Director Orlando Carvalho's Strategic Purchase of 35,000 Shares in Mercury Systems Inc

Mercury Systems Inc (NASDAQ:MRCY) has recently witnessed a significant insider buying event that has caught the attention of investors and market analysts alike. On November 13, 2023, Director Orlando Carvalho made a substantial investment in the company by purchasing 35,000 shares. This move has sparked interest in the company's stock and has led to discussions regarding the implications of such insider activity.

Who is Orlando Carvalho?

Orlando Carvalho is a seasoned executive with a wealth of experience in the aerospace and defense industry. His career includes notable leadership positions, where he has demonstrated a keen understanding of the sector's dynamics and strategic operations. As a director of Mercury Systems Inc, Carvalho brings his extensive expertise to the table, guiding the company through its growth and development phases.

Mercury Systems Inc's Business Description

Mercury Systems Inc is a prominent player in the aerospace and defense industry, providing crucial technologies and services. The company specializes in designing and manufacturing sophisticated processing systems that cater to a wide range of applications, including mission-critical defense and intelligence programs. Mercury Systems' commitment to innovation and quality has established it as a trusted partner for government agencies and prime contractors in the defense sector.

Understanding Insider Buy/Sell

Insider buying and selling refer to the transactions made by company insiders such as executives, directors, and major shareholders in the company's own stock. These transactions are closely monitored by investors as they can provide valuable insights into the insiders' confidence in the company's future prospects. Insider buying, in particular, is often viewed as a positive sign, as it suggests that insiders believe the stock is undervalued or that the company is poised for growth.

Insider Trends at Mercury Systems Inc

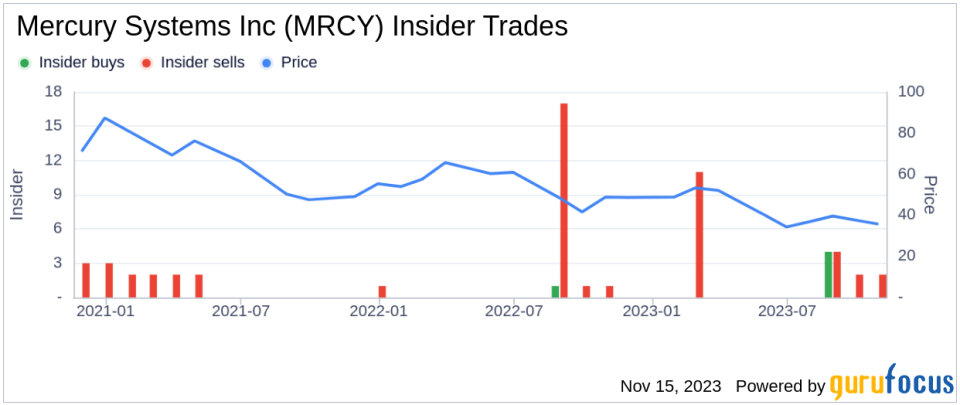

The insider transaction history at Mercury Systems Inc reveals a pattern of insider activity over the past year. There have been a total of 5 insider buys, indicating a certain level of confidence among insiders about the company's potential. On the other hand, there have been 19 insider sells, which could be attributed to various reasons, including portfolio diversification or personal financial planning. It is important to consider the context of these transactions when interpreting their significance.

Valuation and Market Cap

On the day of the insider's recent buy, shares of Mercury Systems Inc were trading at $33.83, resulting in a market cap of $2.056 billion. This valuation is a critical factor for investors to consider as it reflects the market's current assessment of the company's worth.

With a price of $33.83 and a GuruFocus Value of $49.93, Mercury Systems Inc has a price-to-GF-Value ratio of 0.68. This suggests that the stock may be a Possible Value Trap, and investors should Think Twice before making a decision based on its GF Value.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business estimates provided by Morningstar analysts.

Historical multiples include price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

The GuruFocus adjustment factor adjusts for the company's historical returns and growth.

Future business performance estimates are sourced from Morningstar analysts, providing a forward-looking perspective.

Objective Analysis of Orlando Carvalho's Purchase

Orlando Carvalho's recent acquisition of 35,000 shares is a significant event that warrants an objective analysis. Over the past year, the insider has shown a strong conviction in the company by increasing his stake without any recorded sales. This pattern of behavior could be indicative of the insider's belief in the company's undervaluation or future growth prospects.The insider's decision to invest at the current price point, which is below the GF Value, may suggest that he perceives the stock to be undervalued. However, the price-to-GF-Value ratio being below 1 also raises the possibility of the stock being a value trap. This discrepancy between the market price and the GF Value requires careful consideration by potential investors.The insider's purchase comes at a time when the company's market cap stands at over $2 billion, reflecting a substantial size within its industry. The scale of the company, combined with the insider's significant investment, could be seen as a reaffirmation of the company's stability and potential for growth.In conclusion, Orlando Carvalho's purchase of 35,000 shares in Mercury Systems Inc is a noteworthy development that highlights the importance of insider transactions as indicators of a company's health and future performance. While the insider's actions may signal confidence, investors are advised to conduct thorough due diligence, considering both the insider trends and the company's valuation metrics, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.