Director Max Reichenthal Buys 2000 Shares of Friedman Industries Inc (FRD)

On September 11, 2023, Max Reichenthal, a director at Friedman Industries Inc (FRD), purchased 2000 shares of the company. This move is significant as insider buying often signals confidence in the company's future prospects.

Max Reichenthal is a key figure at Friedman Industries Inc, a company that has been in operation for over 50 years. Friedman Industries Inc is a manufacturer, processor, and distributor of steel products. The company's products include hot-rolled steel coils, hot-rolled and cut-length sheets, and tubular products. The company operates in two segments: coil products and tubular products. The Coil Products segment operates from the company's steel processing facility in Hickman, Arkansas, and the Tubular Products segment operates from the company's steel processing facility in Decatur, Alabama.

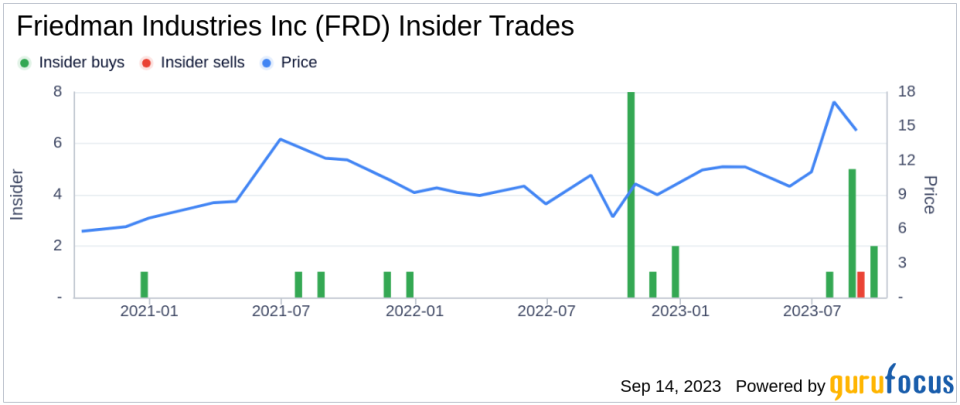

Over the past year, the insider has purchased a total of 11,257 shares and has not sold any shares. This trend of buying indicates a strong belief in the company's potential growth and profitability.

The insider transaction history for Friedman Industries Inc shows a total of 19 insider buys over the past year, with only 1 insider sell. This trend suggests that insiders at the company are bullish about its future.

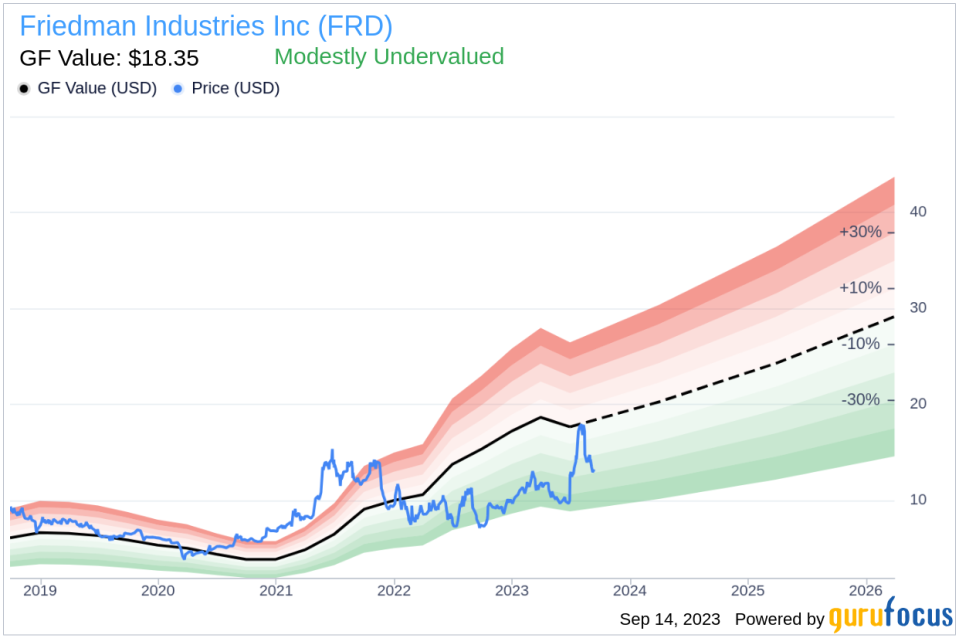

On the day of the insider's recent buy, shares of Friedman Industries Inc were trading at $13.35, giving the company a market cap of $98.24 million. The price-earnings ratio is 5.48, which is lower than the industry median of 12.64 and lower than the companys historical median price-earnings ratio. This suggests that the stock is currently undervalued.

The GuruFocus Value of Friedman Industries Inc is $18.35, which means the stock is modestly undervalued with a price-to-GF-Value ratio of 0.73. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity at Friedman Industries Inc, coupled with the company's undervalued status, suggests that the stock could be a good investment opportunity. However, as always, potential investors should conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.