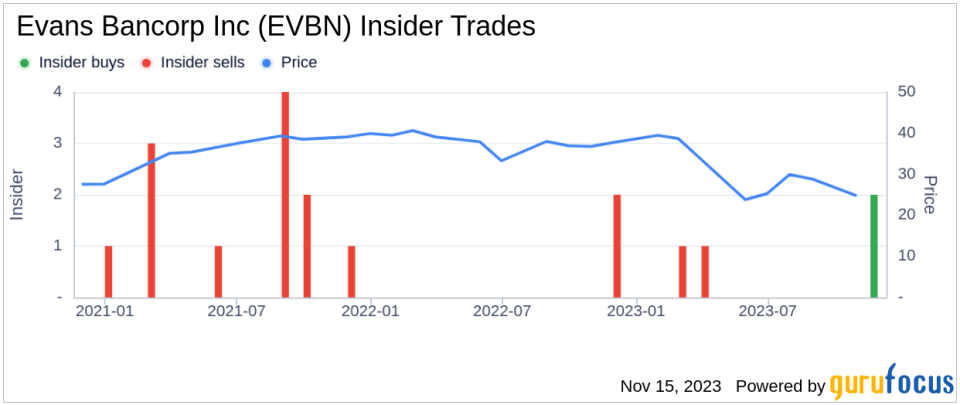

The insider transaction history for Evans Bancorp Inc shows a mix of buying and selling activities over the past year. There have been 2 insider buys and 3 insider sells during this period. The recent purchase by Lee Wortham stands out as a significant investment, given that the insider has bought 4,000 shares and has not sold any shares in the past year.

Valuation

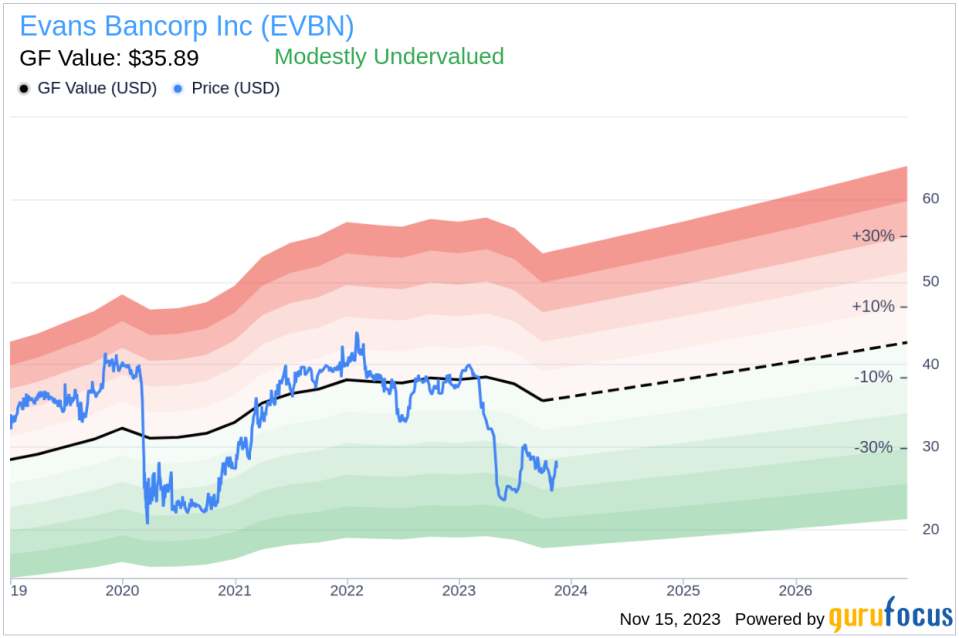

On the day of the insider's recent buy, shares of Evans Bancorp Inc were trading at $27.15, resulting in a market cap of $150.964 million. The price-earnings ratio of 7.40 is lower than both the industry median of 8.45 and the company's historical median price-earnings ratio, suggesting that the stock may be undervalued relative to its peers and its own trading history.

Moreover, with a price of $27.15 and a GuruFocus Value of $35.89, Evans Bancorp Inc has a price-to-GF-Value ratio of 0.76. This indicates that the stock is modestly undervalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

Objective Analysis of Lee Wortham's Purchase

Lee Wortham's decision to invest in 4,000 additional shares of Evans Bancorp Inc can be seen as a strategic move, especially when considering the company's current valuation metrics. The lower price-earnings ratio compared to the industry median suggests that the stock may be undervalued, which could have been a factor in the insider's decision to increase their stake.

The modestly undervalued status of the stock, as indicated by the price-to-GF-Value ratio, further supports the notion that the insider sees potential for growth or a market correction that would bring the share price closer to its intrinsic value. Wortham's insider buying activity, coupled with the fact that there have been more insider sells than buys over the past year, may also suggest a contrarian view or specific insights that the insider holds about the company's future.

It is important to note that insider transactions should not be viewed in isolation. While they can provide valuable signals, they are just one piece of the puzzle when it comes to evaluating a stock's potential. Investors should also consider other factors such as the company's financial performance, industry trends, and broader market conditions before making investment decisions.

Conclusion

Director Lee Wortham's recent purchase of 4,000 shares in Evans Bancorp Inc is a significant event that warrants attention from the investment community. The transaction, when viewed in the context of the company's valuation and the insider's unique position within the company, suggests a positive outlook on the bank's future. As always, investors should conduct their own due diligence and consider a range of factors when assessing the implications of insider trading activity.

For those interested in following insider transactions and gaining insights into the potential implications for stock performance, staying informed about such strategic moves can be a valuable component of a well-rounded investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.