Director Phillip Gobe Sells 20,000 Shares of ProPetro Holding Corp

On September 18, 2023, Phillip Gobe, a director at ProPetro Holding Corp (NYSE:PUMP), sold 20,000 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 197,860 shares over the past year and has not made any purchases.

ProPetro Holding Corp is a Texas-based oilfield services company that provides hydraulic fracturing and other complementary services to leading upstream oil and gas companies engaged in the exploration and production of North American unconventional oil and natural gas resources.

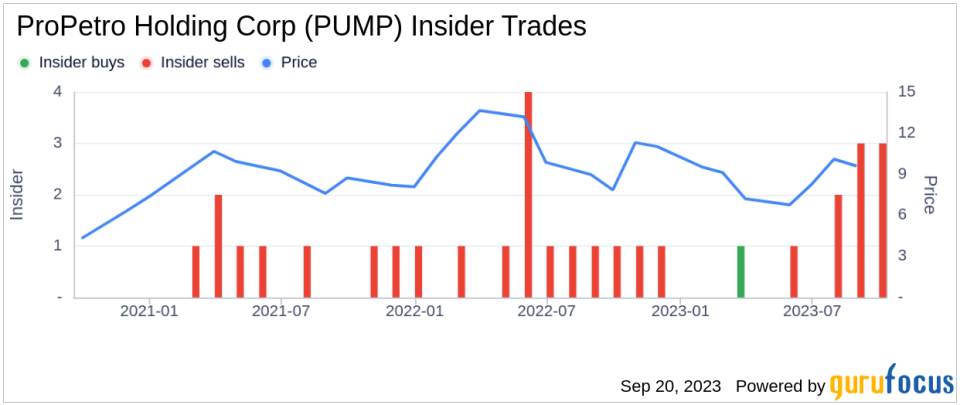

The insider's recent sell-off comes amidst a broader trend of insider selling at ProPetro Holding Corp. Over the past year, there have been 11 insider sells and only 1 insider buy. This trend is illustrated in the following image:

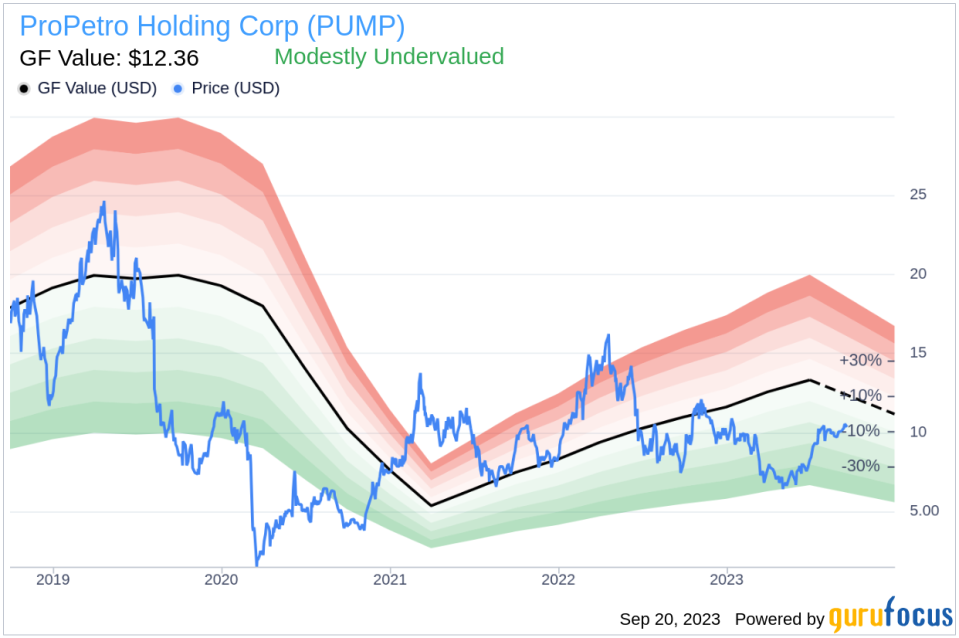

On the day of the insider's recent sell, shares of ProPetro Holding Corp were trading at $11 each, giving the company a market cap of $1.163 billion. This is higher than the industry median and the company's historical median price-earnings ratio of 12.86.

Despite the insider's sell-off, ProPetro Holding Corp appears to be modestly undervalued based on its GuruFocus Value of $12.36. With a price-to-GF-Value ratio of 0.89, the stock could still offer potential upside for investors. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. The GF Value is illustrated in the following image:

While the insider's recent sell-off could be a cause for concern, it's important to consider the broader context. The insider has been selling shares over the past year, and the company's stock appears to be modestly undervalued. Investors should keep an eye on future insider transactions and other indicators to gauge the company's health and potential for growth.

As always, it's crucial to conduct thorough research and consider multiple factors before making investment decisions. Insider transactions can provide valuable insights, but they are just one piece of the puzzle.

This article first appeared on GuruFocus.