Director Scott Wagner Bolsters Confidence in BILL Holdings Inc with Recent Insider Purchase

Insider buying can be an encouraging signal for potential investors, indicating that those with the most intimate knowledge of a company's operations and prospects are willing to invest their own money in its stock. This is the case with BILL Holdings Inc (NYSE:BILL), where Director Scott Wagner has recently made a notable purchase of shares.

Who is Scott Wagner of BILL Holdings Inc?

Scott Wagner is a seasoned executive with a track record of leadership in various technology companies. His experience spans across different roles, including CEO positions, which have equipped him with a deep understanding of the tech industry's dynamics. At BILL Holdings Inc, Wagner serves on the board of directors, bringing his extensive experience to guide the company's strategic decisions. His recent investment in the company's stock is a strong vote of confidence in BILL's future.

BILL Holdings Inc's Business Description

BILL Holdings Inc is a leading provider of cloud-based software that automates complex back-office financial operations for small and midsize businesses. The company's solutions streamline and manage processes such as invoicing, bill payment, and financial documentation, thereby enhancing efficiency and reducing the need for manual intervention. With a focus on innovation and customer satisfaction, BILL Holdings Inc is at the forefront of the digital transformation of financial services.

Description of Insider Buy/Sell

Insider transactions are the buying and selling of a company's stock by its executives, directors, or other insiders. These transactions are closely monitored by investors and analysts as they can provide insights into insiders' views on the company's current valuation and future prospects. An insider buy, such as the one executed by Scott Wagner, suggests that the insider believes the stock is undervalued or that there is potential for future appreciation. Conversely, insider sells might indicate that insiders believe the stock is fully valued or they are diversifying their investments.

Scott Wagner's Insider Trading Activity

According to the data, Scott Wagner has shown a strong belief in the potential of BILL Holdings Inc. Over the past year, the insider has purchased a total of 8,750 shares and has not sold any shares. This pattern of buying without corresponding sales suggests a bullish outlook on the part of Wagner.

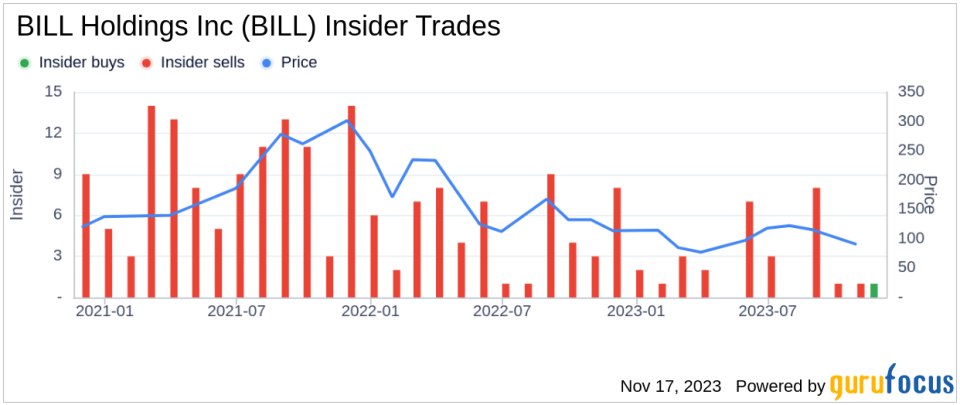

Insider Trends at BILL Holdings Inc

The insider transaction history for BILL Holdings Inc reveals a mixed sentiment among insiders. While there have been only 2 insider buys over the past year, there have been 33 insider sells during the same period. This could indicate that while some insiders see value at current prices, others may be taking profits or reallocating their investments.

Valuation of BILL Holdings Inc

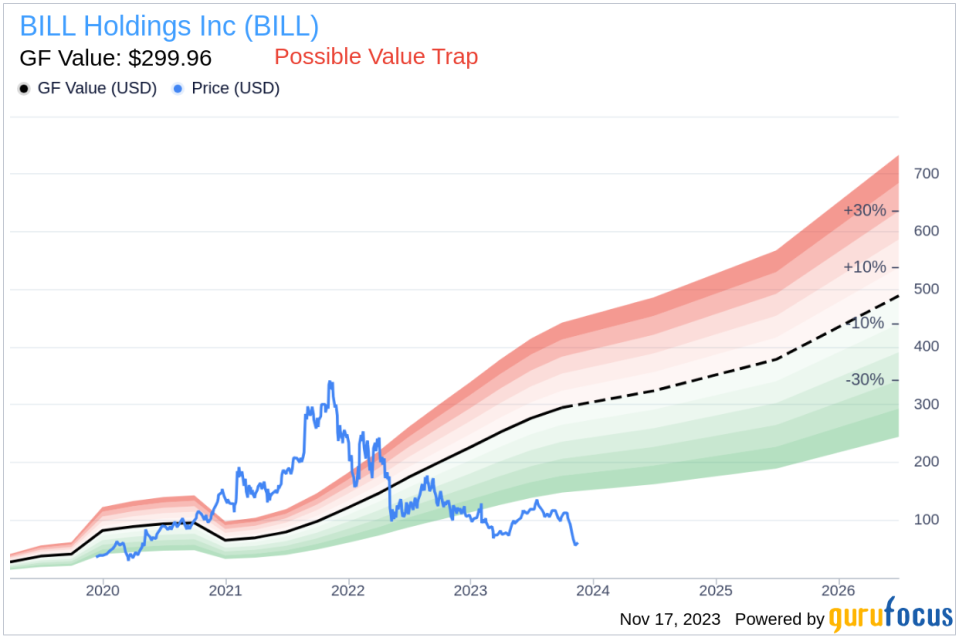

On the date of Scott Wagner's recent purchase, shares of BILL Holdings Inc were trading at $58, giving the company a market cap of $6.498 billion. This valuation is significant as it reflects the market's current assessment of the company's worth.

However, with a price of $58 and a GuruFocus Value of $299.96, BILL Holdings Inc has a price-to-GF-Value ratio of 0.19. This suggests that the stock is a Possible Value Trap, and investors should Think Twice based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The low price-to-GF-Value ratio could be interpreted in several ways. It might indicate that the stock is undervalued, presenting a buying opportunity if the market has not fully recognized the company's potential. On the other hand, it could also mean that there are underlying issues or challenges that the market is pricing in, warranting caution among investors.

Conclusion

Scott Wagner's recent insider purchase of 8,750 shares of BILL Holdings Inc is a significant event that warrants attention from investors. While the company's stock appears to be trading at a substantial discount according to the GF Value, the mixed insider transaction history suggests a more nuanced picture. Investors should consider the potential reasons for this insider buy, alongside the broader context of insider selling activity and the company's valuation metrics, before making investment decisions.

As with any investment, it is crucial to conduct thorough research and consider a multitude of factors, including insider transactions, valuation metrics, and the overall market environment. Scott Wagner's confidence in BILL Holdings Inc, as evidenced by his insider purchases, is just one piece of the puzzle that investors must piece together in their quest for successful investments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.