Director Phillip Gobe Sells 15,000 Shares of ProPetro Holding Corp

On September 12, 2023, Director Phillip Gobe sold 15,000 shares of ProPetro Holding Corp (NYSE:PUMP). This move comes amidst a year where the insider has sold a total of 177,860 shares and purchased none.

Phillip Gobe is a key figure in ProPetro Holding Corp, serving as a Director. ProPetro Holding Corp is a leading oilfield services company that provides hydraulic fracturing and other complementary services to leading upstream oil and gas companies engaged in the exploration and production of North American unconventional oil and natural gas resources.

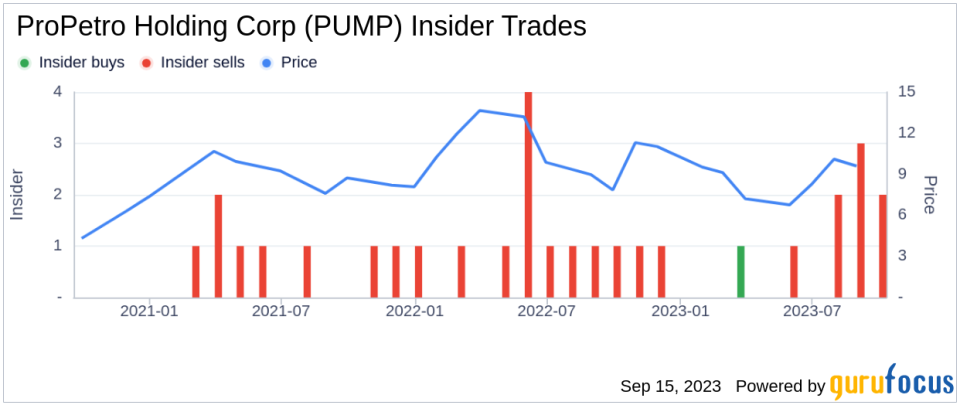

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 10 insider sells and only 1 insider buy. This could potentially signal a lack of confidence in the company's future performance.

The stock was trading at $10.5 per share on the day of the insider's recent sell, giving the company a market cap of $1.18 billion. This is a significant figure, and it's worth noting that the price-earnings ratio is 12.77, higher than both the industry median of 9.26 and the company's historical median price-earnings ratio.

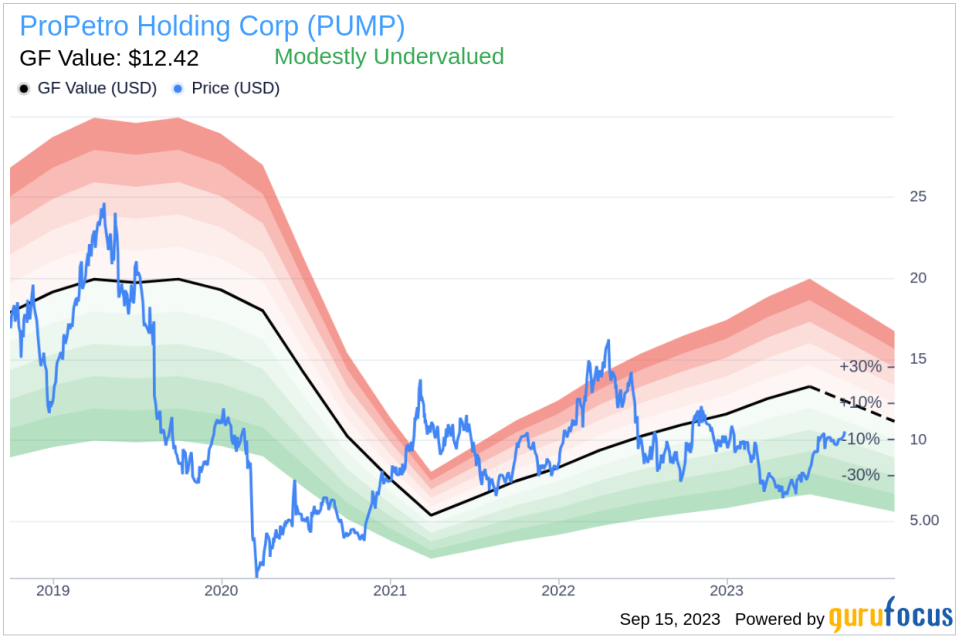

Despite the insider's sell-off, the stock appears to be modestly undervalued according to the GuruFocus Value. With a price of $10.5 and a GuruFocus Value of $12.42, the stock has a price-to-GF-Value ratio of 0.85.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell-off may raise some eyebrows, the stock's current valuation suggests that it may still be a good buy for investors. However, potential investors should keep a close eye on the company's insider transactions, as they can often provide valuable insights into the company's future performance.

This article first appeared on GuruFocus.