Director Linda Thomas Sells 1,200 Shares of Northrim BanCorp Inc

On September 14, 2023, Linda Thomas, a director at Northrim BanCorp Inc (NASDAQ:NRIM), sold 1,200 shares of the company. This move comes amidst a year where the insider has sold a total of 1,200 shares and purchased 375 shares.

Linda Thomas has been a part of Northrim BanCorp Inc for several years, contributing to the company's growth and development. Her role as a director involves making crucial decisions that shape the company's future. Her recent sell-off of shares is noteworthy and warrants a closer look.

Northrim BanCorp Inc is a full-service bank holding company that provides a comprehensive range of banking products and services to businesses, professionals, and individuals in Alaska. The company operates in two segments: Community Banking and Home Mortgage Lending. It is headquartered in Anchorage, Alaska, and has 14 branches across the state.

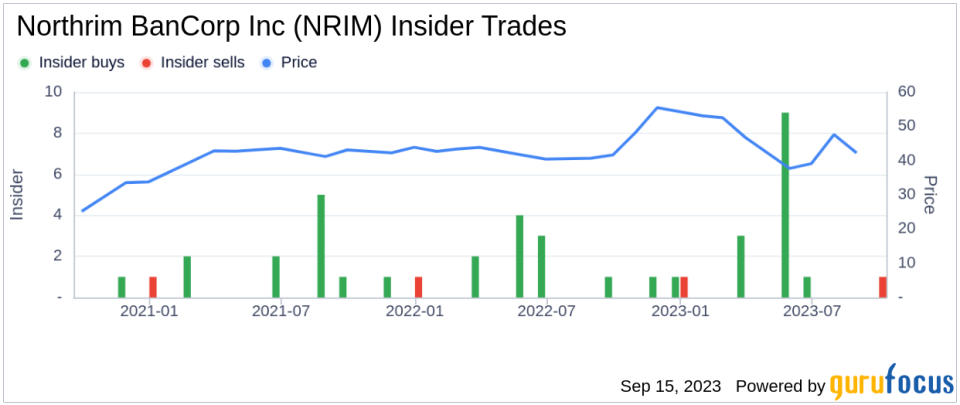

The insider transaction history for Northrim BanCorp Inc shows a total of 15 insider buys over the past year, compared to 2 insider sells over the same timeframe. This suggests a generally positive sentiment among insiders towards the company's stock.

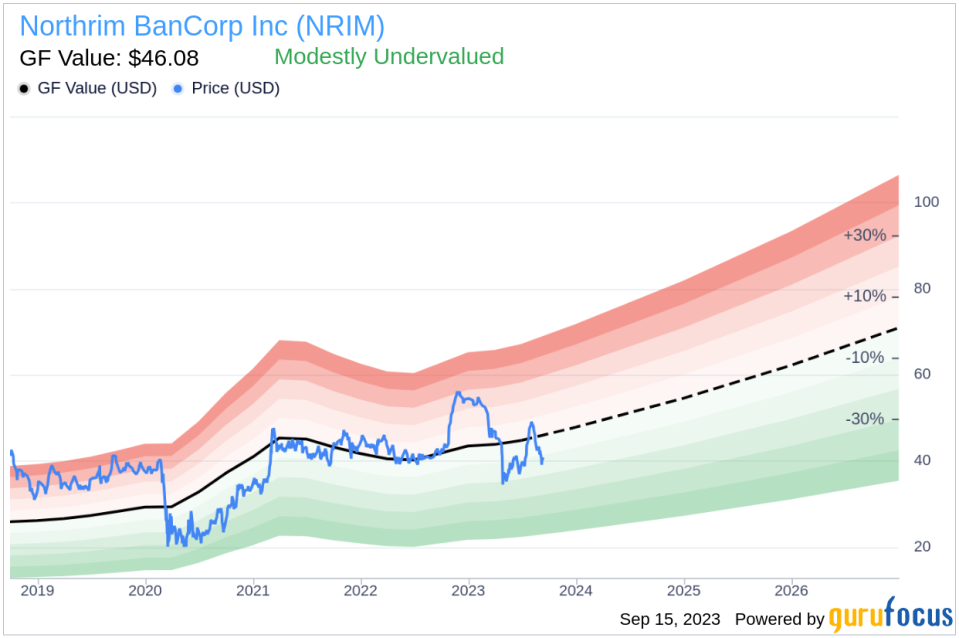

On the day of the insider's recent sell, shares of Northrim BanCorp Inc were trading for $40.75 apiece, giving the stock a market cap of $229.813 million. The price-earnings ratio is 8.13, lower than both the industry median of 8.29 and the companys historical median price-earnings ratio. This indicates that the stock is currently undervalued.

The GuruFocus Value for Northrim BanCorp Inc is $46.08, resulting in a price-to-GF-Value ratio of 0.88. This suggests that the stock is modestly undervalued.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The recent sell-off by the insider could be a personal decision or a strategic move based on her assessment of the company's future prospects. However, given the stock's current undervaluation and the overall positive insider buying trend, it may be an opportune time for investors to consider Northrim BanCorp Inc.

As always, potential investors should conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.