Director Paul Whiting's Strategic Purchase of Heritage Insurance Holdings Inc Shares

On December 14, 2023, a notable transaction occurred within Heritage Insurance Holdings Inc (NYSE:HRTG), a company specializing in personal and commercial residential insurance products. Director Paul Whiting made a significant investment by purchasing 40,871 shares of the company. This move by a key insider has sparked interest among investors and market analysts alike, prompting a closer look at the implications of such insider activity.

Who is Paul Whiting of Heritage Insurance Holdings Inc?

Paul Whiting is a seasoned professional with a deep understanding of the insurance industry. As a director of Heritage Insurance Holdings Inc, Whiting brings a wealth of experience to the table, which includes strategic planning, risk management, and corporate governance. His decision to increase his stake in the company is often interpreted as a strong signal of his confidence in the firm's future prospects and financial health.

Heritage Insurance Holdings Inc's Business Description

Heritage Insurance Holdings Inc is a property and casualty insurance holding company headquartered in Clearwater, Florida. The company, through its subsidiaries, provides personal and commercial residential insurance, primarily focusing on homeowners' insurance in the southeastern United States. Heritage prides itself on its customer service and the ability to respond quickly to natural disasters, leveraging its expertise to offer a comprehensive range of insurance products designed to protect against the financial impact of major perils.

Description of Insider Buy/Sell

Insider buying and selling refer to the transactions made by company insiders such as directors, officers, or shareholders owning 10% or more of the firm's total shares in the company's stock. These transactions are closely monitored by investors and regulators since insiders possess an intimate knowledge of the company's operations, financial condition, and future plans. Insider buying can be seen as a positive sign, suggesting that insiders believe the stock is undervalued or that the company is poised for growth. Conversely, insider selling might raise concerns about the company's future performance, although it can also occur for personal reasons unrelated to the company's prospects.

Insider Trends

The insider transaction history for Heritage Insurance Holdings Inc reveals a pattern of insider confidence, with a total of 4 insider buys over the past year and no insider sells during the same period. This trend suggests that those with the most intimate knowledge of the company's workings are betting on its success.

Valuation

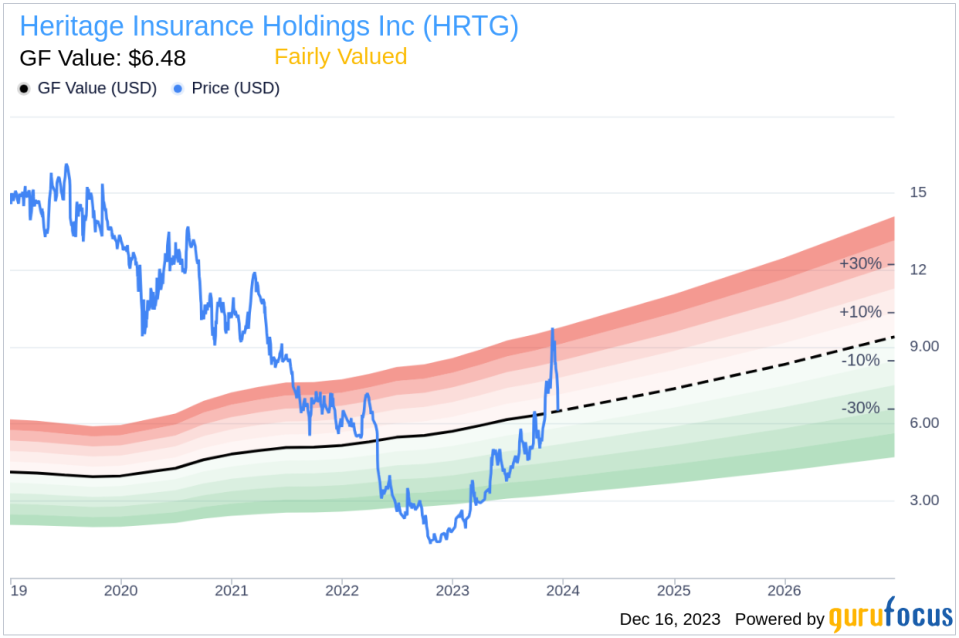

On the day of the insider's recent buy, shares of Heritage Insurance Holdings Inc were trading at $7.34, resulting in a market cap of $174.363 million. This valuation places the stock's price-earnings ratio at 6.20, which is lower than the industry median of 10.945 and also below the company's historical median price-earnings ratio. Such a low price-earnings ratio could indicate that the stock is undervalued relative to its peers and its own historical performance, potentially offering an attractive entry point for investors.

Moreover, with a share price of $7.34 and a GuruFocus Value of $6.48, Heritage Insurance Holdings Inc has a price-to-GF-Value ratio of 1.13. According to this metric, the stock is Fairly Valued, suggesting that it is trading at a price close to its intrinsic value as estimated by GuruFocus.

The GF Value is a proprietary intrinsic value estimate that takes into account several factors:

Historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

An adjustment factor based on the company's past returns and growth, as determined by GuruFocus.

Future business performance estimates provided by Morningstar analysts.

When insiders like Paul Whiting make substantial purchases, it often warrants attention from the investment community. The insider's recent acquisition of 40,871 shares could be interpreted as a strong vote of confidence in the company's valuation and future prospects. Given the current market cap, price-earnings ratio, and the price relative to the GF Value, Heritage Insurance Holdings Inc appears to be positioned in a way that could be appealing to both value and informed investors.

As with any insider transaction, it is important for investors to consider the broader context, including market conditions, company performance, and sector trends. However, the insider's recent buying activity, coupled with the company's valuation metrics, provides a compelling narrative for those looking to understand the potential direction of Heritage Insurance Holdings Inc's stock.

Investors and analysts will continue to monitor insider transactions and company performance to gauge the potential impact on the stock's future price movements. For now, the insider's recent purchase serves as a noteworthy development for Heritage Insurance Holdings Inc and its stakeholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.