Director Michael Larson Buys 13,000 Shares of Western Asset Inflation Linked Income Fund (WIA)

On September 27, 2023, Director Michael Larson made a significant purchase of 13,000 shares of Western Asset Inflation Linked Income Fund (NYSE:WIA). This move is noteworthy and deserves a closer look by investors and market analysts alike.

Who is Michael Larson?

Michael Larson is a Director at Western Asset Inflation Linked Income Fund. He has a long-standing history in the financial sector, with a keen eye for investment opportunities. His recent purchase of WIA shares indicates a strong belief in the company's future performance.

About Western Asset Inflation Linked Income Fund

Western Asset Inflation Linked Income Fund is a closed-end fund that aims to provide current income for its shareholders while protecting the purchasing power of their income from inflation. The fund invests primarily in inflation-linked securities issued by the U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations.

Insider Buying Analysis

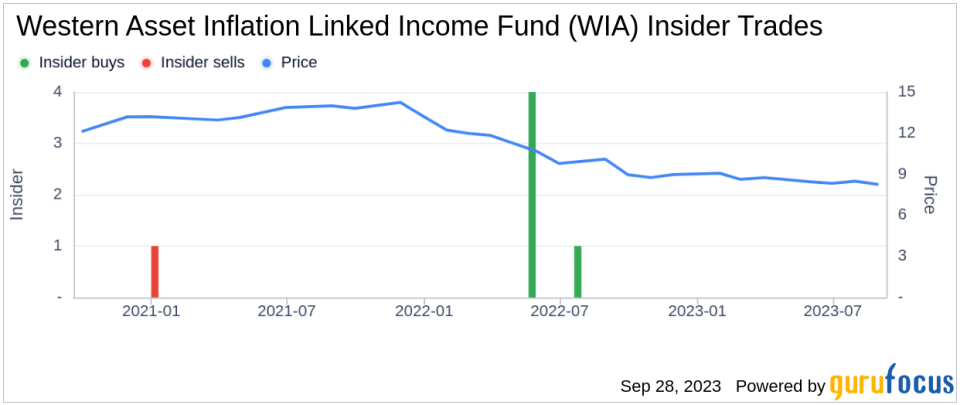

Over the past year, the insider has purchased 13,000 shares in total and sold 0 shares in total. This indicates a strong bullish sentiment from the insider towards the company's stock. The insider's recent purchase further strengthens this sentiment.

The insider transaction history for Western Asset Inflation Linked Income Fund shows that there have been 1 insider buys in total over the past year. Meanwhile, there have been 0 insider sells over the same timeframe. This trend suggests that insiders at the company have a positive outlook on the stock's future performance.

Relationship with Stock Price

Shares of Western Asset Inflation Linked Income Fund were trading for $7.9 apiece on the day of the insider's recent buy. This gives the stock a market cap of $183.313 million. The insider's purchase at this price point suggests that they believe the stock is undervalued and has potential for growth.

Conclusion

Insider buying can be an encouraging signal for potential investors. In the case of Western Asset Inflation Linked Income Fund, the insider's recent purchase of 13,000 shares indicates a strong belief in the company's future performance. Investors should consider this insider activity as a positive sign and may want to take a closer look at the company.

This article first appeared on GuruFocus.