Director Roxanne Austin Sells 6,303 Shares of Freshworks Inc (FRSH)

On October 9, 2023, Roxanne Austin, a prominent director of Freshworks Inc (NASDAQ:FRSH), sold 6,303 shares of the company. This move is part of a larger trend of insider selling within the company, which we will delve into later in this article.

Roxanne Austin is a seasoned executive with a wealth of experience in the tech industry. She has served on the board of Freshworks Inc, a leading provider of customer engagement software, for several years. Her insights and leadership have been instrumental in guiding the company's strategic direction and growth.

Freshworks Inc is a global company that provides innovative customer engagement software for businesses of all sizes. Their cloud-based suite is widely used by teams to collaborate and provide multichannel support, including email, phone, chat, and social media. With their software, businesses can streamline their customer conversations in one place, automate repetitive work, and personalize their service to create better customer experiences.

Now, let's take a closer look at the insider trading activity at Freshworks Inc. Over the past year, Roxanne Austin has sold a total of 58,381 shares and has not made any purchases. This recent sale of 6,303 shares is part of this larger trend.

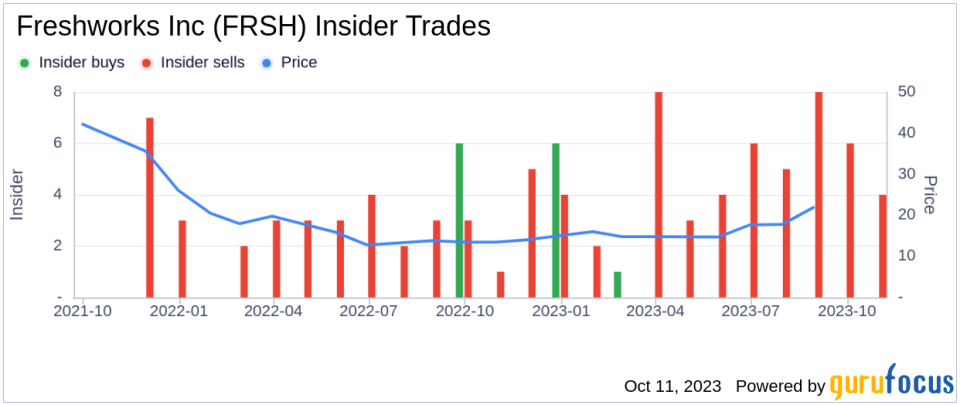

The insider transaction history for Freshworks Inc shows a total of 7 insider buys over the past year, compared to 55 insider sells. This suggests a trend towards selling among insiders, which could be a signal for investors to be cautious.

On the day of the insider's recent sale, shares of Freshworks Inc were trading at $19.2 each. This gives the company a market cap of $5.48 billion. It's worth noting that the stock price can be influenced by many factors, including insider trading activity. However, it's also important to consider other factors such as the company's financial health, market conditions, and industry trends.

In conclusion, while the insider's recent sale of shares may raise some eyebrows, it's crucial for investors to consider the broader context. Insider selling can sometimes be a bearish signal, but it can also be driven by personal financial needs or other factors unrelated to the company's performance. Therefore, investors should always conduct thorough research and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.