Director More Avery Acquires 7,000 Shares of SolarEdge Technologies Inc (SEDG)

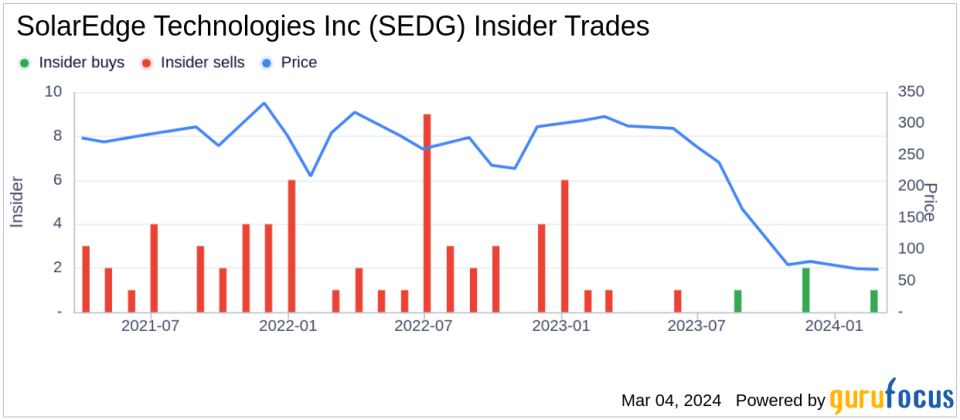

Director More Avery has recently increased their stake in SolarEdge Technologies Inc (NASDAQ:SEDG) by purchasing 7,000 shares of the company's stock, according to a SEC Filing dated 2024-02-29. This transaction has expanded More Avery's holdings in the company, following a pattern of consistent share accumulation over the past year.SolarEdge Technologies Inc is a global leader in smart energy technology. The company provides a broad range of products that include power optimizers, inverters, and a cloud-based monitoring platform for the photovoltaic (PV) industry. These solutions aim to increase energy output through module-level Maximum Power Point Tracking (MPPT).Over the past year, the insider has purchased a total of 22,300 shares and has not sold any shares of the company. This trend of insider purchases may be indicative of the insider's confidence in the future prospects of SolarEdge Technologies Inc.The insider transaction history for SolarEdge Technologies Inc shows a pattern of more insider buying than selling over the past year, with 4 insider buys and only 1 insider sell recorded.

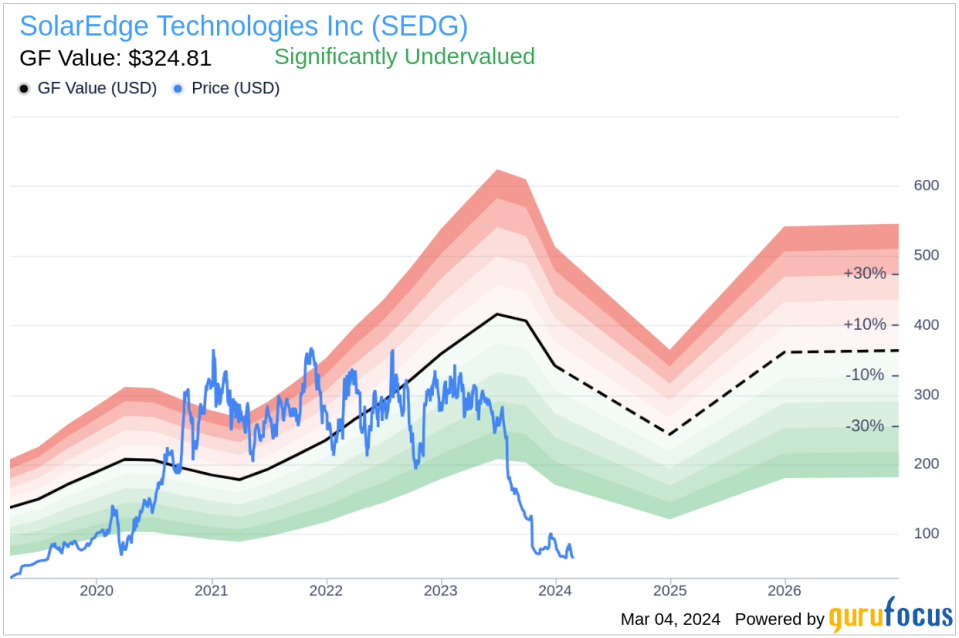

On the valuation front, shares of SolarEdge Technologies Inc were trading at $67.75 on the date of the insider's recent purchase, giving the company a market cap of $3.815 billion. The price-earnings ratio stands at 148.42, which is above both the industry median of 29.72 and the company's historical median price-earnings ratio.

The stock's price relative to the GuruFocus Value (GF Value) suggests that SolarEdge Technologies Inc is significantly undervalued. With a share price of $67.75 and a GF Value of $324.81, the price-to-GF-Value ratio is 0.21. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.The recent insider buying activity, coupled with the company's current valuation metrics, may be of interest to investors monitoring insider behaviors and looking for potential investment opportunities within the renewable energy sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.