Director Marcus Lemonis Buys 40,293 Shares of Overstock.com Inc

On October 27, 2023, Marcus Lemonis, a director at Overstock.com Inc (NASDAQ:OSTK), purchased 40,293 shares of the company. This move is significant as it provides insight into the insider's confidence in the company's future performance.

Marcus Lemonis is a well-known figure in the business world, renowned for his strategic acumen and leadership skills. He has been a director at Overstock.com Inc, an American internet retailer selling primarily furniture and home decor. The company also has a blockchain division, Medici Ventures, which is focused on applying blockchain technologies to existing industries to eliminate middlemen, democratize capital, and rehumanize commerce.

Insider buying and selling activities are closely monitored by investors as they provide valuable insights into how insiders view the company's stock. Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

Over the past year, Marcus Lemonis has purchased a total of 147,293 shares and has not sold any shares. This indicates a strong belief in the company's prospects and a commitment to its success.

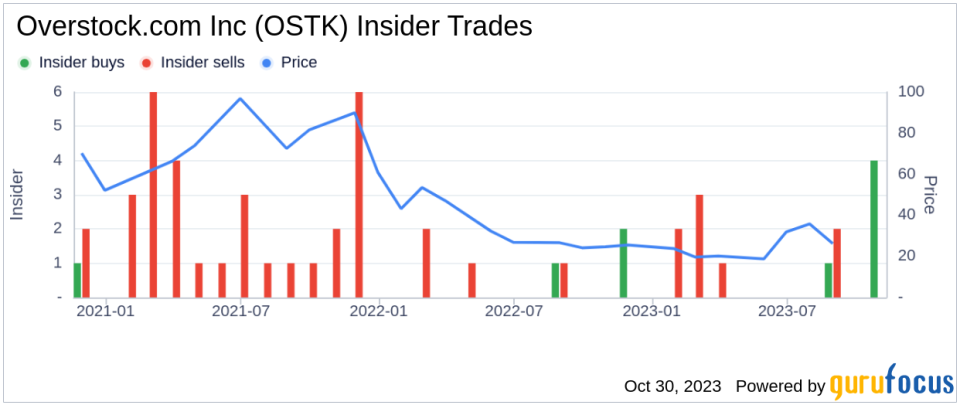

The insider transaction history for Overstock.com Inc shows a mixed trend. Over the past year, there have been 7 insider buys and 8 insider sells. Despite the higher number of sells, the insider's recent purchase could signal a positive outlook for the company.

On the day of the insider's recent buy, shares of Overstock.com Inc were trading for $14.79, giving the company a market cap of $700.188 million.

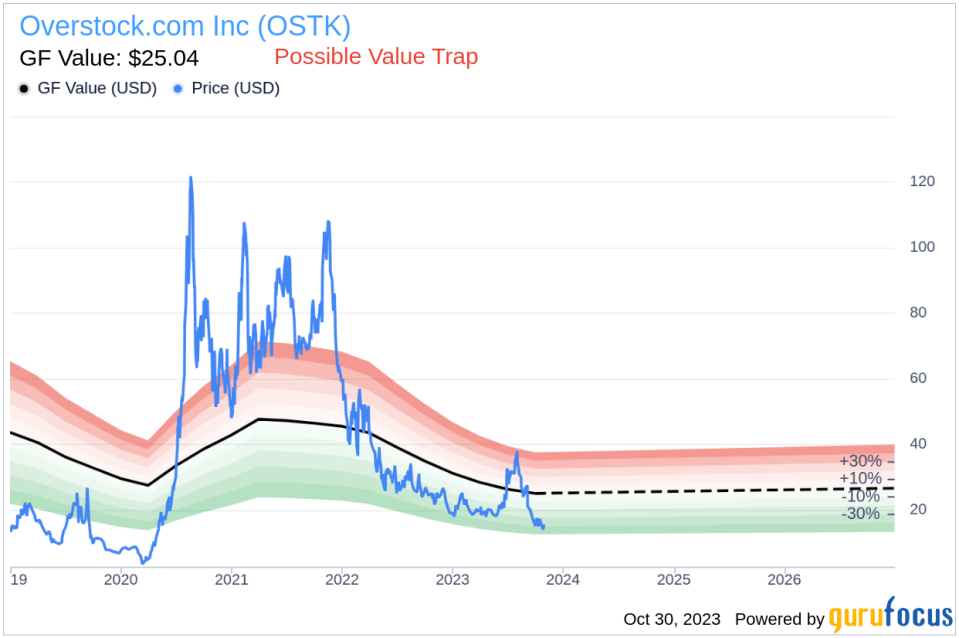

With a price of $14.79 and a GuruFocus Value of $25.04, Overstock.com Inc has a price-to-GF-Value ratio of 0.59. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent purchase of Overstock.com Inc shares could be a positive sign for the company. However, given the stock's current valuation, investors should exercise caution and conduct further research before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.