Director Marcus Lemonis Buys 33,000 Shares of Overstock.com Inc

On October 4, 2023, Marcus Lemonis, a director at Overstock.com Inc (NASDAQ:OSTK), purchased 33,000 shares of the company. This move by the insider has sparked interest in the financial community and warrants a closer look.

Who is Marcus Lemonis?

Marcus Lemonis is a well-known business tycoon, television personality, philanthropist, and politician. He is best known for his role in the CNBC reality show "The Profit", where he helps struggling businesses to recover. At Overstock.com Inc, Lemonis serves as a director, bringing his vast experience and business acumen to the table.

About Overstock.com Inc

Overstock.com Inc is an American internet retailer headquartered in Midvale, Utah, near Salt Lake City. The company initially sold exclusively surplus and returned merchandise on an online e-commerce marketplace, liquidating the inventories of at least 18 failed dot-com companies at below-wholesale prices. Overstock has since expanded to sell new merchandise as well.

Insider Buying Analysis

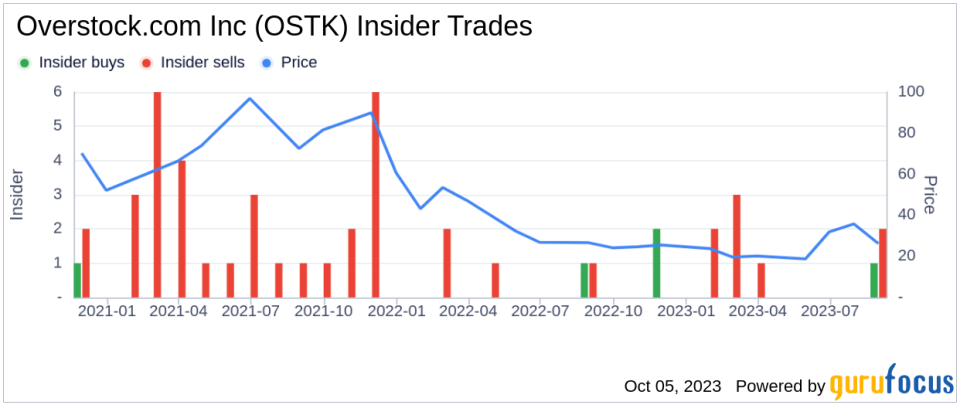

Over the past year, the insider has purchased a total of 33,000 shares and sold 0 shares. This recent purchase by Lemonis is significant as it represents a substantial investment in the company.

The insider transaction history for Overstock.com Inc shows a total of 4 insider buys over the past year, compared to 8 insider sells. This could indicate a positive sentiment among the insiders about the company's future prospects.

Stock Price and Valuation

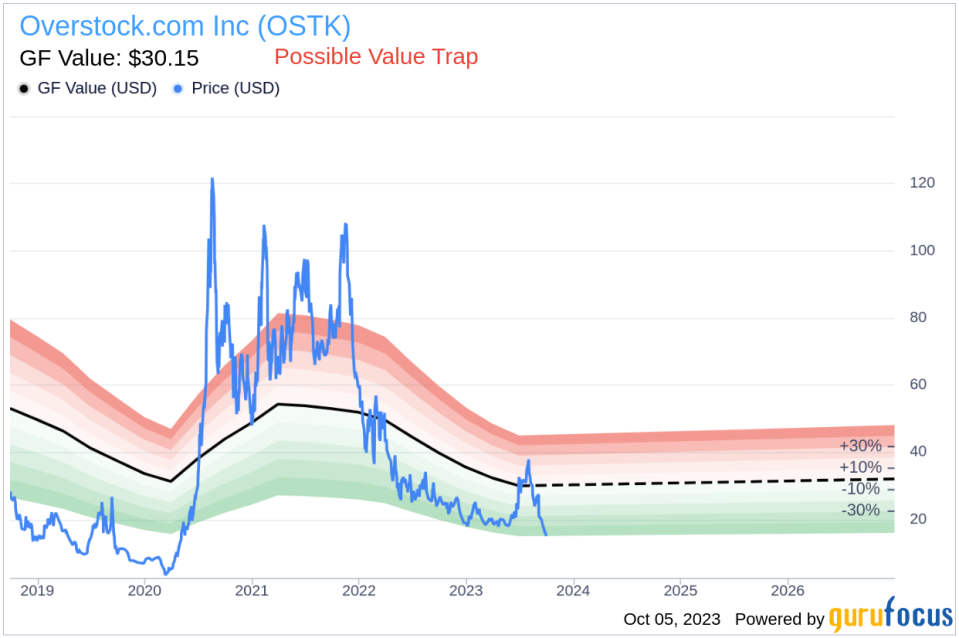

On the day of the insider's recent buy, shares of Overstock.com Inc were trading for $14.94 apiece, giving the stock a market cap of $674.657 million.

With a price of $14.94 and a GuruFocus Value of $30.15, Overstock.com Inc has a price-to-GF-Value ratio of 0.5. This suggests that the stock is possibly a value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance.

In conclusion, the recent purchase by Marcus Lemonis could be a positive signal for the company's future prospects. However, investors should also consider the company's valuation and other factors before making an investment decision.

This article first appeared on GuruFocus.