Director Richard Hancock's Strategic 23,000 Share Purchase in Avid Bioservices Inc

Investors often keep a close eye on insider transactions as they can provide valuable insights into a company's prospects. A recent transaction that has caught the attention of the market is the purchase of 23,000 shares of Avid Bioservices Inc (NASDAQ:CDMO) by Director Richard Hancock on December 15, 2023. This article will delve into the details of this insider buying activity, providing an objective analysis based on the available data.

Who is Richard Hancock of Avid Bioservices Inc?

Before analyzing the insider buying activity, it is important to understand who Richard Hancock is within the context of Avid Bioservices Inc. Richard Hancock is a seasoned executive with extensive experience in the biopharmaceutical industry. His role as a director at Avid Bioservices Inc provides him with a deep understanding of the company's operations, strategic direction, and potential growth opportunities. His decision to increase his stake in the company can be seen as a sign of confidence in its future prospects.

Avid Bioservices Inc's Business Description

Avid Bioservices Inc is a dedicated contract development and manufacturing organization (NASDAQ:CDMO) that provides a comprehensive range of process development, high-quality cGMP clinical and commercial manufacturing services for the biotechnology and biopharmaceutical industries. With expertise in monoclonal antibodies, recombinant proteins, and cell and gene therapies, Avid Bioservices Inc is focused on helping its clients realize their drug development and commercialization strategies. The company's services are designed to help clients move their products through the development process efficiently and cost-effectively, ultimately bringing them to market for the benefit of patients worldwide.

Description of Insider Buy/Sell

Insider buying occurs when a company's executives, directors, or other insiders purchase shares of the company's stock. This is often interpreted as a positive signal, as insiders may buy shares because they believe the stock is undervalued or that there are positive developments on the horizon that could drive the stock price higher. Conversely, insider selling can occur for a variety of reasons, including diversification of personal assets, tax planning, or concerns about the company's future performance. However, selling is not always indicative of a lack of confidence in the company.

According to the data provided, Richard Hancock has been active in the market over the past year, purchasing a total of 23,000 shares and selling 30,000 shares of Avid Bioservices Inc.

Insider Trends

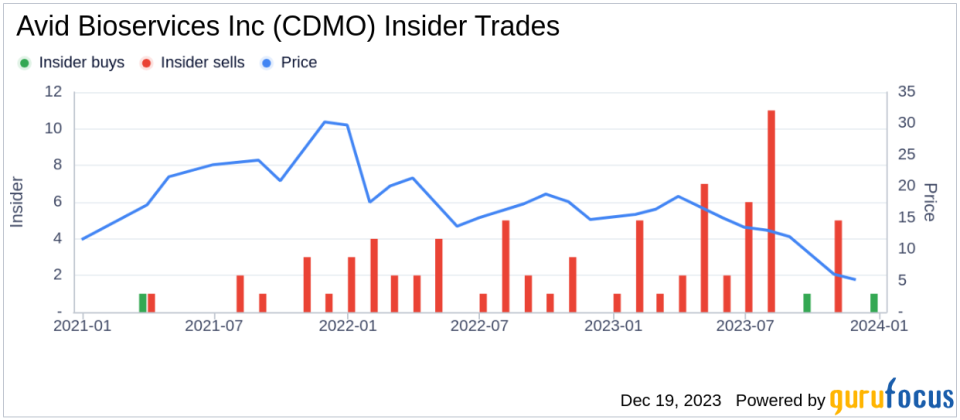

The insider transaction history for Avid Bioservices Inc shows a pattern of insider activity over the past year. There have been 2 insider buys and 39 insider sells during this period. This trend can provide context to the recent purchase by Richard Hancock.

Valuation and Market Cap

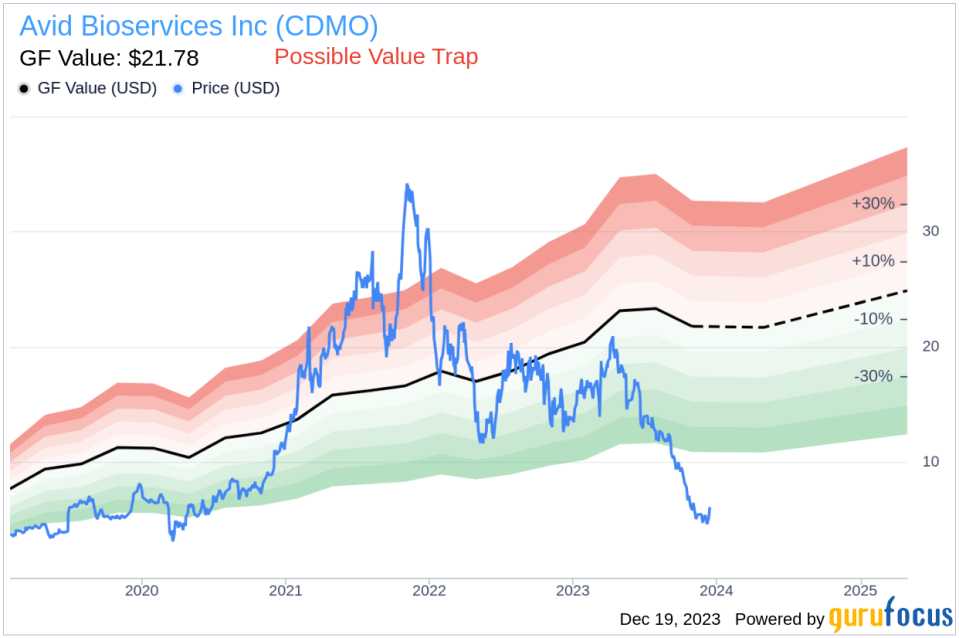

On the day of the insider's recent buy, shares of Avid Bioservices Inc were trading at $5.86, giving the company a market cap of $386.392 million. This valuation is a critical piece of information for investors as it reflects the market's current assessment of the company's worth.

When considering the GF Value, which is an intrinsic value estimate developed by GuruFocus, Avid Bioservices Inc's stock appears to be significantly undervalued. With a price of $5.86 and a GuruFocus Value of $21.78, the stock has a price-to-GF-Value ratio of 0.27. This suggests that the stock is a Possible Value Trap, and investors should Think Twice before making an investment decision based on its GF Value.

The GF Value is calculated based on historical multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. It also includes a GuruFocus adjustment factor based on the company's past returns and growth, as well as future estimates of business performance from Morningstar analysts.

Conclusion

The recent insider buying by Richard Hancock at Avid Bioservices Inc is a noteworthy event that warrants attention from investors. While the insider's overall transaction history over the past year shows more sales than purchases, the latest acquisition of 23,000 shares could signal a belief in the company's undervaluation or upcoming positive developments. However, given the current price-to-GF-Value ratio, investors should carefully consider the potential risks and conduct thorough due diligence. The insider trends and valuation metrics provide a starting point for further analysis, but they should not be the sole factors in making investment decisions.

As with any investment, it is important to look at the broader picture, including the company's financial health, competitive position, and industry outlook. Avid Bioservices Inc's role as a CDMO in the growing biopharmaceutical sector positions it in a dynamic market with potential for growth. Nonetheless, the insider's recent purchase is just one piece of the puzzle, and investors should weigh all available information before drawing conclusions about the stock's future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.