Director McKelvey James Morgan Jr.'s Strategic 8,000 Share Purchase in Emerson Electric Co

In the realm of stock market movements, insider trading activity is often a beacon that attracts the attention of investors seeking clues about a company's future prospects. A recent transaction by Director McKelvey James Morgan Jr., who bought 8,000 shares of Emerson Electric Co (NYSE:EMR), has sparked interest and speculation. This article delves into the details of the transaction, the background of the insider, and the business landscape of Emerson Electric Co, providing an objective analysis based on the available data.

Who is McKelvey James Morgan Jr.?

McKelvey James Morgan Jr. is a seasoned member of the board of directors at Emerson Electric Co, a global technology and engineering company providing innovative solutions for customers in industrial, commercial, and residential markets. The insider's decision to increase their stake in the company is a move that market watchers often interpret as a signal of confidence in the company's future performance.

Emerson Electric Co's Business Description

Emerson Electric Co, headquartered in St. Louis, Missouri, operates through two main business segments: Automation Solutions and Commercial & Residential Solutions. The company's Automation Solutions segment offers an extensive array of products and services for a wide range of industries, including oil and gas, refining, chemicals, power generation, pharmaceuticals, food and beverages, and more. The Commercial & Residential Solutions segment provides products that promote energy efficiency and sustainability in heating, air conditioning, and refrigeration for residential and commercial applications. Emerson's commitment to innovation and sustainability has positioned it as a leader in its field, with a reputation for reliability and performance.

Description of Insider Buy/Sell

Insider buying occurs when an officer, director, or any person with access to key company information purchases shares of the company's stock. Conversely, insider selling refers to the sale of shares by these individuals. These transactions are closely monitored as they can provide insights into the insider's view of the company's value and future prospects. While not always a definitive indicator, a pattern of insider buying can be a bullish sign, suggesting that those with the most intimate knowledge of the company's workings see undervalued potential.

Insider Trends

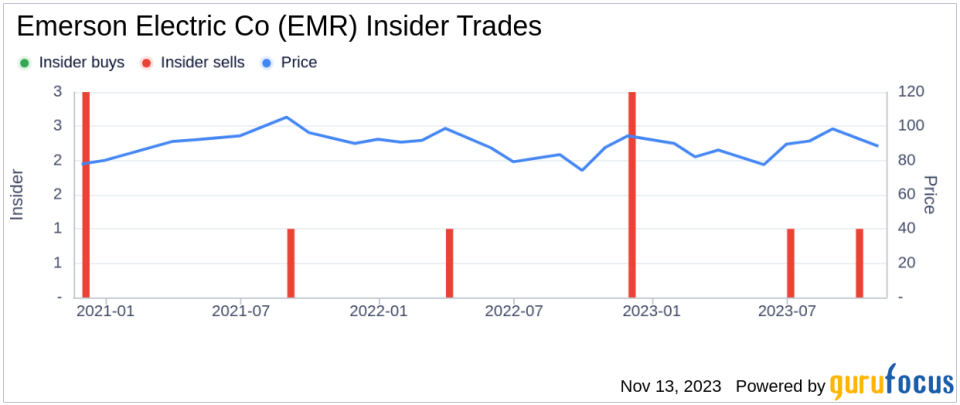

The insider transaction history for Emerson Electric Co shows a cautious but potentially optimistic pattern. Over the past year, there has been a single insider buy by McKelvey James Morgan Jr., who has purchased a total of 8,000 shares. In contrast, there have been three insider sells in the same timeframe. This could indicate a mixed sentiment among insiders, but the recent purchase by the director may suggest a turning point in insider confidence.

Valuation

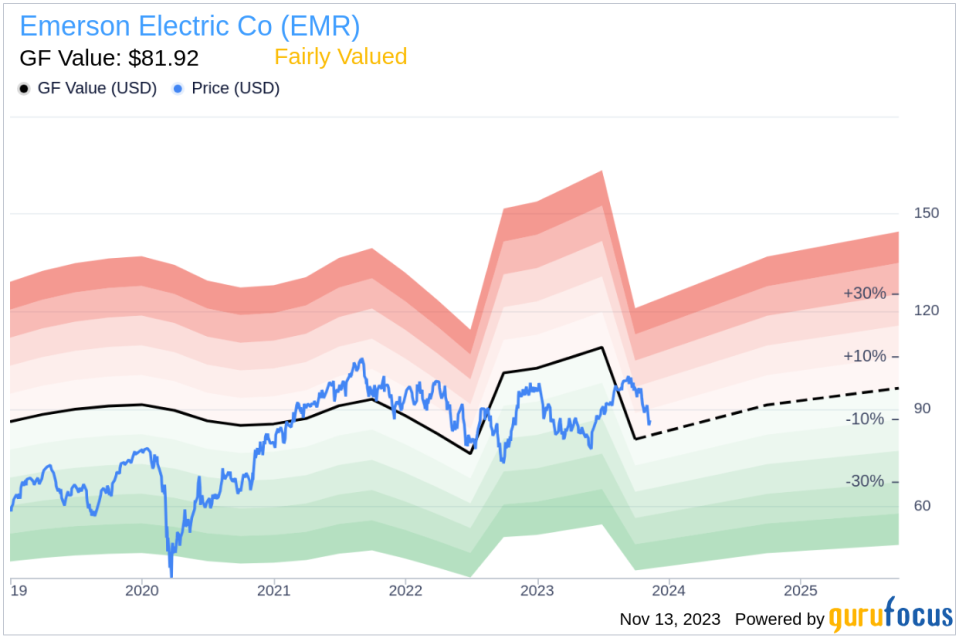

On the day of the insider's recent buy, shares of Emerson Electric Co were trading at $85.5, giving the company a market cap of $49,491.901 billion. The price-earnings ratio of 3.78 is significantly lower than both the industry median of 21.43 and the company's historical median price-earnings ratio. This disparity suggests that the stock may be undervalued relative to its peers and its own historical valuation standards.With a price of $85.5 and a GuruFocus Value of $81.92, Emerson Electric Co has a price-to-GF-Value ratio of 1.04, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Objective Analysis Based on Data

The insider's decision to invest in 8,000 additional shares of Emerson Electric Co aligns with several positive indicators. The low price-earnings ratio compared to the industry median suggests that the stock may be undervalued, providing a potentially attractive entry point for the insider. The Fairly Valued status based on the GF Value corroborates this perspective, indicating that the stock is not overpriced relative to its intrinsic value.Furthermore, the insider's choice to buy rather than sell shares is a vote of confidence in the company's direction and future growth potential. This is particularly noteworthy given the insider's intimate knowledge of Emerson Electric Co's operations and market position.In conclusion, the recent insider buying activity by Director McKelvey James Morgan Jr. at Emerson Electric Co presents an intriguing data point for investors. While insider transactions are just one piece of the puzzle when evaluating a stock's potential, the alignment of a low price-earnings ratio, a Fairly Valued GF Value status, and a strategic insider purchase suggests that Emerson Electric Co may be poised for positive developments in the eyes of those who know it best. Investors would do well to consider these factors alongside a comprehensive analysis of the company's financial health, market trends, and broader economic conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.